Hello

No matter what your past experience or beliefs may be about trading the likes of Forex, crypto, index,volatility etc

I want you all to know that you can independent trader

However, I must emphasis on this

Forex trading is not a 'get rich quick scheme'. Please you have to change any otherwise mentality of it.

It requires mastery, studying and consistency in becoming a consistent winning trader.

If financial freedom is what you seek the trading has it all to give you.if you will diligently study the market

FOREX is just a Short form for FOREIGN EXCHANGE

Forex is one of the Largest market in the world

With a Total Daily Liquidity of about $5.3 Trillion dollars

The New York Stock Exchange which is the Second Largest Market is having a Daily Trading Volume of $169 Billion Dollars as we can see in the Statistics above

That is to show the massive Liquidity.... Which is on the Forex Market.

That is how large the Forex market is

So we have seen a Brief Introduction of the Forex market.

We will still see more, but for now let's fire on

While the Cryptomarket, for those of us who know about Bitcoins has a Total Market cap of just $139 Billion as of today, this is not even the Daily Volume.

In Forex all we trade are currency pairs.

E.G.

EURUSD(EURO VS US DOLLARS)

XAUUSD(GOLD VS US DOLLARS)

GBPUSD(GREAT BRITAIN POUNDS VS US DOLLARS)

ETC.

All currency pairs that involve USD are called major currency pairs while others that do not involve USD are called CROSSES

There are some other common CROSSES which include JPY PAIRS(Japanese yen), GBP PAIRS(Great Britain pounds), ETC.

More on the currency pairs will be discussed soon

WHO IS A FOREX BROOKER

Forex Brookers are Firms that gives you access to the FOREX MARKET .

They provide U as a Trader access to the Financial market...

By providing a Trading account for U.

They give Traders what we call Leverage. (we will see that soon)

They also provide Support Functions to the traders

There are various Brookers in the Forex Market

We have

Hotforex

Fxtm

Fxcm

Fbs

LiteForex

*IC markets *

Alpari

Robo Forex

Etc

We are still going to take time to talk about Brokers in details

But we are now aware of their Functions and what they offer the Traders

Now let's move to trading sessions

We have :

SYDNEY SESSION

TOKYO SESSION

LONDON SESSION

FRANKFURT SESSION

NEW YORK SESSION

The Sessions names are derived from the major cities in which most of the Transactions are done

For example

Sydney Session represents Australia and other countries around that Time zone

Tokyo session sometimes called ASIAN Session represents Japan and some of the Asian countries.

Let's Fire on

London Session represents The United Kingdom and the countries within it.

FRANKFURT session which is in Germany represents Europe.

While

NewYork Session represents The Americas

Forex is actually a 24 hours market.

It is most times regarded as the Market that never Sleeps because it's open for 24 hours of the day

So no matter where you are around the World, no matter your Time zone.... U can actually Trade this Large, Highly Liquid market

Let's now get to their Trading Times....

Because each of this Session have their own Opening and Close times...

SYDNEY SESSION

Opens by 9PM GMT

TOKYO SESSION

OPENS BY 11 PM GMT

LONDON SESSION

OPENS BY 7AM GMT

FRANKFURT SESSION

OPENS BY 8AM GMT

NEW YORK SESSION

OPENS BY *1PM GMT

Also Note that these Times are listed in GMT

Greenwich Meridian Time

So you should do the appropriate Calculation depending on your countries Time zone, so as to know which session, U are currently on

All Sessions lasts for 9 hours.

So having known their Opening Times, To get their appropriate Closing Times.

Just Add 9 hours to the Opening Time to get when they will Close

Example

Sydney Session that Opens by 9 PM GMT

Will close by 6AM GMT

also TOKYO Session that Opens by 11PM GMT

Will close by 8AM GMT

NEWYORK SESSION that Opens by 1 PM GMT

Will CLOSE BY 10PM GMT

AND SO ON FOR OTHERS..

just Add 9 hours to their Opening Times

Now there is an important thing to Note here...

This is what many Forex Traders don't actually understand because nobody taught them.

It is always good to Trade the Market when 2 or more Markets are opened at the same time.

I. e When 2 of the sessions are open

Please Take note of this Important point

Example by

12 AM GMT

Sydney Session and Tokyo Session will be opened together and it will have more Volatility than someone that is Trading at 9PM GMT because the market will be Quiet.

Another Example is by 8AM GMT

London Session and Frankfurt Session will be open, infact even Tokyo will be with them briefly, so you will notice that Volatility will increase during such times.

So as a Forex Trader , Always time your Trading to fall in periods where 2 or more Markets are opened at the same time.

By doing that U will always have an edge in the market .

We will be learning more important things, let's just follow the Trading closely

This is Because, Volatility is always more when 2 or more Sessions are Open .

Volatitily simply means how fast and far a market is at a duration of time

And in Forex Market, More Volatility means More money. 💵

As a Forex Trader, U wouldn't want to trade a Quiet market, because there won't be much Fluctuations and it's those movements that make money for us.

TERMINOLOGIES USED IN FOREX

Just Like every Field you try to learn, U would have to get accustomed to its Terms and Terminologies

So also is the Field of Forex, U would need to learn about the Terminologies so as to be able to communicate with the Market, Analysts and also with your fellow Traders.

U may be among the gathering of Forex Traders but U won't understand a dime of what they are saying, this is because U don't know the terms.

So that is what we will be learning in this section

So as I was saying

For every New field you embark upon in Life, U would encounter New Terminologies and terms which is peculiar to such field.

Be it Law, Medicine, Journalism , Engineering etc

And you will have to get yourself acquainted with their Terminologies so as to be able to communicate properly

So also is Forex, for you to be able to Learn and Trade, U should get to know some of the terms that is used in FOREX Trading.

So that u can understand the News, Flow with your Fellow Forex traders and understand Analysts

The next terms we will see are

BULLISH MARKET.......

A market that is going Upwards

BEARISH MARKET...... A Market that is going downwards.

When someone tells u that a currency pair or a commodity is Bullish

It's telling you that its going Up

While

One that is Bearish is going down

Let's be noting all these terms

U all would be needing them as U we progress

BULLS..... The Buyers are referred to as Bulls

BEARS..... The Sellers are referred to as Bears

RANGING.....

A Market is said to be Ranging, if it does not have any particular direction.

It's neither moving Upwards not Downwards

TRENDING......

A Market that is has a direction.

It's either moving Upwards or downwards

So you can hear people say a market is Trending upwards or the market is Trending downwards

So you may hear people tell you that the Market is just Ranging.

They are indirectly telling you that the the market has not found any direction yet.

So let's get to it

TERMINOLOGIES USED IN FOREX

TO GO LONG....means to BUY

TO GO SHORT...... means to SELL

If a Trader tells you that he went Long on a Currency pair.

He meant that, He Bought the pair.

While if they tell you that they Short a Currency pair, it means that they Sold the pair

Soon you will get to see that All what we are doing in Forex is Buying and Selling

Also Most of the Currency pairs have specific names in which they are called....

We would get to know them soon

Eg

The dollar is sometimes called Greenback or Bucks

The Pounds is called the cable

The New Zealand dollars is called the Kiwi

The Australian dollars is the Aussie

The Canadian Dollars is called the Loonie

Oil is referred to as the Black Gold

Etc

It's just to get you acquainted with the most popular ones so that When you see fellow Forex Traders discussing, U will tag along easily

The next terminology that we will be looking at is

HAWKISH

This term is mostly used when referring to the Central Bank Governor or personel of a Country.

When they are Hawkish, they tend to be liberal on interest rate and are willing to increase it.

This is good news for investors

DOVISH

This is the opposite of Hawkish.

Financial personnel who are Dovish are very restrictive... They do not want to tamper with the interest rate.

They even want to reduce it.

This is bad news for investors.

In other to trade in forex, there are types of analysis but I’m dropping two

*FUNDAMENTAL AND TECHNICAL ANALYSIS *

FUNDAMENTAL ANALYSIS

&

TECHNICAL ANALYSIS

Note them down

Let's start with the first one

FUNDAMENTAL ANALYSIS

This is also known as News Trading

Here you are analysing the Forex market with respect to the News

It's been said that News is what moves the market.

Everyday Various news are being released by these major countries

And they either positively Or negatively affect the Currency pair involved and then you make your Trading decision based on the news u heard

We see all these News on CNN, Bloomberg, CNBC etc

Also Your MT4 App has a Summary of News Section

Also some sites like forexfactory.com, dailyfx.com, forexstreet.com etc.

Gives you summary of this News.

We will come to see them later

Now whether the News is Positive or Negative

As a Forex trader, that is none of your business because u make money both ways.

Those(I'm one of them) into Crypto Trading will tell you that u only make money when a Coin is appreciating.

But in Forex, we make Money Both ways.

If a Currency pair is appreciating, We go long on the pair

When a Currency is also depreciating based on the News, We go short on the pair.

Like many traders do everyday, They buy some and sell some

So In Forex, U make money on both sides of the News

We will come to see how to trade the News later

Today We will be discussing an Important News Released by the United States.

Even though there are News release everyday.

There is what we Forex Traders Call KING OF ALL NEWS

It's called the NFP(you might have seen me shouting about it on my status)

NON FARM PAYROLL

Non Farm Payroll is one of the Biggest News that every trader awaits on

Let's start with understanding what NFP is

Even though there are News released everyday.

There is what we Forex Traders Call KING OF ALL NEWS

It's called the NFP

NON FARM PAYROLL

It's a News that contains various data and statistics released by the US Bureau of Labour and Statistics

It's very influential as an indicator of US Economy because of the US Federal Reserve makes monetary policy decisions based on this data

This is a News released by the United States of America.

Among all the news released by the US, this is the highest because it causes the most Volatility in the market.

These data includes employment in the manufacturing sector, Construction sector, Goods sector etc.

Excluding Farm workers (hence the name), Also excluding Private Household employees and non profit organizations

The data released include

1). Non Farm Payroll increase

This is the number of new jobs added in the US labor sector in the previous month

Hence Investors, Financial Analysts, Forex traders, Stock traders make trading decisions with the News

It is released every 1st Friday of the Month by 8:30amEST

ie 12:30pm GMT

IE 12:30pm Ghana time

ie 1:30pm Nigerian time

ie 2:30pm South Africa time

Etc

Just Calculate according to your Time zone perhaps u re in other country

It also includes the Average hourly earnings of the workers in the US

This is also an Economic indicator because even if the number of workers didn't change.

But however their earnings increased...

It would have the same effect as if their number increased

Same also could be interpreted in reverse, if their earnings reduced

Let's get to how to interpret the data

INTERPRETATION OF NFP

So when more jobs are added, it means that Business ventures are growing and remember that these newly employed would be paid....

Hence more people would have money to spend on goods and services hence increasing the growth of the economy

It also includes

- Unemployment rate of the US

- Which sectors of the economy, these jobs were added mostly

It gives investors and traders where are the possible sectors to invest in as the sector that added more jobs would be most likely to have experienced growth

However

When the number of jobs added are reduced.

The reverse occurs... People won't have money to spend on goods produced and services... hence dwindling the economy.

Also the US govt has an amount of money paid to the unemployed.

When more jobs are added, more people would be employed.

This reduces the unemployment rate, as the unemployed citizens reduce

, less money leaves the govts pocket, hence boosting the economy

Then lastly the data includes a revision of previous non farm payroll..

Because investors compare these values together....

Whether there has been an improvement or reduction.

This also gives you an idea if the economy is growing or reducing

So this is just a Breakdown on What NFP entails and why it's so Volatile.....

It's usually released 1st Friday of every month

So we will all probably be together and Trade the Next NFP, because it's better seen than explained

No Forex Trader fixes his Wedding or Party on the First Friday of any month except it's a Night event.

So as Forex Traders, Never miss it.

If you are driving and it's 12:20 PM GMT

Just park, Open your Phone Trade your NFP and continue where you are going...

If you are sick (God forbid), just tell them to give you your Phone that Friday, because you can't miss NFP. That's how Big it is.

TECHNICAL ANALYSIS

This form of Trading is when you Analyse the Market using Indicators, Charts Patterns , Candlesticks, Fibonacci, Support and Resistance, Pivot Points, Elliott waves Order blocks,BMS,Liquidity,premium market etc

When you use any of the above to analyze the market, It's called Technical Analysis.

Majority of what we listed on the Course outline are Technical Analysis

Let's move on to the next form of Analysis

The other form of Analysis is

TECHNICAL ANALYSIS

Among the 2 major Forms of Analysis,

No one is superior to each other and also no one is used in Isolation.

We learn how to harmonise the two to constantly keep you on top

For this coming parts to be more interactive...

We will all need to open our MT4 Apps

We will be getting into more serious Business from now

Let's Open the App

We will all Start with the DEMO ACCOUNTS

That is what we will be using for Now

The first topic on technical is CURRENCY PAIRS

We are now entering the Practical Section of Forex where you all will be seeing what we do online.

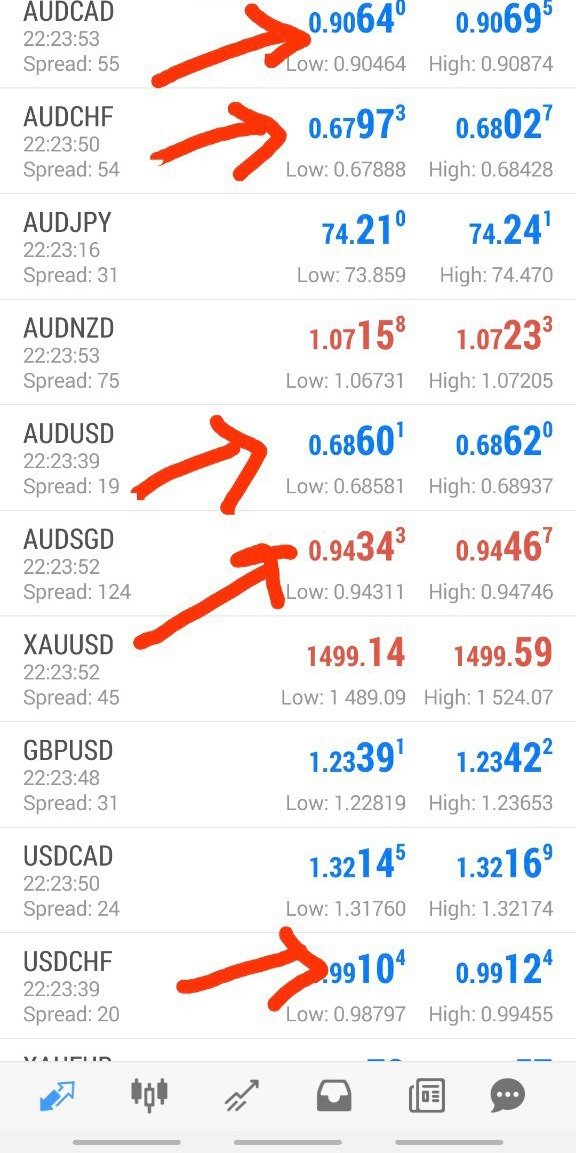

Now you should all open the MT4 APP and click on "QUOTES*

Now here they are..

Like I said yesterday the ones with USD are called major while others are called CROSSES..

However based on how they are listed here.. E.g AUDCAD( AUSTRALIAN DOLLARS VS CANADIAN DOLLARS).. the first one, e.g. AUD is usually called the base currency while the second ones e.g CAD here are called quotes

Like I said all first currency in the currency pairs except few ones are called base while the second are called quotes.

The effect of this is that the base currencies are stronger than the quote currencies

E.g. If I say USDNGN, USD here is the base currency, why? Because if is the stronger one while Naira is the quote

But there are few ones that the reverse is the case

That is the first ones written are the quotes while the second are the base..

So you will ask, how are you supposed to recognise such?

Very simple..

Look at the currency pairs that I pointed the arrows to.. You will see that their prices start with 0.something

Those are the exceptions we have..

The fact that their prices start with 0. Shows inversion.. Which means their first are the quotes while the second are the quotes

While the second are bases *

So apart from them, any other currency pairs that their prices start with whole numbers follow the normal procedure of base/quote

In front of each currency pairs u will see 2 prices. The first (red arrow) is called the BID PRICE while the second is the ASK PRICE

BID PRICE is the price at which we SELL a currency pair while ASK PRICE is the price at which we BUY a currency pair

Note the emphasis on SELL and BUY

Yh.. The first prices in front of each pairs are called bid price while the second ones are ask prices

Technical is the major.. Infact what happens in the market through your technicals determine what news will say

Leverage basically means how much larger can you trade relative to your account size.

I've seen people mentioning leverage like how much more you can borrow.

But I wouldn't really use the word ‘borrow’ down here.

Because when you are trading Forex, your broker is not really lending you any money.

It's just a term that refers to how much larger you can trade relative to your account size.

I'll just give you an example…

Let's say you fund your account $10,000.00, and your broker offers you a leverage of 1:50.

What this means, is that your broker will allow you to trade up to $500,000.00 worth of currencies, because he gives you a 1:50 leverage.

This is what it means…

Your broker isn't really going to physically or electronically lend you another $490,000.00 in your account.

It just means that you can trade up to $500,000.

This is what I mean by a 1:50 leverage.

If it's a broker that offers 1:100

You can trade up to $1,000,000.

Just take the leverage factor, and multiplied by the amount of cash in your trading account.

That's your leverage.

Now, what is margin?

Essentially, margin and leverage they are two sides of the same coin.

You can apply this formula, just take 100, divide by your leverage factor.

So earlier we spoke about a factor of 1:50, so your margin this over here is 2%.

What this means is that your broker requires you to put at least 2% margin in your account to be able to trade the 1:50 size that you want.

To put it simply, if you were to trade $500,000.00 worth of currencies, your broker requires you to put 2% of this amount in your account, which is equivalent to $10,000.00!

This is why I say they're pretty much two sides of the same coin...

Leverage, and margin.

And one thing to bear in mind is that leverage is a double-edged sword.

You can potentially make more money, with a higher leverage.

But at the same time, you can potentially lose more in a faster period of time, because all you need is just a small percentage move against you.

And you will lose a lot depending on how much leverage you're using.

When you are actually trading, I don't really consider leverage and margin when I'm trading.

Because when I'm trading, I always have my stop loss in place and from there on I can calculate the appropriate position size for my trade.

And even though I'm trading with high leverage, I won't use a huge chunk of my capital because the risk has been taken into consideration.

A PIP is by how much a market goes up or down

Note this..

The movement of a market up or down is measured by a PIP

So based on the number of decimal places a PIP is calculated as this

For a 4 decimal places currency pair

1pip=0.0001

For 2 decimal places

1pip =0.01

As u can see here the AUDJPY is in 2 decimal places..

And AUDNZD is in 4 decimal points (dp)