This is part two of a series on performing some due diligence on coins that I own.

There's been some delay in posting part two, but that mostly boils down to be being pretty unhappy with how the first post came out. I'm hoping to put together something a bit nicer this time around.

Polkadot ($DOT)

Polkadot was founded by Robert Habermeier, Peter Czaban, and Gavin Wood in 2016. Gavin Wood is one of the co-founders of Ethereum, served as Ethereum's CTO, and even wrote the Solidity programming language.

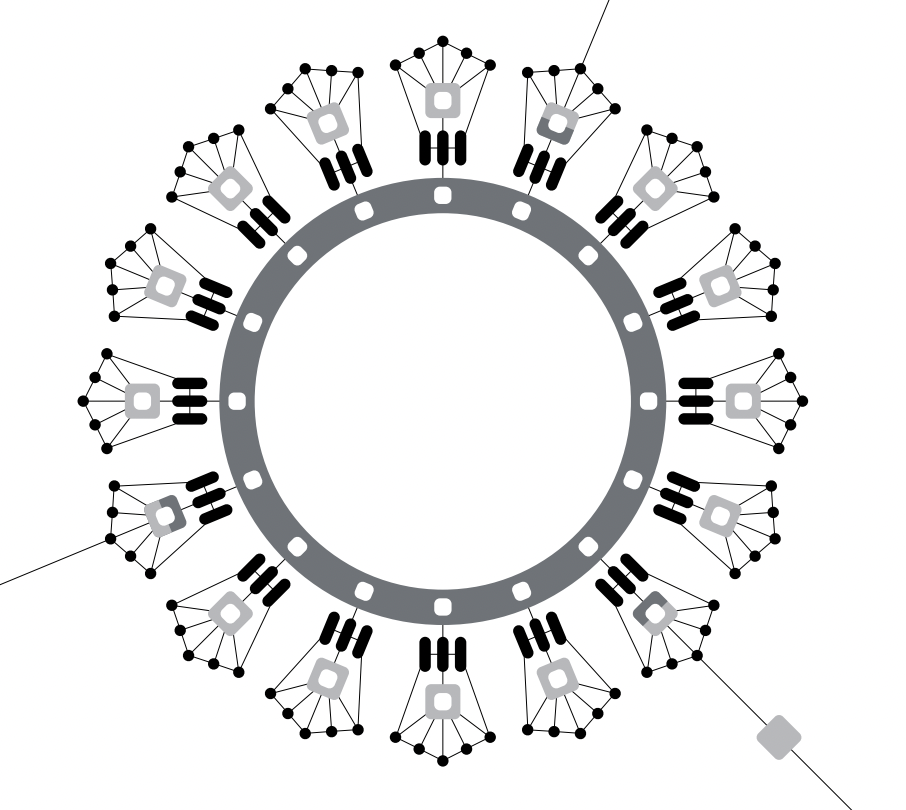

Polkadot recognizes that blockchains make trade-offs to serve specific purposes. As time goes on, this specialization will continue to grow. Polkadot is a sharded blockchain, aiming to connect several chains together. This allows blockchains that are optimized for their own use cases to easily engage with one another, instead of one trying to serve every single purpose out there.

The $DOT token serves three purposes:

- Governance: DOT holders are in control of the protocol.

- Staking: Good actors are incentivized with rewards, ensuring the network stays secure.

- Bonding: A parachain is added by bonding tokens. Out-dated or non-useful parachains are removed by removing the bonded tokens.

Polkadot aims to solve a lot of problems that other blockchains experience: scalability, interoperability, and security. Polkadot achieves consensus via proof-of-stake, and allows transactions to be processed in parallel. The connectivity built-in means that anything Polkadot is lacking can easily be introduced into the blockchain with a parachain. For example, while smart contracts do not exist natively on Polkadot, Edgeware will provide that functionality by existing as a parachain within Polkadot.

A lot of people like to call Polkadot an Ethereum killer, which I think is silly. There will be a lot of blockchains that coexist while providing similar functionality. This is a good thing. We want multiple blockchains that do the exact same thing. Competition is a breeding ground for innovation.

Polkadot provides a legitimate product, experiences active development, and has a solid team behind them. That's far more than what you can say for the vast majority of other blockchain products out there.

I'm pretty sure I purchased $DOT after reading a random comment on Reddit. While I'm glad I did, now that I understand Polkadot better, I do wish I picked up a bit more.

I've been staking my $DOT on Kraken for a solid 12% APY. I plan to hold onto my $DOT for quite a while, and pick up some more when the bull run finishes up.

Stellar Lumens ($XLM)

The Stellar Network was co-founded by Jed McCaleb and Joyce Kim in 2014. Jed McCaleb is known for being the founder of Mt. Gox, and a co-founder of Ripple.

Stellar's goal is to enable the world's financial systems to work together on a single network by enabling digital representations of all forms of money to be transmitted across the network. Stellar aims to solve the modern problems associated with moving money across borders by providing low fees, quick transfers, and security via frequent node consensus.

The $XLM token was originally created to deter bad behavior from taking advantage of the network. In order to facilitate transactions on the network, a balance of 1 lumen is required, along with a minimum fee of 0.00001 lumen. While these are very small amounts, we can see how a lack of a fee on Nano enabled a DoS attack.

XLM is the token that I have engaged with more than any other thanks to its availability on almost every single exchange, close to $0 fee, and quick transfer times to other wallets. I typically pick up my XLM on Crypto.com, which allows for instant transfers right after purchases, and then send it over to whatever exchange I need at a small fee of .1 XLM.

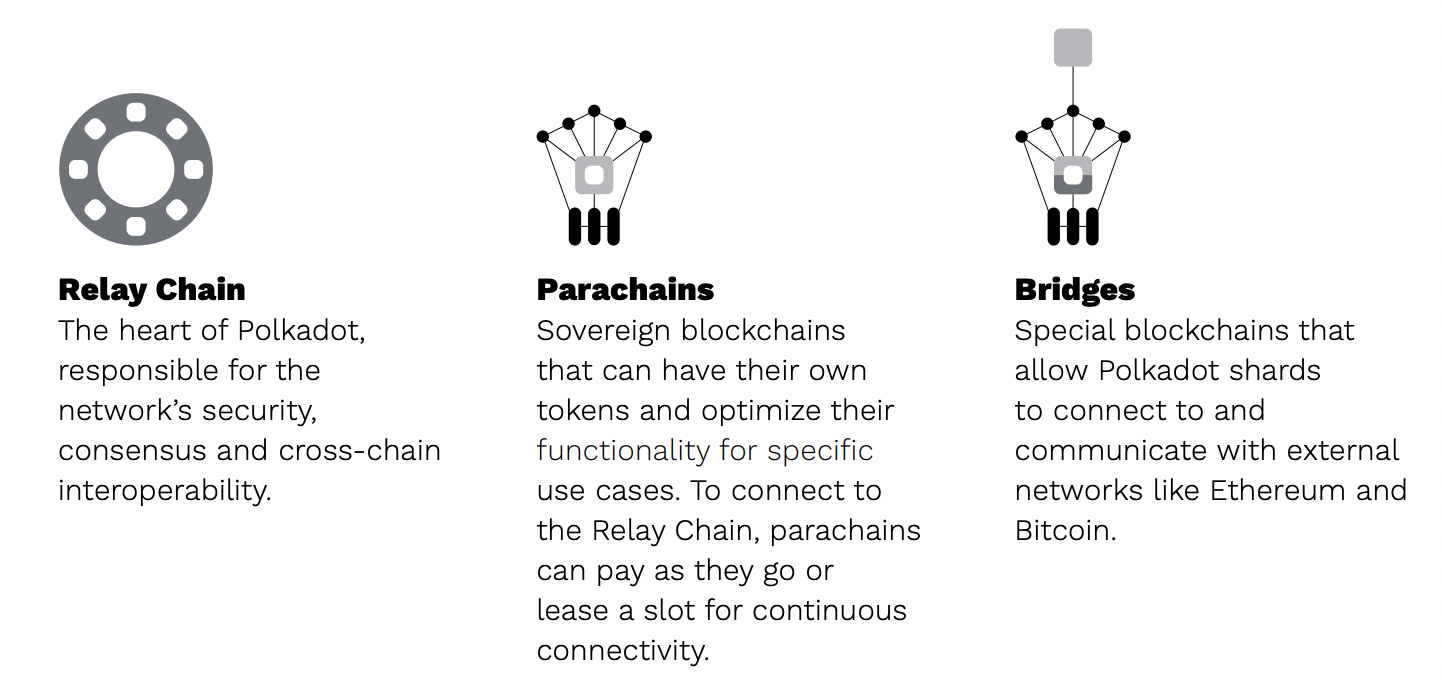

Owning $XLM has been fairly uneventful, as it has been trading sideways for over a month at this point:

While it is somewhat nice to have the token that I use frequently to purchase other tokens be stable, I have to say that I am fairly surprised at how little movement I see. For example, Stellar teaming up with MasterCard seemed to do nothing to change the price.

All in all, I really enjoy using $XLM, but I can't say that I enjoy holding it right now. But hey: there's nothing wrong with that. Just like $DOT, I see myself picking up a healthy amount of $XLM when prices do eventually come down.

Uniswap ($UNI)

Uniswap is an application that allows market participants to provide liquidity between various ERC-20 token pairs. This eliminates the need to deal with a centralized exchange, as swapping USDC for ETH occurs within the pool itself at the current market rate. Liquidity providers receive a fee for providing that liquidity to the market.

Uniswap paved the way for other applications, such as SushiSwap on Ethereum, PancakeSwap on Binance Smart Chain, and our very own Cub Finance.

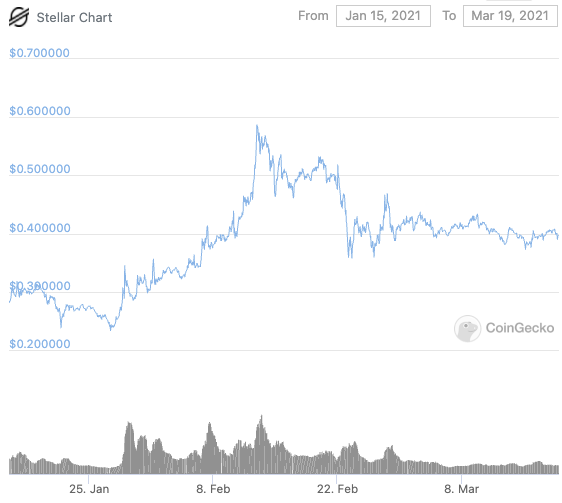

$UNI is Uniswap's governance token, which allows community ownership of the Uniswap protocol. The initial airdrop of $UNI was provided to individuals that had historically participated in Uniswap's liquidity pool. $UNI represents direct voting shares in the future of Uniswap's development. Token holders can bring up proposals to a vote, and then other token holders can stake their tokens for or against the proposal.

I originally purchased $UNI when I realized how interesting the platform was. Unfortunately, the high fees associated with ERC-20 tokens right now means that my $UNI hasn't left the exchange that it was purchased on. I'm currently holding onto them until the eventual release of Optimism.io, at which point I hope to either interact with Uniswap directly (with reasonable fees), or sell them.

In Conclusion

That is it for part two of the series. I think this format is a large improvement over the first part, and I'm hoping to make them better with each iteration. This has been a fun exercise: investing in cryptocurrency is easy, but trying to understand the mechanics behind each individual project is a completely different ballgame.

As always: this isn't financial advice, and you should always do your own research before making any investments.

Posted Using LeoFinance Beta

Congratulations @phul!

You raised your level and are now a Minnow!