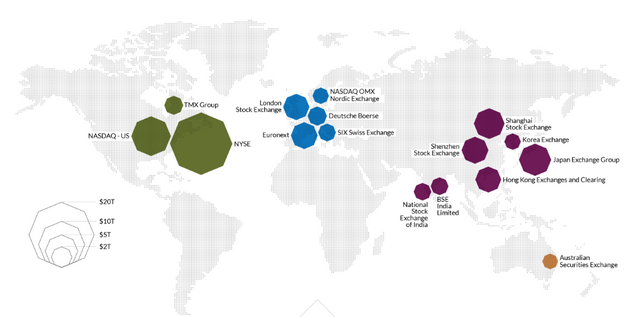

The Standard & Poor's 500 Index (known commonly as the S&P 500) is an index with 500 of the top companies in the U.S. Stocks. Because the S&P 500 Index represents approximately 80% of the total value of the U.S. stock market, it’s the bellwether index for the U.S. stock market. In addition, the U.S. stock market is the largest stock market in the world, it’s also the bellweather for equity markets around the world. The S&P 500 is arguably the most important stock market index on the planet.

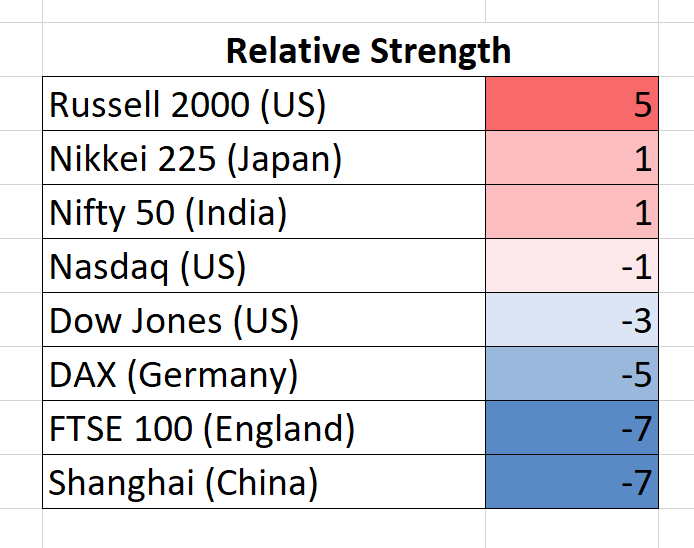

Because we live in a global economy, the global equity markets interconnected and highly correlated. However, some will outperformance other in the short term and long term. When constructing an equity portfolio, for the best returns one needs to have the ability and the capacity to assess all the major equity markets around to asset allocation purposes. However, the first step is to determine the relative strength of the major equity markets, relative to the bellweather, the S&P 500.

DAX (Germany)

Dow Jones (US)

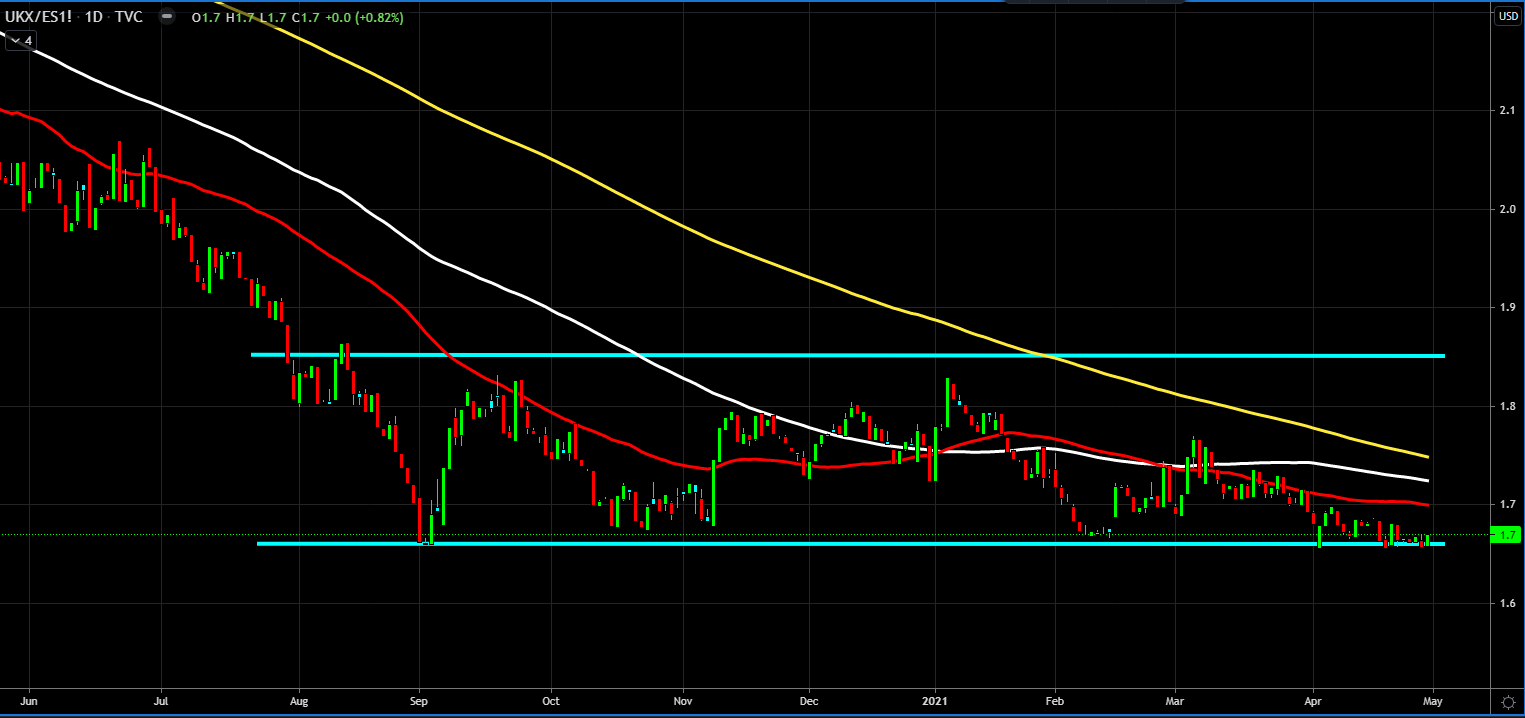

FTSE 100 (England)

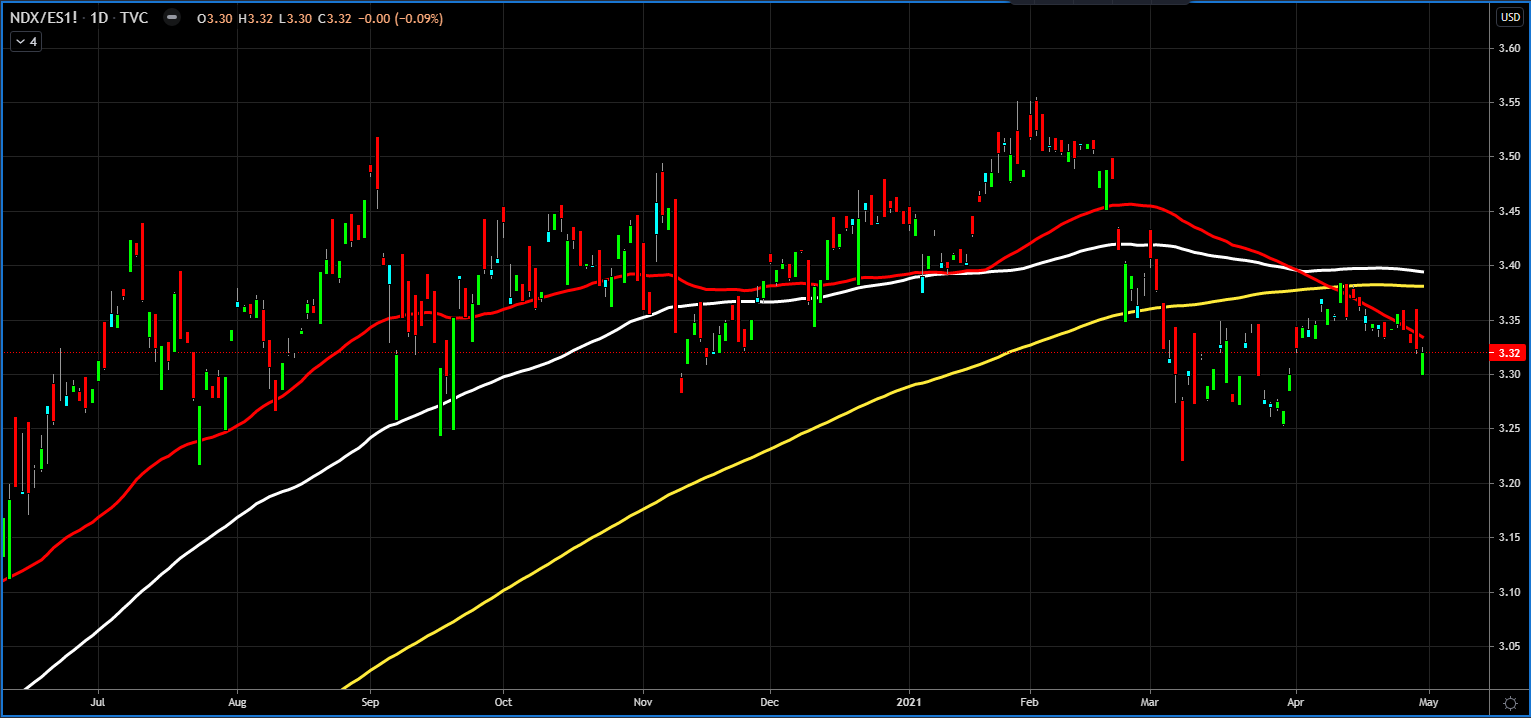

Nasdaq (US)

Nifty 50 (India)

Nikkei 225 (Japan)

Shanghai (China)

Russell 2000 (US)

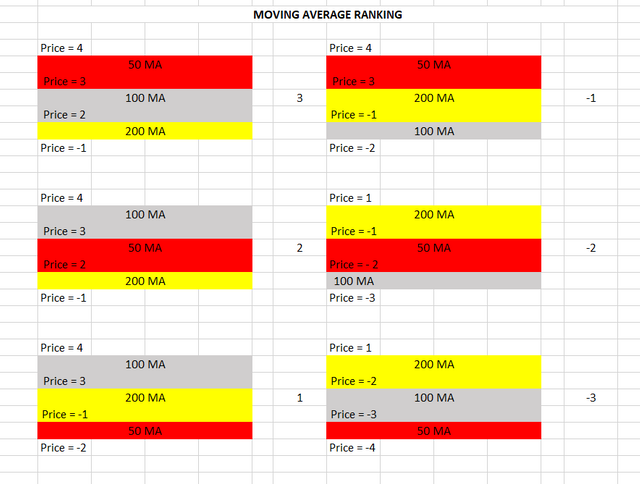

Based on the moving averages and the last daily closing price, relative to the moving averages,

the world equity markets' relative strength, relative to the S&P 500 are the following:

Two Weeks Ago

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|  |  |

Posted Using LeoFinance Beta

Hi Roland

Please consider supporting this No Loss Lottery Project. https://leofinance.io/@shortsegments/leofinance-lions-community-based-promotion-of-cubfinance

A reblog and a supportive comment would be great!

Also if you would support the No Loss Lottery that would be great. I could use some help building up the reserve, non-ticket purchase monies which increase the pot size to increase the prize win by smaller accounts entered in the Lottery. There are over 120 entries!

Posted Using LeoFinance Beta

I wonder how much longer the US will find itself as the dominant market power. I think it feels as if other nations are really catching up with us

Posted Using LeoFinance Beta

The Chinese Yuan is coming on strong, but the IMF will establish a world currency in the future.

Posted Using LeoFinance Beta

Will that be crypto-based? In your opinion

Posted Using LeoFinance Beta

When? And what?

Posted Using LeoFinance Beta

Hmmmm in a world dominated by corona and lockdowns the ability of the US to print cash continues to make it a dominant currency I think. During time’s of uncertainty, people turn to what they know, the US Dollar. Only the Awoke turn to cryptocurrency. :)

Posted Using LeoFinance Beta

Well I am happy to be a part of that "awoke" group then

Posted Using LeoFinance Beta

Your post has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Agree that the S&P 500 is the strongest group of companies and a good investment choice.

Posted Using LeoFinance Beta

How do you use the relative strength indicators in your trading activity?

Posted Using LeoFinance Beta