The cryptocurrency market is still relatively new and very high risk and volatile.

The recent events with Terra / UST is a perfect example, a top 10 project that went to zero in days.

The potential for reward in this space is extremely high, but so is the risk.

You need rules in place so you are managing the risk, do you have some?

Everybodies rules will be different depending on their personal circumstances, below I will outline my rules. None of this is financial advice, do not take my rules as gospel as your circumstances may be very different to mine and your priorities and goals may also be different.

RULE 1: Do not invest more than I can afford to lose.

Self explanatory really, everything I invest in the crypto space I can afford to lose. If the whole crypto space went to zero it would not ruin me financially.

RULE 2: Have some funds that are easily accessible in an emergency.

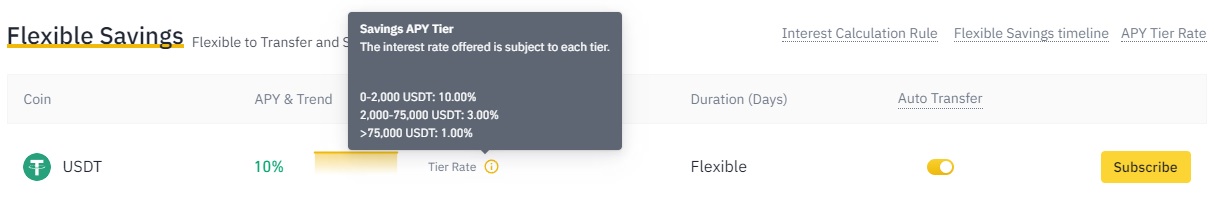

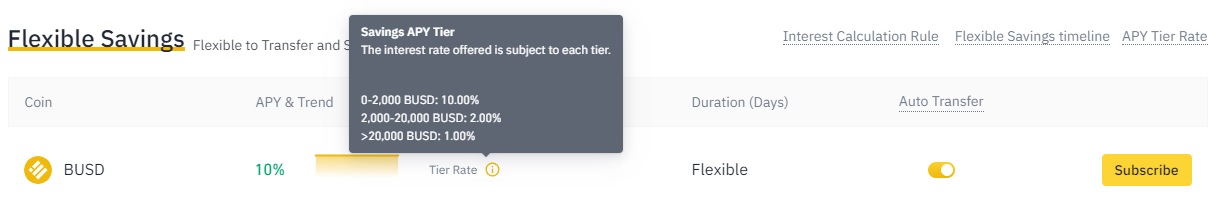

I can hold up to $2k in USDT and up to $2k in BUSD and earn 10% APY at Binance in flexible savings which is available when I need it. There are risks here, funds are on a centralized exchange, funds are in stablecoins that may potentially lose peg, but for me it is an acceptable risk.

Of course I need an off ramp to get to these funds if I need them. I can withdraw from Binance but what if i need the funds right now? This is where Crypto.com comes in. I have one of their debit cards which I can top up with crypto. In an emergency I can liquidate funds on Binance, send to my Crypto.com account and then top up my debit card, I would have the funds in the time it takes the blockchain to confirm my transactions. Both assets can be sent on multiple chains so transaction fees can be kept to a minimum. This money would be available to spend anywhere VISA is accepted.

RULE 3: Diversify

Spread my risk as much as possible. This does not just apply to my portfolio, but also where I keep my tokens.

My portfolio I want split as follows 25% BTC, 25% ETH, 25% stablecoins, 25% others.

If I keep this balance then I will also be taking advantage of market conditions. If BTC goes up by 20%, which is entirely possible, then my portfolio becomes unbalanced, I sell some BTC and move it around to balance things out. This also applies if the price drops, I sell some stablecoins and buy some BTC. This way I am making sure I am taking some profits. Sure if I just held my BTC it might hit the moon and I would have been better off just holding it, but it also might not, for me balance is the better way to go.

I also want to diversify where I hold my tokens. I have a Ledger Nano X so I can store coins here and also stake them to earn interest. This has it's pros and cons. The keys are mine, the tokens are mine, nobody can access them without access to my Ledger, but on the down side if there is a large movement in a token, the congestion might be bad and by the time I get the coin to an exchange I may have missed the price move. This was highlighted recently with the Terra/UST collapse. If you had Terra staked on chain from a hardware wallet then you had no chance. With 21 days to unstake, it was all over way before then. UST was taking some time to move also with everyone trying to move it, by the time it reached the exchange for you to offload it then the price had dropped more. So although my Ledger wallet is the safest, I do want some of my portfolio in places I can easily liquidate, even if this means keeping it centralized.

RULE 4: Invest what I hold

I do not want my tokens sitting idle. If I can earn interest on them then I should be so I can continue to grow my portfolio.

Where I earn interest depends a lot on the token, whether there is on chain staking I can do through my Ledger, even if it means using a 3rd party wallet to access the tokens, the funds are still secured through the Ledger. I will also keep some on Binance, the interest rates here are surprisingly good for small amounts with the 90 day locked staking, even with the flexible savings for BTC you can earn 5% on up to 0.01 BTC. There are plenty of other sites you can earn with your tokens, here are a few: Nexo, BlockFi, Gemini, Stakecube, Hodlnaut, Swissborg. A lot of these will offer you a sign up bonus when you deposit, so it is a good idea to sign up to multiple to pick up the bonuses, this is an easy way to grow your portfolio. Even if your funds are not enough to sign up to all, you can do one, send your BTC or other token, get your bonus, once the bonus is confirmed (some you may need to hold your initial deposit for a set time like 30 days, others are instant when funds deposit) you then sign up to another and move your funds there to pick up the next bonus.

There is also DeFi investing, I have some coins in DeFi protocols, but mostly single coins, I am not a big fan of liquidity farming, I have tried this and with the volatility of the market I found the divergence loss often outweighed the profits.

RULE 5: Stay cool

I know the market is volatile, my portfolio is going to go up and down by big margins. Don't panic sell, All markets go in cycles, the bull will return. There is no need to be constantly checking my portfolio. I can spend an hour a week on it to rebalance, claim and compound any staking rewards etc and just enjoy my life without stressing about it, knowing I am here for the long term and the cycles will continue.

Those are my rules for my investments in the crypto space

Posted Using LeoFinance Beta

Pretty decent set of rules. I'd call them good guidelines at the very least, since crypto people tend to hate rules!

Posted Using LeoFinance Beta