On another note, I find the way that you present your argument difficult to follow...maybe it's just me. I would evaluate the risk of attack by constructing a table with cost/benefit analysis.

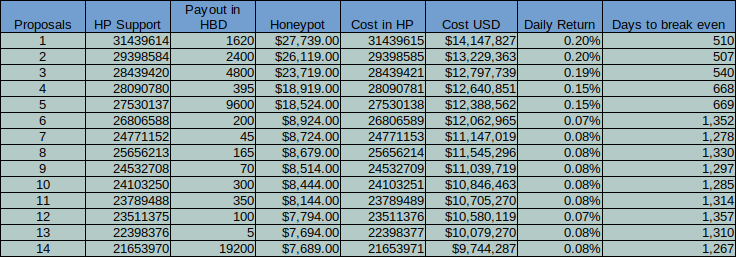

The table above shows the current cost of siphoning funds from the DHF. Each row represents the cost/benefit of the stake needed to displace each of the proposals that are receiving funding at the present time.

An attacker also needs to consider the possibility of losing the stake with a hard fork (it's not like we haven't shown a willingness to do that). In order to successfully carry out an attack, the malicious stake needs to sustain its actions well beyond the break-even date.

Note: I am considering a Hive price of 0.45 USD and an HBD worth one dollar. The "Honeypot" is the available daily budget at each attack level. Of course, the days to break even would decrease with a higher HBD and the cost of the attack would vary in tandem with the Hive price.

EDIT: This model assumes that the attack is coming from an outside agent that is able to purchase its stake over the counter. In practice, that is difficult to do (although not impossible). A group of existing whales colluding is more difficult to counter.

Given the costs and the time that it can take to profit from an outside attack on the network via the DHF, I find that possibility to be a remote one. It's much more profitable to simply buy low and sell high or invest in a yield farm.

You're right, this is easier to follow. I tried to find the scenarios where either the budget has grown too far either through HBD stabilizer or SBD runaway, both are currently happening. The most interesting one to me was what would happen with current budget levels and an HBD price of $4.30. I did consider forks, but even that probably won't lead to a full loss as ETC shows.