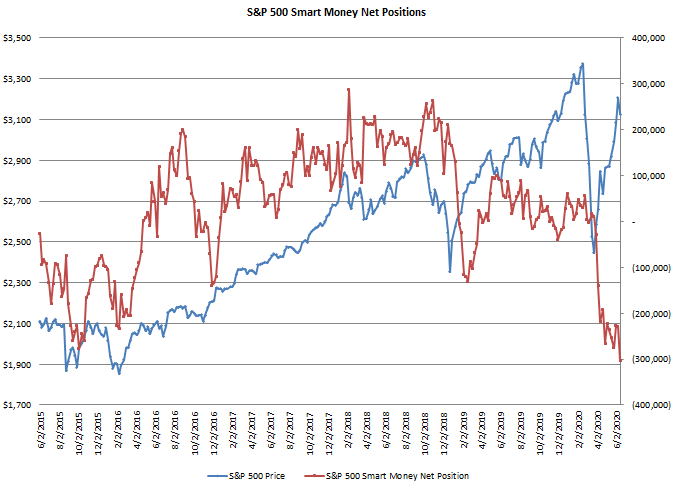

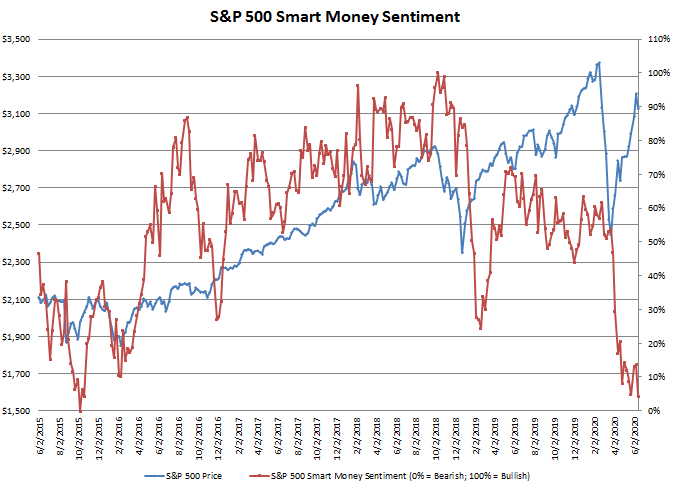

The Commitments of Traders (COT) is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) listing the positions held by commercial traders and the “Smart Money”, the hedge funds and bank institutions in various futures markets in the United States. Since the COT measures the net long and short positions held by speculative traders and commercial traders, it is a great resource to gauge sentiment in the Markets.

Jeremy Grantham, co-founder and chief investment strategist at Grantham, Mayo, Van Otterloo & Co., recently said what we are witnessing is the real McCoy. It’s actually the fourth real McCoy as Jeremy has call the top in three previous bubbles. Jeremy cites life on Wall Street and Main Street as the world deals with the greatest pandemic of the past century wreaking havoc on unemployment numbers and business bankruptcies. Speaking of bankrupted companies, Jeremy also cites the asinine 500%+ rally in Hertz in recent weeks and the stay at home day traders as additional signs of a frothy top. Two weeks ago, when Dave Portnoy, founder of Barstools called out Buffett saying he a “washed up” investor who’s no longer relevant, that was my warning sign of the Markets topping out.

But Mark Haefele, chief investment officer at UBS has a different opinion on the matter.

In our call of the day, UBS said the Federal Reserve’s “unambiguous” story would drive stocks higher in the medium term and said now wasn’t the time for investors to be sitting on the sidelines. The central bank unveiled plans to start buying a broad and diversified portfolio of corporate bonds last week, sending stocks higher. Other central banks, including the Bank of England and the European Central Bank, have implemented further support in recent days.

The analysts, led by chief investment officer Mark Haefele, said three narratives were currently driving markets; the ‘Fed story’ — ongoing central bank stimulus — the second-wave story, and the U.S. election story.

“Overall we see the second-wave and U.S. election stories as contributing to market volatility as headlines feed investors’ hopes and fears about the speed and strength of the economic recovery. But it is the Fed story that will endure over the medium term,” they said in a note on Monday.

However, if I'm siding with the Smart Money, then I'm in the Jeremy Grant camp as the Smart Money is the most short on the S&P 500 in 9 years.

And the sentiment is just as bad with a sub 10% bearish reading.

I was once short the Markets, until I decided not to fight the Feds any longer, but this data I put together is telling me to just be ready as I might get another opportunity to short the Markets in the near future.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance

In 2007 I saw the housing market crash coming but didn't know how to play it other than sell my house at the top.

Now it looks like we are being setup for a fall again.

My question is and I'm not asking for advice, how are you positioning yourself for this?

What's your play?