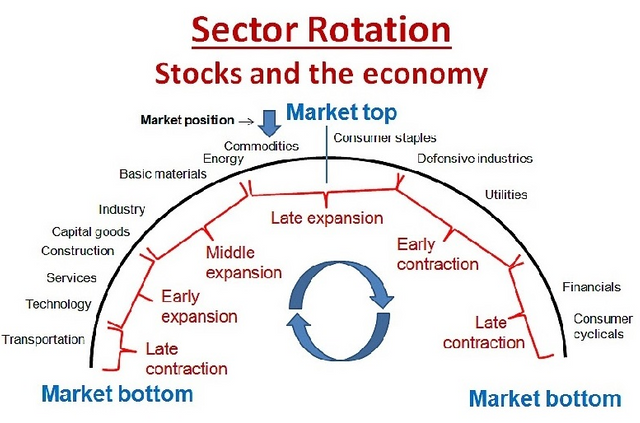

Sector rotation is the action of shifting investment assets from one sector to another to take advantage of cyclical trends in the overall economy in an attempt to beat the market. Sector rotation seeks to capitalize on the theory that not all sectors of the economy perform well at the same time because sectors of the stock market perform differently during the phases of the economic and market cycle.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

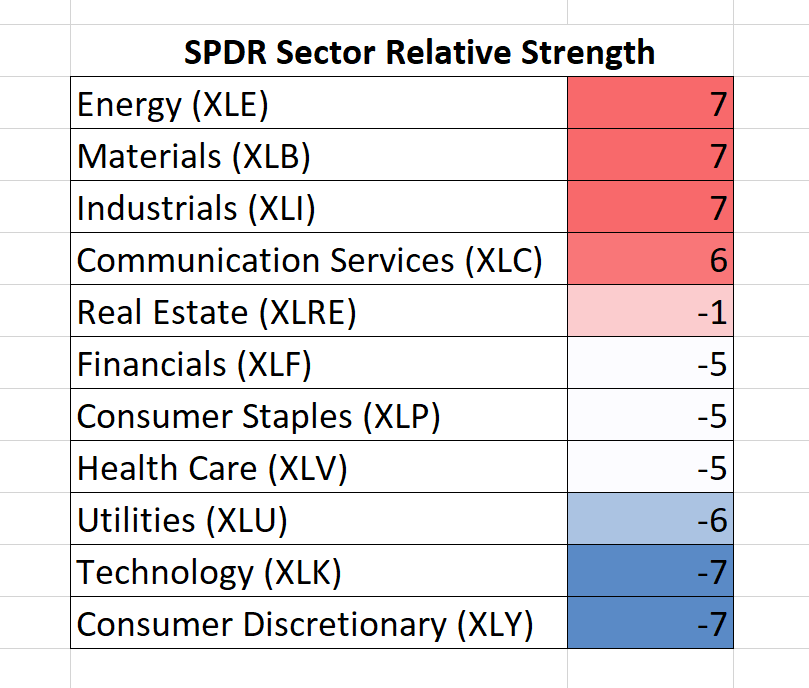

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

Communication Services (XLC)

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financials (XLF)

Health Care (XLV)

Industrials (XLI)

Materials (XLB)

Real Estate (XLRE)

Technology (XLK)

Utilities (XLU)

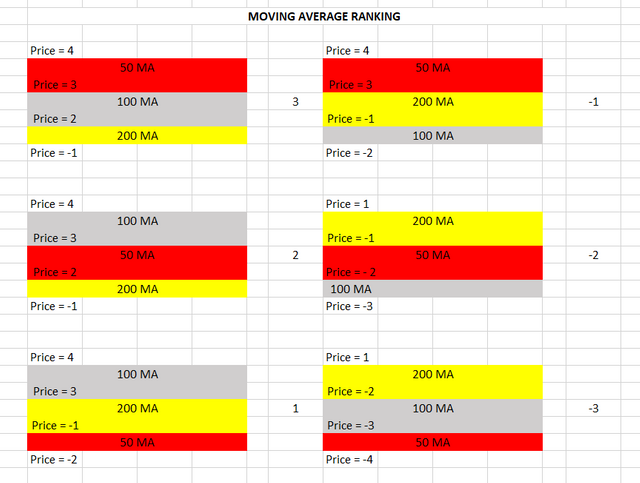

Based on the moving averages and the last daily closing price, relative to the moving averages,

the SPDR sectors' relative strength, relative to the SPY are the following:

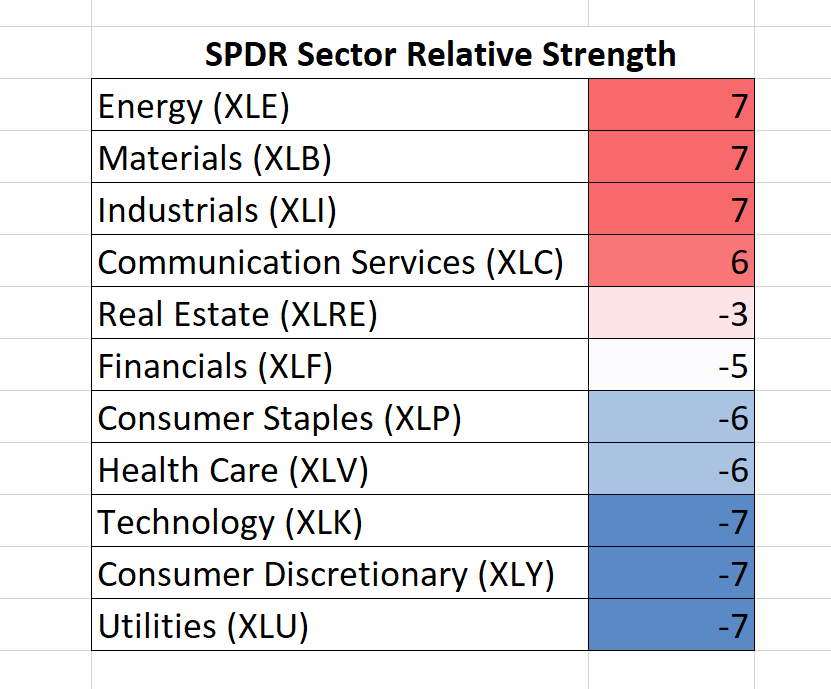

Two Weeks Ago

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|  |  |

Posted Using LeoFinance Beta

Hmmm....

So I know you are a Demand Investor, but also it seems your are also traditional in seeking diversification?

My thoughts on understanding the lesson of this post, from the Teacher (you) to the student (me)

You state:

So the S&P 500 is an ETF of the top 500 companies in the US to invest in and you create a sector analysis, comparing the relative strength of what appear to be sector ETFs, and you use this relative strength analysis to help you pick which one to invest in?

And I assume you are doing this in the name of thatcher principle of stock investing called Diversification?

So this is how you guide your sector diversification efforts when investing?

Am I correct?

Please explain what else I should get from this.

Thank you

@shortsegments

Posted Using LeoFinance Beta

@shortsegments I have never heard of thatcher principle of stock investing, something for me to invest and learn. It's less about diversification and more about putting the odds in your favor. So we are still in a bull market, so invest in the strongest stocks. Typically, 80% of a stocks move is due to the index and sector the stock is in. So I like to work backwards first...from index, to sector, to stock.

Posted Using LeoFinance Beta

Hi @rollandthomas

Thank you very much for the explanation.

I am revisiting Mara tomorrow to see if it’s options dipped, and if there is a mean revision profit to be potentially harvested there.

Posted Using LeoFinance Beta