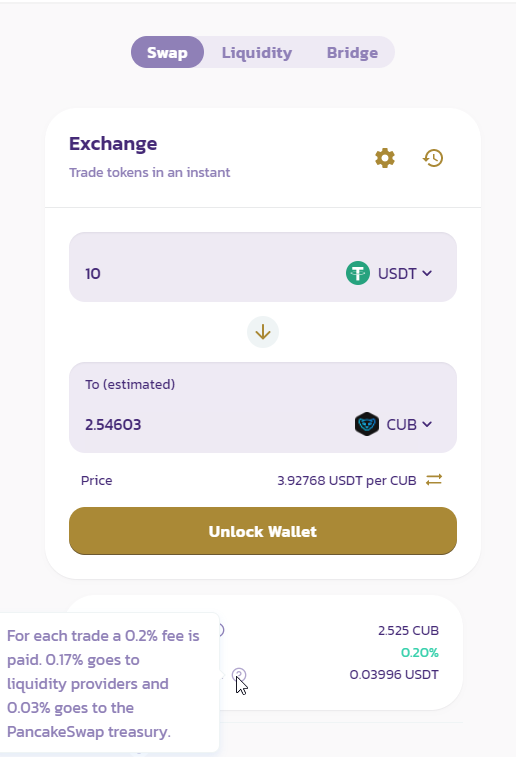

there's fees paid for trading between different currencies.

As you can see here, the fees paid for that trade would be about 4 cents, 85% of which goes to liquidity providers. The more liquidity there is added, the lower the APR, as it just launched, the liquidity is fairly low. There's also a promotion running atm increasing APR by a multiplier to promote adding liquidity. The normal APR yield atm for CUB should be 50.66%, BUSD 183.94% and WBNB 93.42%.

Edit: based on your screenshot, not time of commenting.