It is always fascinating to talk about how these five developing countries are forming a coalition against the global superpower. I wrote the first article of this series on @leofinance where I analyzed why these countries are mulling de-dollarization and what has been done so far. Let’s continue the conversation further as the members of the coalition met in South Africa this week and discussed the potential expansion of the BLOC.

What happened this week in Cape town, South Africa?

Senior officials from over a dozen countries including Saudi Arabia and Iran and the member nations were in talks on closer links with the BRICS bloc of major emerging economies last week. The objective as always is to deepen ties and position the group as a counterweight to the West led by the US and Europe. BRICS is considering expanding its membership. There are more than 25 countries, mostly from the global South, that have expressed interest in joining.

Iran, Saudi Arabia, the United Arab Emirates, Cuba, Democratic Republic of Congo, Comoros, Gabon, and Kazakhstan all sent representatives to Cape Town for the "Friends of BRICS" talks. Egypt, Argentina, Bangladesh, Guinea-Bissau and Indonesia were participating virtually.

External Affairs Minister S Jaishankar (India) said BRICS expansion is still a work in progress and member nations are approaching the idea with a positive intent and an open mind. This bloc of nations has shown strong intent to form alliance with other developing countries since the start of the Ukraine war in February 2022 which is led by China and well supported by Russia.

In a joint statement issued at the end of the meeting, the BRICS nations underlined the need for using local currencies in international trade and financial transactions. A potential new shared currency between them could shield other member countries from the impact of sanctions such as the ones imposed against Russia by the US and European countries.

What’s the proposal when it comes to a new currency?

There is a global backlash against the hegemony of the US dollar in the global market. Russia has been vocal in using trade in local currency for the overall process of “de-dollarization”. Recently, Brazil and China struck a deal to trade in their local currencies bypassing the US dollar. India and Malaysia have also signed a deal to ramp up the use of rupee in bilateral trade. China is actively trying to present Yuan as an alternative to the dollar. China’s yuan has surpassed the US dollar as the most traded currency in Russia as Moscow continues to deepen its political and economic ties with Beijing.

The BRICS nations are looking to “ensure that we do not become victims to sanctions that have secondary effects on countries that have no involvement in issues that have led to those unilateral sanctions,” Naledi Pandor, South Africa’s minister of international relations, reportedly said after the meeting.

On the one hand, proponents argue that a BRICS currency holds the potential to challenge the supremacy of the US dollar, or at the very least, unsettle its position of authority by facilitating cross-border trades among the BRICS members and like-minded countries.

On the other hand, critics argue that a BRICS currency is a flawed idea. As it is an attempt to create a nonsensical optimal currency as the economies are dramatically different in terms of trade, growth, and financial openness across the region.

How big is BRICS?

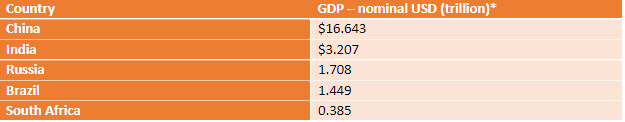

Here is a table comparing the 2021 nominal Gross Domestic Products (GDPs) of the BRICS countries. China is the largest economy followed by India, Russia, Brazil and South Africa.

*Please note that these figures are approximate.

BRICS represents 41% of the global population, 24% of the global GDP, and 16% of global trade. The member economies are so huge and diverse that it is almost impossible to compare. As shown in the table above, their economic sizes vary as do their growth rates, and industrial structures.

Brazil has a mixed economy and is one of the world's largest agricultural producers while Russia has a mixed economy with a significant focus on natural resources, particularly oil, natural gas, and metals. It is one of the leading global producers and exporters of energy resources. The country also has a strong defense and aerospace industry and is known for its advancements in technology and research.

India has a diverse and rapidly growing economy, driven by sectors such as information technology, telecommunications, manufacturing, services, and agriculture. It is one of the world's largest economies in terms of purchasing power parity (PPP). China has the world's second-largest economy and is the largest exporter and manufacturer globally. They are the biggest player in international trade and have been investing heavily in infrastructure and innovation.

South Africa has the most diverse economy among the BRICS countries. It has a well-developed financial sector and is rich in natural resources, including gold, platinum, and diamonds.

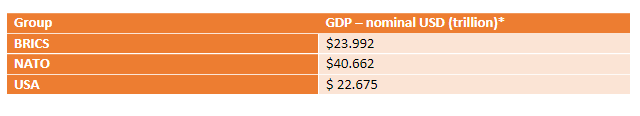

How is BRICS compared to NATO and the USA?

If the bloc is a force of the developing nations that are being considered the next superpower, it would be nice to compare them with NATO and the US. The table compares the nominal GDP of BRICS, NATO (30 member countries), and the United States based on 2021 estimates:

What are the challenges?

There are challenges in achieving their desired goals and addressing various issues that they thought they would be tackling.

The New Development Bank was established as an alternative to institutions like the World Bank, with the goal of providing quicker financing and fairer governance. However, the NDB has faced criticism for being less transparent and accountable than other multilateral development banks.

The Contingent Reserve Arrangement (CRA) established swap arrangements between BRICS central banks to provide liquidity during balance of payments crises. However, to date, no BRICS central bank has utilized the arrangement.

While the BRICS leaders have agreed to create additional entities like a vaccine center and a new credit rating agency, these agreements have not been implemented. They have not been successful in reforming existing global economic governance institutions such as the IMF.

The BRICS countries are not unified in their demands for reform. For example, while Brazil, India, and South Africa support UN Security Council reform, China and Russia, as permanent members, do not. Similarly, not all BRICS countries have supported South Africa's call for a third African seat on the IMF's board of directors.

What’s next?

The BLOC leaders will meet in August in South Africa to decide on new currency and membership expansion. Many countries are interested in joining BRICS due to its symbolization of a multipolar world. The friends of BRICS are all powerful economies that control natural resources and fuel supply. That makes the membership expansion a huge agenda both for the member nations and the west alliance. Saudi Arabia and Iran working together with Russia and China is a huge prospect.

Could this be a challenge to the global political order guarded by the United Nations?

Will it bring in the international economic reform that boosts the future of cryptocurrencies?

We will wait.

Posted Using LeoFinance Alpha

Everyone pays attention to the number of countries involved and percentage of the population, and yet excludes the most important metric: How much trade, in dollar valuation stands to be affected... it's marginal, almost nothing over a year, especially in comparison to dollar-dominated daily trade on Forex markets. The dollar is up almost 7% against the Yuan since January this year. Don't even mention the Rand... the dollar is up almost 25% against the rand in the same period. De-dollarization is an agenda-driven narrative... quite similar to the SEC-driven narrative against Crypto. It's rather disappointing how the Crypto community has lapped this up. True de-dollarization is quite a way off.

I agree. There is no way dollar is letting go its dominance especially when almost all international trade happens in dollar. Russia traded with India in their native currencies and they don't know how to deal with the Indian Rupee reserved that they have in billions.

It is all about political optics and narrative. That also means dedollarization is many moons away and is being raised by countries as a bargaining narrative. Let's see how this evolves.

One thing is for certain though, the political hegemony of the West is being challenged here. We have to wait to figure out how successful this narrative will be.

Posted Using LeoFinance Alpha

It is the US that wants de-Dollarization.

Read this article (it was written in 2014, no one would believe in de-Dollarization if someone had said this back in 2014, but now it is the talk of the town)--

https://www.nytimes.com/2014/08/28/opinion/dethrone-king-dollar.html

And U know who is Jared Bernstein? And what position he holds now?

In Geopolitics, things are not explicit neither they will pinpoint a particular objective or outcome, U always need to connect the dots to explore that outcome.

https://leofinance.io/threads/rmsadkri/re-leothreads-snswbgvy

The rewards earned on this comment will go directly to the people ( rmsadkri ) sharing the post on LeoThreads,LikeTu,dBuzz.