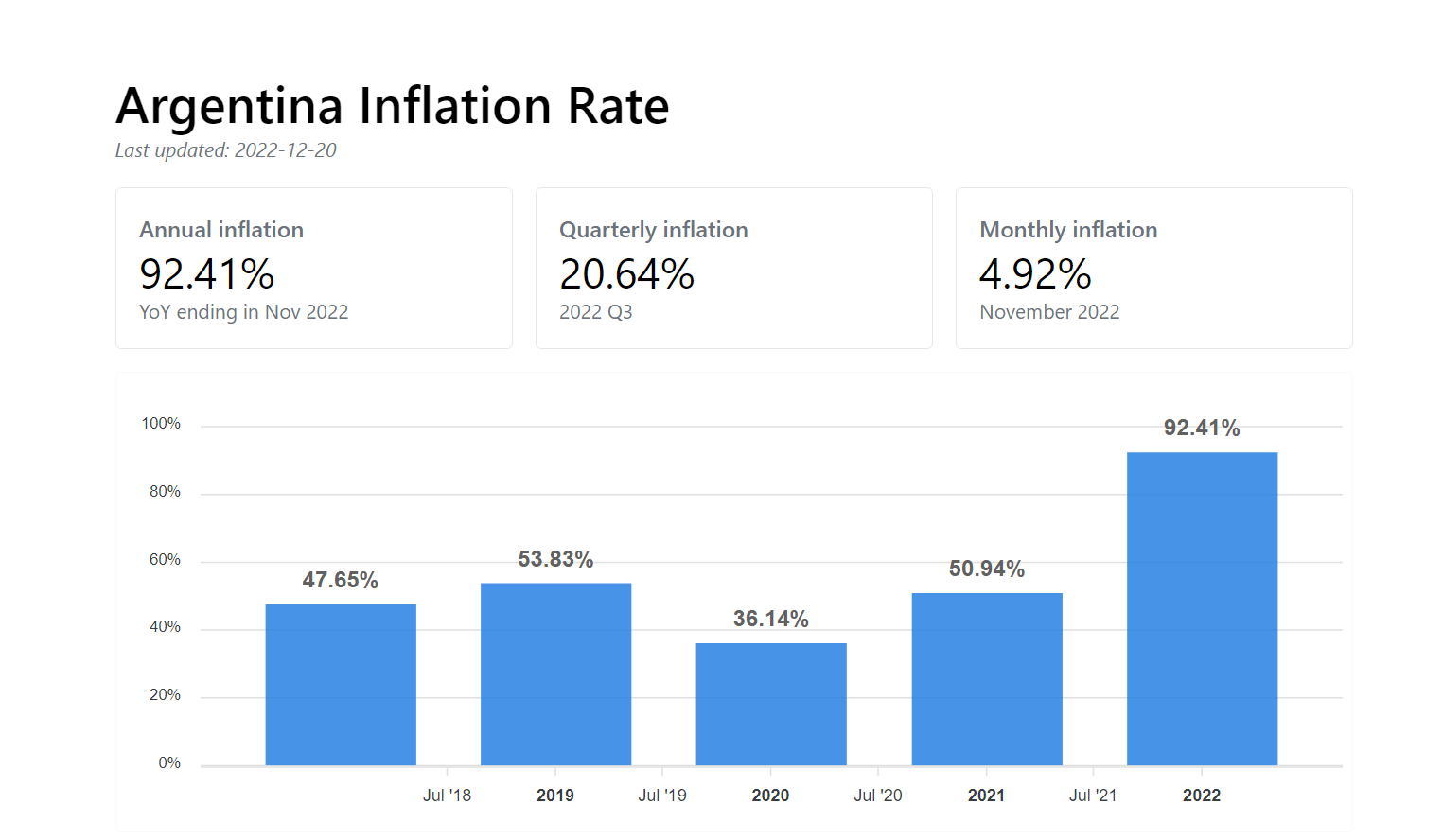

Inflation in Argentina has been on a steady rise for the past five years, causing significant negative impacts on the economy. This is a concerning trend, as it affects the purchasing power of citizens and businesses alike.

Argentina Inflation (5 yrs)

Inflation is a sustained increase in the price of goods and services over time. It is measured in terms of the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services. In Argentina, the CPI has increased by over 30% since 2015, meaning that the value of the peso has been steadily decreasing. This has resulted in fewer people being able to afford basic necessities, as well as a decrease in business profits.

The primary cause of inflation in Argentina is the government’s decision to print more money. This has put pressure on the currency and caused its value to decrease. As a result, prices of goods and services have skyrocketed, leading to an increase in inflation. In addition to printing money, the government has also implemented several policies to try and combat inflation. These include increasing taxes on imports, encouraging savings, and reducing government spending. However, these measures have not been effective in controlling inflation, as the country’s inflation rate remains high. The negative impacts of inflation on the economy of Argentina are numerous. It has decreased the purchasing power of citizens, leading to a decrease in consumer spending. This in turn has resulted in businesses having less revenue and profits, leading to job losses and decreased economic growth. In addition, it has caused the value of the peso to plummet, making it difficult for businesses to access capital.

Negative Impacts of Inflation

Inflation can have a devastating effect on a nation’s economy, currency, and purchasing power, as well as its relationships with foreign powers. Inflation is an economic phenomenon that occurs when prices consistently increase over an extended period of time.

It is often caused by an increase in the money supply and is usually accompanied by a decrease in the value of a nation’s currency. When inflation takes hold, it can have a profound effect on a nation’s economy. It can lead to higher prices, reduced purchasing power, and decreased savings. As prices continue to rise, people tend to adjust their purchasing habits to account for the higher costs of goods and services. This can lead to reduced consumer spending, which can further weaken the economy. This can lead to a decrease in living standards as people are forced to purchase fewer goods and services due to the decrease in purchasing power.

Inflation can also have a damaging effect on a nation’s currency. When prices increase, the value of the currency decreases, making it less attractive to foreign investors. This can lead to a decrease in foreign investment and a decrease in economic growth. In addition, other nations may view a nation’s currency as being less stable and may be less likely to enter into trade agreements with them. Finally, inflation can negatively impact a nation’s relationships with foreign powers. When the value of a nation’s currency decreases, other nations may view that nation as being weaker and less stable. This can lead to a decrease in foreign investment and a decrease in foreign aid.

The Entry of Bitcoin.

As the world continues to grapple with the effects of inflation, countries like Argentina could potentially shift their focus more on Bitcoin to counter inflation in the long run. Inflation is a major concern for the Argentinian economy and has been a major factor in driving down the value of the Argentinian peso.

The adoption of Bitcoin as a means of exchange could lead to more stability in the economy and better economic results. With the ability to freely trade and exchange Bitcoin, users can also avoid costly fees associated with traditional banking. Additionally, Bitcoin transactions are easy and can be conducted without the need for third-party services. As the value of the Argentinian peso continues to decline, Bitcoin could be an ideal solution for countering inflation. With its built-in security and decentralized nature, Bitcoin offers users the ability to store and transfer money without having to worry about the instability of their local currency. Furthermore, Bitcoin has become increasingly popular in Argentina, making it easier for users to buy and sell digital currency.

Bitcoin has proven itself to be a reliable hedge against inflation, with its value increasing steadily over time. This is largely due to its limited supply, which means that prices remain stable in the long run. Furthermore, it is a decentralized currency, meaning that it is not subject to the same political and economic pressures as traditional currencies.

- Bitcoin is a secure form of payment. Transactions are encrypted and secure, reducing the risk of fraud or theft. This makes it a much safer form of currency than traditional fiat currencies.

Store in HBD.

Another option is putting the money in HBD as it gives an estimated 20% APR annually and also remains very stable and not much FUDS out there either like we have with USDC and USDT, giving the power to individuals to print money. Here is an article I read long time ago on Leofinance regarding this topic by @geekgirl.

There are some corrections in this which are done by Taskmaster, you can look out through that.

Thanks for going through the post and I hope you must have attained value from it and also, enjoyed it. Rest, this all is not financial advice but rather, my thoughts being shared here and also just for entertainment purposes. Have an amazing rest of your day!

SANJAM

Posted Using LeoFinance Beta

Congratulations @sanjamkapoors! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 400 replies.

Your next target is to reach 300 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: