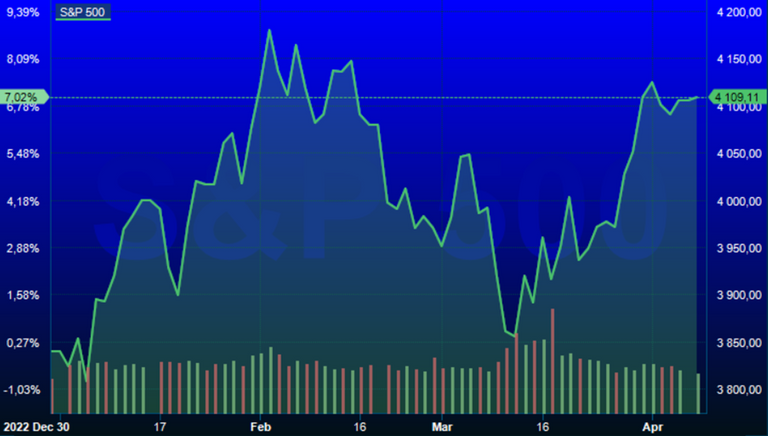

Investor nerves are back! The costs of rapid interest rate hikes are coming to light, and small investors must also take them into account. Winter is over, but neither the temperature nor the conditions suggest that spring has arrived (especially in Norway). In the stock markets, there is once again rough terrain. In March, most stock indices fell significantly. The world's most important stock index, the S&P 500 in New York, fell a lot in March but had it's comeback in early April. Now, hoovering in the greens, more specifically around 7% (Year to date).

Source: Infront

At the same time, we are seeing hefty price movements in the bond market. In just a few trading days in March, the interest rates on German and US government bonds fell sharply. We need to go back 10 years to see something similar. The downturn this year began when major challenges in the US financial sector surfaced...

Three banks in the US collapsed before the end of March. Losses on bonds were particularly heavy to bear. The fact that authorities have already intervened with measures may limit the scope of the crisis. Bank customers' deposits are guaranteed. Overall, the regulation of the banking sector is now significantly better than before the financial crisis struck. But even medium-sized banks can stumble. Bank failures are a reminder that regulations can be more tailored. And that there is still latent risk and contagion in the global financial sector. When problems in the economy's central nervous system arise, many investors' nerves immediately freeze. We are in a vulnerable time now. Central banks printed too much money and kept interest rates too low during the pandemic. The experiment contributed significantly to triggering the inflation spiral we are in now. Now, central banks are trying to correct past mistakes. Aggressive interest rate hikes are the antidote that ideally stifles inflation. But at the same time, economies risk going bust. Every time central banks try “shock therapy”, there are also side effects. This time, among other things, there are significant losses on a range of investments in commercial real estate and bonds. Just ask Swedish real estate giants or now-failed US banks.

Crises often create opportunities. The US bank collapses have highlighted the costs of raising interest rates frequently and rapidly. Perhaps over time, the reactions will contribute to lower interest rate peaks. And new optimism may prevail among investors on the stock markets. At least if inflation continues to show signs of further decline. Until price hikes and systemic risk are more clarified, most stock indices may freeze again with irregular intervals. Small investors should also take this into account. A diversified portfolio is better equipped for different outcomes in the weeks ahead.

I am Olebulls and I’m working in IT and Finance. I’ve always been passionate about finance and finding smart ways to manage and save money. I believe establishing money management strategies as early as possible is the key to securing your future. I began using different strategies myself in real estate, stocks and crypto and I have now built some decent amounts.

||

I’m here to create content about finance, crypto, game-fi and money management.

Pleas follow me if you want to learn something valuable about these topics.

||

Disclaimer: This is not financial advice. I am not an expert. You should do your own research before investing.

Posted Using LeoFinance Beta

It sure is a bumpy ride, I cant wait to see how it all plays out. Inflation or deflation seams to be the big argument. I think we are at the end of the dollar as the reserve currency.

Posted Using LeoFinance Beta

Oh ye, agree! Something sketchy shit is going to come for the reserve currency... Filling up my physical silver vault LOL!

Hey @olebulls!

Actifit (@actifit) is Hive's flagship Move2Earn Project. We've been building on hive for almost 5 years now and have an active community of 7,000+ subscribers & 600+ active users.

We provide many services on top of hive, supportive to both hive and actifit vision. We've also partnered with many great projects and communities on hive.

We're looking for your vote to support actifit's growth and services on hive blockchain.

Click one of below links to view/vote on the proposal: