Hi readers!!

In this article, I'd give an introduction to the StaFi rMATIC and its significance to users.

The Proof-of-Stake has undoubtedly experienced a blastoff in the cryptocurrency space. With Proof of Stake (POS), cryptocurrency miners can mine or validate block transactions based on the number of coins a miner holds.

The stafi protocol is a project committed to providing liquidity solutions for all PoS projects and makes staking easier and more flexible to users through rToken.

rToken (reward token) is a redeemable token for the staked assets issued by StaFi protocol that is available for trading in a variety of venues.

Whenever a user stakes a native token through the relevant Staking Contract, a certain amount of rTokens will be issued per amount of the native tokens staked in the Staking Contract and the real-time exchange rate for the rToken.

StaFi has already provided an overwhelming solution to a range of PoS token rETH, rFIS, rDOT, rKSM and rATOM. Now it's time for another rToken to join the league, which is the rMATIC, a staking solution to the Polygon community.

What is rMATIC

rMATIC is a staking derivative of MATIC, a user can stake MATIC through a StaFi staking contract and receive rMATIC in return. rMATIC gives stakers flexibility to trade anytime while still receiving staking rewards.

rMATIC is ERC20-Compatible and could be easily integrated into a variety of Defi applications.

How to generate rMATIC

The rMATIC token is minted from staker MATIC. Stakers can simply stake MATIC through StaFi staking contract and receive rMATIC in return.

Staking Contract are connected to Polygon mainnet and once the staking contract validates, the staking rMATIC will be issued to the staker.

rMATIC is a voucher token to claim staking reward and redeem staked MATIC

Why rMATIC

There will be no need to wait for a long redemption period to transfer or trade staked MATIC assets. rMATIC product users can transfer and trade rMATIC assets at any time to liberate liquidity and hedge price risks.

Learning the complicated Tendermint consensus mechanism or staking reward calculation rules by users may be difficult, with the rMATIC product, users only need to follow a few steps to deposit MATIC into the rMATIC contract, which will automatically select the best validator for delegation by the profit maximization strategy.

Users don't need to worry about the liquidity of staked MATIC, as StaFi would produce liquidity to the staked asset.

The rMATIC contract integrates a strategy for maximizing staking rewards, which automatically selects a group of Original Validators with the highest rewards on the chain for staking.

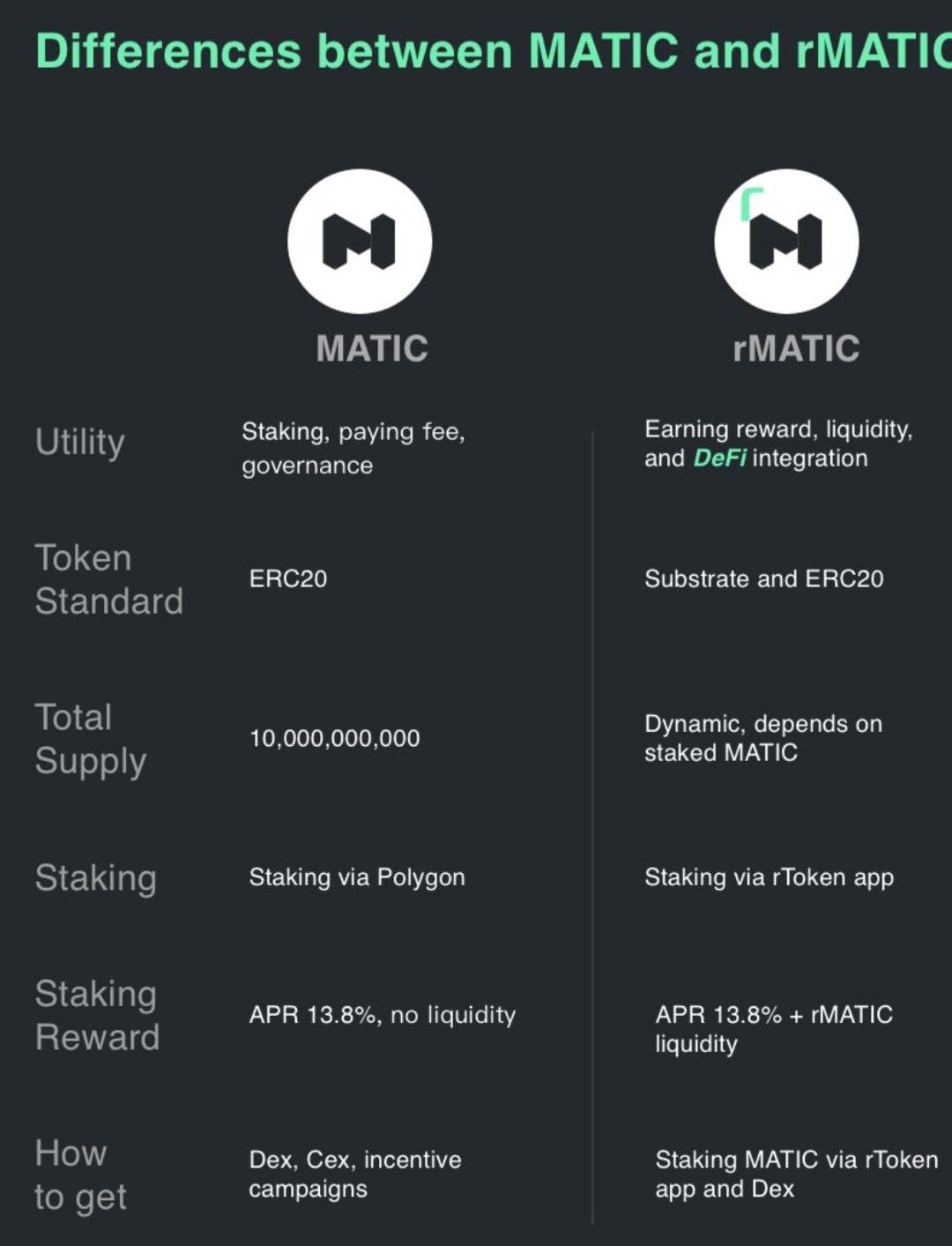

Difference between MATIC and rMATIC

Reference

https://images.app.goo.gl/CTfwD9FRmaMP9eP68

About StaFi Protocol

StaFi is the first DeFi protocol unlocking liquidity of staked assets. Users can stake PoS tokens through StaFi and receive rTokens in return, which are available for trading, while still earning staking rewards. rToken is a synthetic staking derivative issued by StaFi to users when users stake PoS tokens through StaFi rToken App (https://app.stafi.io). rTokens are anchored to the PoS tokens staked by users and the corresponding staking rewards. rTokens can be transferred and traded at any time.

Website: www.stafi.io

rToken App: https://app.stafi.io

Twitter: @Stafi_Protocol

Telegram Chat: https://t.me/stafi_protocol

Telegram Announcements: https://t.me/stafi_ann

Discord: https://discord.com/invite/jB77etn

Forum: https://commonwealth.im/stafi