I just published this opinion-piece at Medium. Feel free to read it, and tell me what you think!

https://real-rouse.medium.com/bitcoin-its-successors-cryptos-linked-to-it-1a5a1799b0f9

Posted Using LeoFinance Beta

I just published this opinion-piece at Medium. Feel free to read it, and tell me what you think!

https://real-rouse.medium.com/bitcoin-its-successors-cryptos-linked-to-it-1a5a1799b0f9

Posted Using LeoFinance Beta

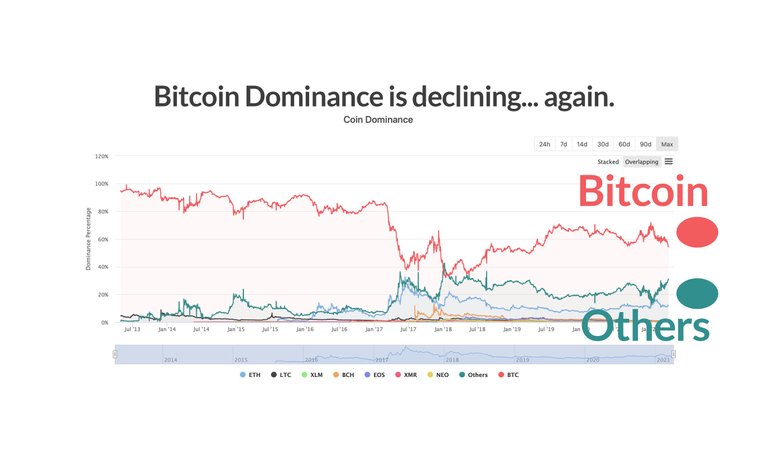

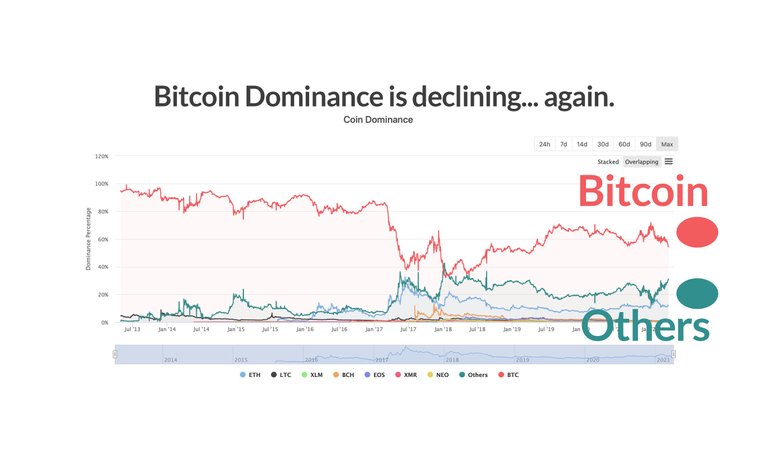

I like that people have started to see cryptocurrencies as something other than just headlines about Bitcoin's next record. Statistics about Bitcoin's dominance are really just a percentage comparison of token capitalisation on a chart. I don't take away from the importance of this representation, after all, if there is money to be made then you can see the market share Bitcoin has.

However, if one were to create such a chart based on a number of variables such as user knowledge of the token, percentage share in an investor's portfolio or checking for new information then I am sure Bitcoin would not even be on the podium.

Posted Using LeoFinance Beta

I feel bitcoin now is different from what it used to be. It has become a gold reserve of sorts and has deviated from the core values it once held. It was meant to be a currency for all but now is a reserve luxury of the rich. It was meant to put wealth into the hands of the poor which it isn't. But moving away from issues of the heart to the techincal aspects. It is slowly losing its current utility (or gaining a new one) Its main utility was to be a peer to peer currency which solved double spending, speed of transaactions and removing the middleman all while being fluid and psuedonymous.In its nature bitcoin was anarchist, rebelling from the norms of traditionaal finance. The coin has paved the way for defi, a new way of looking at finance but is itslef regressing to traditional finance in that it has huge transaction fees, is unaffordable and not so fluid. Just my small opinion on the matter

Posted Using LeoFinance Beta

No it never was.

My opinion is that bitcoin is doing very well, and being a store of value is necessary before enough people can trust it to be a currency. You can't expect someting to be a good mean of currency in only 10 years, it takes way more time than that. Imo it will continue its way to being the global currency where everything is priced in BTC, in parallele LN will continue to grow and we will use it for daily transactions. A lot more coins and tokens will be used for specific services and we will easily exchange them versus BTC. People are too much in a hurry.

Posted Using LeoFinance Beta

I feel BTC has won the store of value debate. Alts are now having to prove them selves in real world applications. dEFI, Search, Advertising, Privacy. Fail to prove application and adoption will mean death for many projects.

Posted Using LeoFinance Beta

I will check it out when I get a chance. Thanks for sharing. I definitely think the alts are starting to bust out. Seeing BNB top $400 in the past 24 hours was quite a wake up call for me.

Posted Using LeoFinance Beta

Congratulations @realrouse! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 400 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I believe there will come a time they'll meet halfway. Bitcoin has limited features that can be called obsolete because other blockchains offer effective and efficient technologies.

Posted Using LeoFinance Beta

Cool!!

https://leofinance.io/@aggregator/bitcoin-waste-energy

Posted Using LeoFinance Beta

Its gotta be an AltSeason :P

Posted Using LeoFinance Beta

I'll be honest here: I have more trust in cryptocurrencies that have an obvious and clear real-world application (e.g. Hive, Ethereum, VET, XRP) than those that are touted as a "store of value".

If Bitcoin balloons to heights that are too stratospheric, then a government-backed 51% attack becomes very attractive, and it could mess everything up. China is well positioned to do this at the moment.

It's a risk that you simply do not run with gold, so I do think gold and perhaps CO2 credits will win the store-of-value argument in the long run (which is unfortunate for some of course).

Posted Using LeoFinance Beta

I grow firewood and other wood products. This is a real 'CO2 credit'.

Posted Using LeoFinance Beta

I think bitcoin has been slowly losing its dominance, soon others will rise to the challenge and it will come down to which are more accessible, which have the cheaper Gas/transaction fees and which has the widest adoption possibilities, who knows though it may be held as an Investment currency by those not wanting to see reality, it is a nice currency to have in your portfolio but will using it really add any value, Me personally I think not, but I cannot afford to buy 1,000 of coins. Lol

Posted Using LeoFinance Beta

I see this is a promoted post. Can you tell me how much you spent to put it on pronoted page

Posted Using LeoFinance Beta

interesting

Posted Using LeoFinance Beta

By the way the USA prints money 1 trillion won't buy you what it used to. I am sure the other countries are doing the same thing. Also, you have these things going on:

1.Baby boomers retire

2.COVID

3.Quadrillions in debt

4.US Dollar losing reserve currency status

Don't worry guys we have politicians at the wheel!

Summary: Don't be long on FIAT!!!!!

Posted Using LeoFinance Beta