Back in May, it was revealed that the Governor of the Bank of England was considering negative interest rates in order to encourage spending to stimulate the languishing covid-economy.

We haven't yet tipped into negative rates, adopting QE and a cut to a very low 0.1% rate instead, but it's likely that the worst repercussions of covid-19 won't be felt until later this year - once furlough wraps up and job loses kick in - and so we might see a negative rate introduced sometime in Autumn or Winter.

There is precedent: Japan and Sweden have previously introduced negative interest rates.

I've personally got about £10K kicking around in cash in several different savings accounts, and I've had a lot of emails and letters telling me of my declining interest rate (which was bad enough already), but what affect would negative interest rates have?

Possible consequences of negative interest rates

The first thing that springs to mind is my having to pay to hold savings in a bank....

And just a -0.1% interest rate, I'd pay £100 a year on £10K savings if there was a direct transfer over to me, the consumer....

Now £10K is not a lot of savings in the grand scheme of things, but just the thought of paying around £8 a month to hold it in a bank, that grates, that grates a lot!

In fact I imagine most people would think like me - they'd rather take the money out and store it under the mattress than pay to keep it in a bank, so I imagine banks will be stealthy in the way they'd pass any fees on.

So if we get negative interest rates, I guess bank fees for standard account packages will become more widespread, the fees being linked to the negative rate and tiered so that those paying a higher fee don't pay interest.

I've also read that UBS bank is already charging around a 0.6% fee for wealthier clients holding more than $500 000, which is equivalent to $3000 a year....

Could this mean more crypto adoption?

Surely a negative interest rate would encourage more crypto-adoption?

Especially when the price of BTC has been relatively stable of late....

And the fact that its price is increasingly linked to stocks, this might give new adopters the feeling that it's 'becoming legitimate' - certainly the adoption stats bare this out, with the numbers of people who have bought into crypto in the UK having nearly doubled in the last year.

Crypto marketing should focus on passive returns

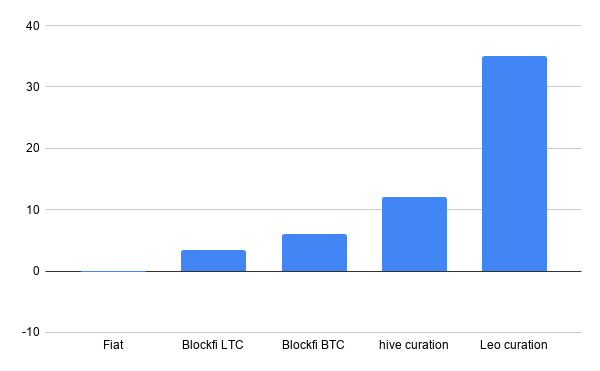

The possibility of negative interest rates on FIAT is a great opportunity for crypto - with so many opportunities to earn a passive income - through sites such as Blockfi, or, in the case of Hive and LEO, powering them up and staking for curation returns - I know it's not the same as interest, but it's a passive return, or at least a passive-ish return, like with interest.

Especially when you consider the relative annual approximate percentage returns going forwards (1):

Then crypto sounds like a no-brainer!

(1) based on my own stats!

Posted Using LeoFinance

I dont think enough people go into crypto or gold for that matter where it will have much of a difference.

Negative interest rates will likely force more money out of bonds and into equities.

This is the biggest reason for the run up in the markets...traders and investors look for a return. Even a kid can figure out that negative interest rates do not provide a return to the holder.

Posted Using LeoFinance

I guess it's a matter of where people put their cash - I was reading recently about the negative bond - where you get less than you put in to help prop up the economy during Covid.

Sounds like a real way to feed on people's paranoia - 'invest in this and we promise it will only get a little bit worse'...

Equities quite possibly yes.

I do wonder who holds cash these days anyway!

Posted Using LeoFinance

If you’d even mentioned “negative interest rates” a decade ago, people would have (rightly) wondered if your brain was malfunctioning. Now they’re just another tool of the war on savers.

Too many people are complacent, lulled by normalcy basis. It might take bank runs followed by bail-ins to focus their attention.

But negative interest rates “to encourage spending” would only incentivize those who have savings. Something like a third (or maybe it’s half?) of American households don’t have $500 in liquid assets for emergencies. Central banks may need to hand out more helicopter money if they want people to spend. Of course that raises other issues.

A lot of articles I've read were saying that the negative rate won't be passed on to most people - banks and credit cards will have a lower limit in place

It's a good time to reflect on money itself - interest is relatively new concept after all!

Posted Using LeoFinance

Negative rates=capital destruction..punish savings and reward borrowing. Horrible policy!

Posted Using LeoFinance

But only capital fiat destruction!

Posted Using LeoFinance

To me, it is one simple thing that more people will be attracted to cryptocurrencies when they will be unsatisfied by stock prices, more interest rates, slow economic growths etc. They might adopt crypto considering it as an alternative to traditional investments

We have crypto stable-coins, why not use those if people think the regular ones are too risky? DAI is one I can think of.

I get those letters too, 'we are delighted to tell you that you will be earning less interest than previously'. - yeah great!

Well I'm using HBDs myself - as 'sort of' stable - I'm keeping 400 or so as a super emergency fund!

Yes those letters - reminds you of how many accounts one has - I must have set up a dozen over the last decade to take advantage of introductory rates and left a few quid in each of them!

I'm on the cricket now on BBC2, feels good, old skwel.

Posted Using LeoFinance