Robert Kiyosaki is the author of Rich Dad Poor Dad. The book has sold over 30 million copies and written in 51 languages. The book is a staple and should be in everyone’s library because it talks about financial literacy, something lacking in American.

The book is about Robert and his two dads, his real father (poor dad) and the father of his best friend (rich dad) and how the poor dad worked for money, but the rich dad made money work for him. Concepts from the book include:

You must know the difference between an asset and a liability, and buy assets.

An asset puts money in your pocket. A liability takes money out of your pocket.

Once you understand the difference between assets and liabilities, concentrate your efforts on buying income-generating assets.

“The rich buy assets. The poor only have expenses. The middle class buy liabilities they think are assets.”

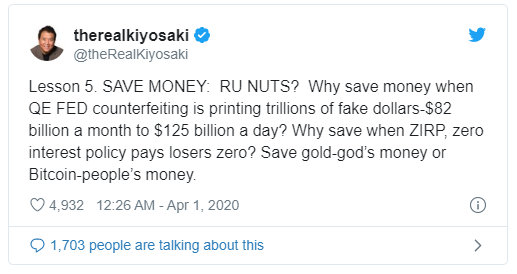

Early this month Robert made headlines when he said to not save your money, spend it on the ‘best buy for future security.’

Robert later went on to say, buy Bitcoin, Gold and Silver as the US dollar will continue to lose value over time.

A global slowdown caused by the global COVID-19 pandemic will weigh on silver industrial demand this year, but according to the latest research for the Silver Institute, investment demand will drive prices higher in 2020.

In a telephone interview with Kitco News, Newman said that investor demand for silver, led by a rally in gold, could push prices to $19 an ounce this year. The comments come as silver prices struggle to hold gains above $15 an ounce. May silver futures last traded at $14.96, up 0.6% on the day.

Metals Focus’ price target represents a more than 26% gain in silver from current prices.

Investors, companies and households hoarded dollars when the COVID-19 kicked into gear in anticipation of the world economy coming to a halt. But if and I mean if, the economy comes back later this year and the US Feds stay dovish, a weaker dollar should equate to silver moving higher in price.

Silver prices have been range bound for five years, having only breaking out once to the upside and once to the downside. The best time to buy was when price hit the monthly demand at $12, but if the scenario above plays out or if we see another leg down in the stock market, the chart suggests price can move higher to the $20 level.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

In fact, I enjoyed all this valuable information. I liked this. Thank you.

My pleasure, glad you enjoyed it.