You guys have no doubt seen the very recent news about the FED's decision to hike interest rates as a bitter measure to curb inflation. The crypto markets have experienced some volatilities in response to the news but I thought it was a good chance to share a bit of an educative article on how interest rates work and what they have to do with inflation

I'm not a financial expert or anything, but being in crypto for several years has taught me a thing or two about economics and provided me with the passion for sharing them. So, without further ado, let's get started...

What is inflation?

source

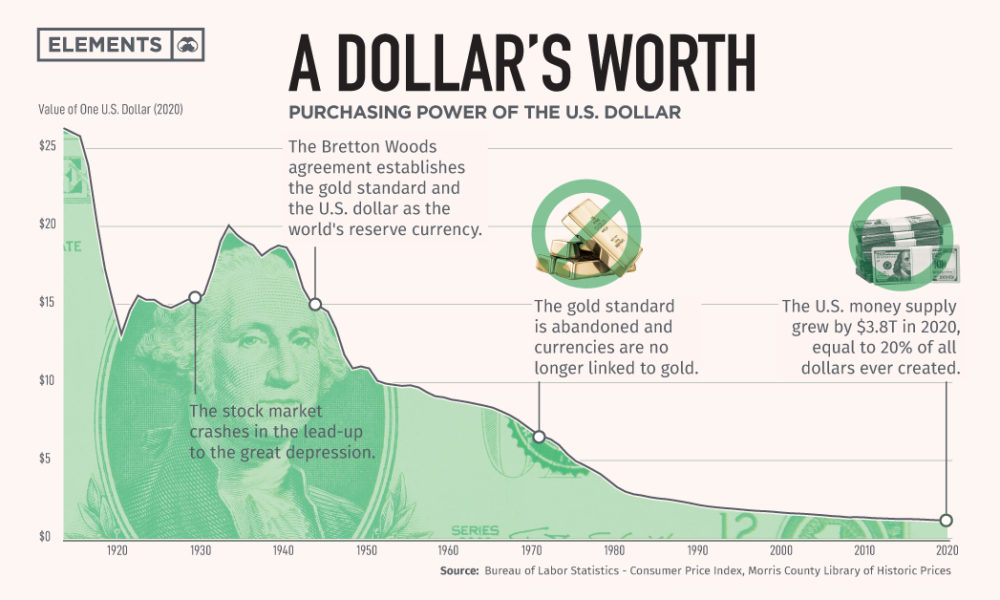

Inflation, in simple words, is the gradual weakening of a currency and the subsequent increase in the prices of goods and services in an economy. It's something inherent in all global economies due to governments printing money. Inflation is what steals the buying power of people and makes it hard for businesses to set the right price for their products and services and for people to plan their spending. Looking at history, we can see countless examples of currencies losing their values over time. The big elephant in the room though is no other than the US Dollar...

Is it a good or a bad thing?

On the face of it, there is no doubt it is a diabolical plot that robs us of all the fruits of our labor and effort, and it actually is. That is why we love BTC and see it as the lifeboat from the sinking fiat ship. But the thing is there is a bit more to inflation than meets the eye. In fact, economists say that inflation, if controlled, is not always a bad thing. Why? well... think about it. If inflation was nonexistent or it was too low, then people wouldn't be encouraged to spend their money, rather they would tend to save more and spend less in anticipation of lower prices. In other words, they would see money the same as they see gold or BTC. And as you might have imagined, the end result of such a scenario might be to impede the growth of the entire economy. That's why governments and economists would rather try and keep a certain percentage of inflation in place. To push people to spend their money and thus spin the wheel of the economy...

What is the "perfect" percentage of inflation?

According to most policymakers, an acceptable inflation rate is "around 2% or a bit below"

What are interest rates?

In a nutshell, interest rates are the cost of borrowing or the reward of saving. It basically tells you the additional amount you should pay/get if you borrow/lend money. Let's take the current interest rate in the US as an example. As you might know, The FED has set its benchmark rate as 2.25%. So, if you get a loan for say $1000 from a bank, then the additional amount you should repay is 22.5 (1000*2.25%) on top of the initial 1000 you've borrowed. So, the total amount is $1022.5.Vice versa in case you save money in a bank.

The inverse relationship between inflation and interest rates...

Now, we can get into the most important part of this post and that is the mechanism governments use to keep inflation under control and the side effects of that mechanism. You know nothing is perfect after all.

Alright, the mechanism is simply toying with interest rates. When inflation is too low, governments tend to lower interest rates which encourages people to spend more but save less, because it is cheap to borrow but less rewarding to save. As a result, people become more daring to throw their money on products, cars, restaurants, vacations...In general, demand is growing more than supply which gradually brings prices up and so does inflation. On the other side of the spectrum, when inflation is too high as it is now, governments tend to raise interest rates which makes borrowing more expensive and saving more rewarding. This encourages people to save more and spend less and as a result, demand for goods and services goes down which in turn pushes prices down as well. In other words, lowers inflation. However, this also harms the economy and causes businesses to cut costs and lay employess off...in the worst case, it might cause a recession. And speaking of recession, we might have already entered its territory, according to yesterday's GDP numbers!

Hi @qsyal

The objective of the FED to increase interest rates, is related to decrease production, if you ask me that is like stop producing the food, goods and services that humanity needs, is something out of any common sense, that only reaches to give stability to the rich countries, but that puts in trouble the weaker ones.

Best regards, be well.