Ok the rate you pay over the income generated through your wealth is indeed 30%, lower than the usual income from work which starts at 37%.

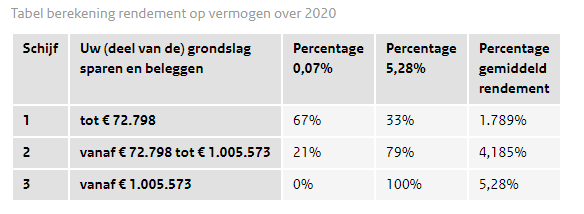

However, it's not the actual interest/profit gained from the wealth but a percentage from your total wealth. Here's the table (in dutch sorry, hard to find on the english page which is a total mess):

what it means is up to ~73k they assume you have 67% savings and about 33% stocks or other income producing assets. they then assume you make 0.07% on the savings and 5.28% on other assets. The more wealth you have they'll assume you have less savings and more assets so you're rate increases. Last row is two rates combined and that percentage of your wealth will be taxed at 30%.

It's kinda complicated with many assumptions, but actually not that bad when you consider the actual gains in crypto and their assumptions :-)

Posted Using LeoFinance Beta

So if I have a normal fulltime work with 37% tax and I sold 1 BTC (35000 Euro) I would pay 30% on that?

Or is it hard to do like that since it depends on your wealth(or assets)?

x)

Ah no it's not like that, there's no specific taxable "event" it's just paying tax on the assumed profit you make from the wealth you have.

So let's do an example, say you just have that bitcoin on January 1st 2020 (and no other savings, stocks etc to simplify). You'd actually pay very little tax because you're just over the threshold for wealth tax, first ~31k was exempt from taxation in 2020 and that figure is actually increased to 50k in 2021.

So you'd only pay tax over 4k euro (35k-31k), the assumption on that is you have 67% in savings and 33% in stocks etc. And the combined total yield on that would be 1.789%. so 4k*0.01789= 71.56

You'd only pay the 30% over this assumed 71.56 euro profit.

Now this is progressive as you can see in the table and the amount and assumed profit gets bigger with more wealth but it's not too bad actually.

The most you'll pay is 30% over the highest assumed gain which is 5.28% so 5.28*.3 = 1.584% tax on your wealth and only the part above the threshold..

Now keep in mind I'm no financial advisor so dyor yada yada, don't make any big decisions based solely on my input, but I'm pretty sure this is how it works

Its sooo confusing haha xD

I cant wrap my head around the "assumption" part xD

Oh ye for sure, no financial advice here :p