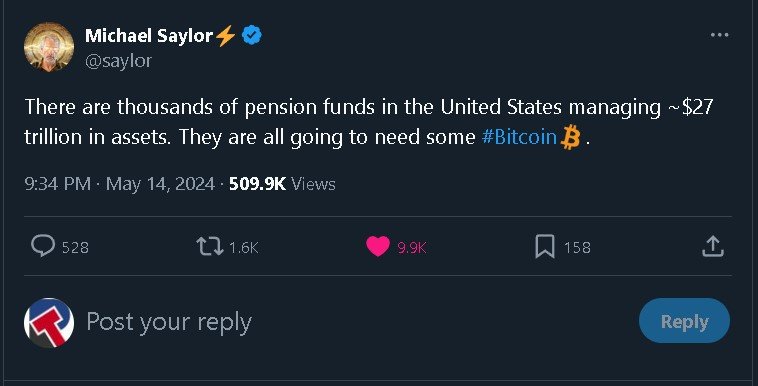

MicroStrategy co-founder Michael Saylor made a prediction about pension funds in his post on X yesterday, saying, "There are thousands of pension funds in the United States managing ~$27 trillion in assets. They are all going to need some Bitcoin". I follow Michael Saylor's posts and statements closely and he is an investor who makes near-accurate predictions and is someone who can really see the future in investing.

In fact, pension funds around the world, not just those in the United States, will need some Bitcoin.

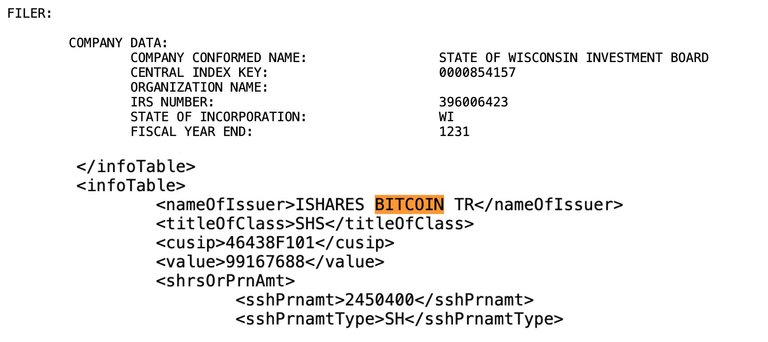

According to data shared by Bitcoin magazine on X, the State of Wisconsin Investment Board (SWIB) is taking important step towards integrating Bitcoin into traditional investment portfolios. The State of Wisconsin Investment Board (SWIB) appears to have invested approximately $100 million in BlackRock's spot Bitcoin ETF (IBIT), according to a recent filing with the Securities and Exchange Commission (SEC). Additionally, SWIB holds over $63 million worth of Grayscale spot Bitcoin ETF (GBTC) in the filing, and it appear to have around $163 million invested in ETFs in total. By the way, the State of Wisconsin Investment Board (SWIB) is the first state-level institution to publicly disclose its holdings in spot Bitcoin ETFs. SWIB's filing with SEC

This is a really important step and one of the largest notable institutional acquisitions into Bitcoin after MicroStrategy and Tesla. Investors follow the shares acquired by pension funds very closely because pension funds prefer companies or assets with growth potential and future investments, which is exactly why it is a big step for pension funds to hold Bitcoin. And since wealthy investors and institutions tend to act together, there could be a very significant increase in investments in Bitcoin and inflows into the crypto market in the near future. Who knows, maybe this has already started.

Institutional investors do not make large investments without detailed research, and pension funds in particular do not invest in assets that they will lose, so they may be investing because they see great potential in Bitcoin. I also think that not only pension funds but also other funds need some Bitcoin. And I think there will be much more inflows into Bitcoin towards the end of this year, and I think this will have a positive impact on the Bitcoin price.

Thank you for reading

@rtonline

This is not investment advice,I am just talking about current developments and only my personal opinions. As with all money markets, anything can happen in the crypto market at any time, so please do your own research before investing.

Posted Using InLeo Alpha

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.