A couple of months ago, Hertz missed Wall Street estimates for EBITDA due to Hertz saw a rapid fall in rental demand, rental cancellations and forward bookings because of COVID-19. At that time, Hertz disclosed that it "did not make certain payments" required under operating lease and service agreement, laid off 10,000 and filed for bankruptcy.

This immediately sent shock waves through the auto sector because if the creditors of the debt using the rental vehicles as security decide to liquidate the fleet to repay the bonds, used-car prices would inevitable head lower.

Carvana Co., together with its subsidiaries, operates an e-commerce platform for buying used cars in the United States. The company purchases, reconditions, sells, and delivers vehicles. The company's direct to consumer business model, bypasses the traditional dealership ecosystem to reduced costs and pass the savings on to the consumer with the use of their car vending machines.

So I thought lower used car prices meant Carvana’s car inventory would be less valuable. In addition, used and off-lease vehicle supply will stack up without wholesale auctions or consumer demand and possible test the March lows.

Last month I ignored Avis’ stock rising when on news that a Morgan Stanley analyst was no longer bearish on the stock due to raise cash and cost cutting initiatives costs and that falling used car prices had subsided.

An abrupt drop in activity due to the pandemic dealt a heavy blow to the used car market, especially in March and April. The prices of used cars also started to crater amid weak demand, unusually timed off-lease inventory and lower auction prices. However, as lockdown restrictions eased, used cars started seeing a recovery in prices driven by a number of factors.

Supply shortage and rising demand of used vehicles on the back of low fuel costs, expensive new vehicles and preference for car ownership rather than usage of public transportation drove the used car prices.

With coronavirus showing no signs of abatement anytime soon, traveling by public transport is not considered a safe choice by many. As such, sales of used vehicles have held up better than new cars. Further, the unwillingness of people to use ride-sharing services amid coronavirus concerns is supporting the used vehicle prices.

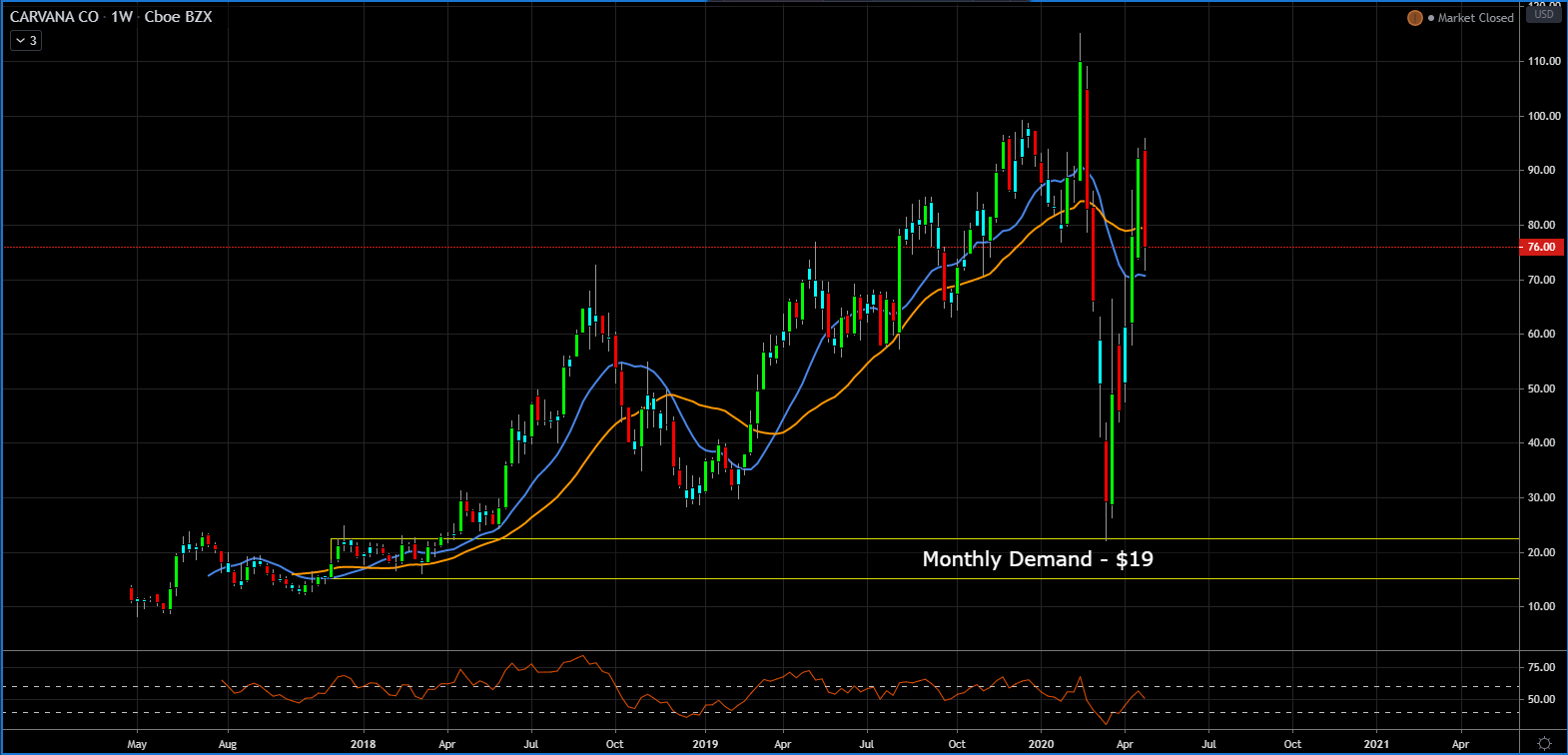

So not only do you have people not wanting to take public transportation or use any ride sharing services, but after the car dealerships started opening up again, you had people not wanting to interact with car salepeople either. And that's where Carvana stepped in to fill that void, resulting in sales increasing 20% to 30% into May with the stock now trading at all-time highs. If you believe in the Carvana story, the chart suggests to buy on a pull back at the daily demand at $117.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

More than that, Carvana also offers financing. They are able to profit from the car sale and the financing.

I am considering the trade-in of my old Prius for an electric car. Carvana is the option I'm considering as they also deliver your purchase, which I would need given the range of the Nissan Leaf.

Posted Using LeoFinance

I should look into them as well, trying to get another nissan maxima, but want the 2014, before the new style that exist today.

Posted Using LeoFinance

OMG! Never even knew something like this existed. All your points made makes Carvana a solid long term hold in my opinion too. Its basically a car dealership killer. Less employees and higher selection of inventory. I can imagine when more car rental companies have to sell their fleet when business continues to slow Carvana will be able to scoop cars cheap and sell them back out due to demand. One drawback I see is anyone else can mimic this business. I will have to do more research to see if Carvana owns patents or licenses. This is really interesting.

I feel you Bro, check out Vroom as well, they just went public...Carvana has comp now.

Posted Using LeoFinance