Following a conversation with @niallon11, I was inspired to write up a little post introducing this index that not too many people actually know about called the DeFi Pulse Index.

What Is It?:

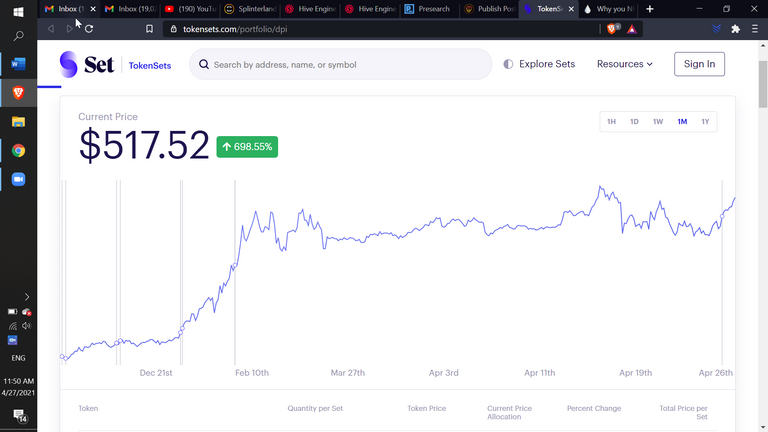

The DeFi Pulse Index, or DPI, is a market-cap weighted index of the popular DeFi tokens on the Ethereum network. It was created on a website called Tokensets.com that allows users to build weighted indexes of tokens to bundle and trade on DEX's.

There are a few types of criteria that are necessary for tokens to be included in the DPI that boil down to evaluating the tokenomics of the token itself and the promise of the protocol that backs it.

It is currently trading for over $500 on DEX's like Uniswap and the weight of the tokens is adjusted regularly to provide optimal exposure.

As of right now those tokens (and weights) are:

- Uniswap (~3.66 tokens)

- Aave (~.22 token)

- Maker (~.016 token)

- Compound (~.079 token)

- Synthetix (~2.6 tokens)

- Sushi (~2.45 tokens)

- Ren (~15.49 tokens)

- Kyber (~3.48 tokens)

- Loopring (~21.26 tokens)

- Balancer (~.19 token)

- Harvest (~.0073 token)

- Cream (~.0098 token)

- Meta (~.371 token)

You can check the live statistics of what is in the DPI and what the exact weighting is in the token bundle here: https://www.tokensets.com/portfolio/dpi

Why Buy DPI? (NFA):

I like the concept of DPI because it allows you to be involved with many different platforms at the same time for one upfront price. Rather than going and buying small amounts and paying the fees numerous times on numerous sites, tokensets has created this bundle for us to get a bit of everything for one fee.

It is convenient and well diversified IMO and though you can use the website tokensets.com to build your own version of the DPI, I really like the balance that this set has.

The Downside:

The downside is that you are lowering the amount of individual tokens you are purchasing. If you really believe in a project you should likely do your own research to see how much of the token you would like to accumulate as the amounts on the DPI are relatively small because there are so many tokens invovled.

Also the DPI is run by a centralized group that has the authority to change the token weights. Though they publicize everything they do, the people who run DPI at the end of the day are the ones who are deciding what is and what is not important to be invested in. However, this is no different than investing in an ETF or a hedgefund, it is a common practice that has historically shown to be profitable in the right circumstances.

Thinking Ahead:

It is my prediction that a tool like this will come out for the Binance Smart Chain as well (if it does not yet exist). I think that I enjoy the idea of hedging my investment to have all of the top picks included and watch the value grow as the overall market improves, there is not a need to pick a favorite it is a positive sum game personified.

Do your own research, but give some merit to the idea of diversification in this blossoming market.

Disclaimer: I am actually not yet invested in DPI though I plan to be at the earliest chance I get!

If you enjoyed this article please feel free to reblog/rehive!

@mariosfame gif once again, I love it

Links and Connections:

Follow me on Twitter: Rob_Minnick23

LeoFinance/HIVE : rob23

Join me on Torum: https://www.torum.com/signup?referral_code=robminnick23

Join Cake DeFi and get $30 in $DFI as a new user: https://pool.cakedefi.com/#?ref=187314

Noise.cash: rob23

Read.cash: R23

Join me on Publish0x: https://www.publish0x.com/?a=M7e587xqd2

Who I am:

My name is Rob and I am a college student doing my best to get involved in the crypto world. I have enjoyed blogging thus far and thank you for reading my article! Give me a follow and let’s build the community together through consistent engagement.

Posted Using LeoFinance Beta

What is the expense fee for doing so? I imagine all those trades will take fees to rebalance so I think it will be similar to how ETFs charge a fee.

Posted Using LeoFinance Beta

interesting point here. I am not entirely sure honestly. I looked into it and couldn't find anything, which actually leads me to believe you may get the version of the DPI that exists when you purchase it; could be totally wrong though

Posted Using LeoFinance Beta

It doesn't make sense for them to not charge you for transaction and management fees. So I fully expect it to be there as I don't think they are running a business that is losing money.

Posted Using LeoFinance Beta

I'm not sure that it is directly considered a business nor service. It is a token bundle built on tokensets and that is essentially just allowing you to copy their diversification allocation, they may receive a kickback in some way from fees, but it is not directly a business in my eyes

Posted Using LeoFinance Beta

I do love the idea of this and have bough in nicely to the one by @jongolson for the hive eco-system.

To be honest I am trying to mave away from anything eth related as I don't like doing anything on that chain with the fees and everything else that makes it awkward to use.

I'll take a look into this project anyway since index tones are a great way to spread risk but if we find one on BNB I'm all over it. That is where the action will be next year as defi moves over there and the price flips eth.

I hear you, ETH is pretty crap IMO. But that being said it has the first mover advantage and thus the defi projects in the space should be the first to grow into successes. I can't wait to see what happens on the BSC end, I really like the token there

Posted Using LeoFinance Beta

nice article.

Posted Using LeoFinance Beta