As per CBDT (Centre Board of Direct Taxes) directives, it is mandatory for all Permanent Account Number (PAN) card holders to link their Aadhaar with PAN on or before Today, March 31, 2021.

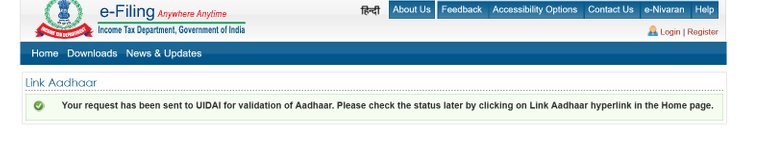

So if you do not know, then today is the last date for linking your PAN to Aadhaar , and there are consequences of not doing it today. If Aadhaar is not linked then your PAN will be considered inoperative and there will be several impacts. As per the notice from my bank, it will have an impact on TDS rate at the time of receiving any policy payouts, TDS rate on taxable payout (Applicable on payouts made to Resident Indian policyholders) will be 20% as per Section 206 of Income Tax Act, 1961 (Effective from 1 April, 2021). Some sites say, there is going to be penalties if you link after today, some say its going to be 1000/- , some says it will be 10000/-. But there is no clear picture. So I had to rush today to do this today and unfortunately the site itself is going through problems. I think, because many are trying to do this today, the site is not able handle the load. After repeated retries for last couple of hours here is where I landed :

But at least now its on them. Ideally, it should have been done in minutes.

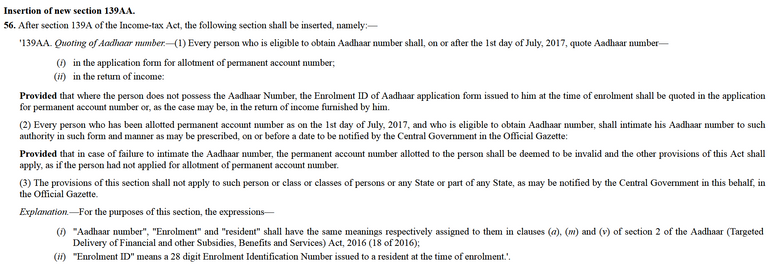

This is as per Insertion of new section 139AA

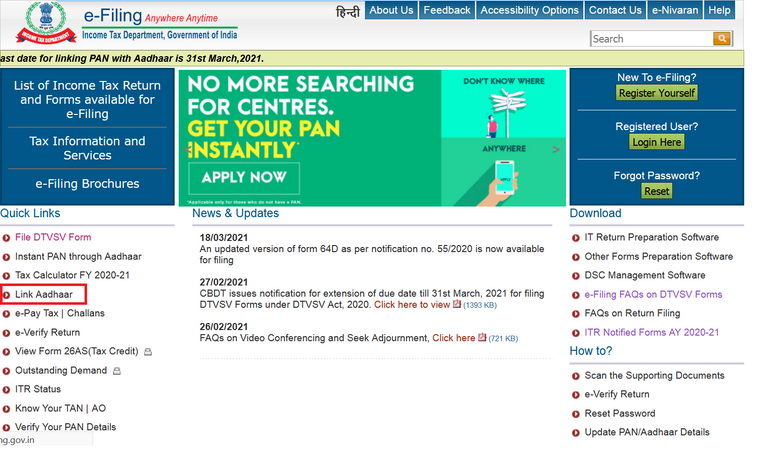

If you have not done this yet ,then here are 3 ways to link your Aadhaar with PAN

Tax Website

Visit http://www.incometaxindiaefiling.gov.in/home and click on Link Aadhaar

SMS

Send UID PAN → SPACE → 12 digit Aadhaar →Space →10 digit PAN to 567678 or 56161

For example: UIDPAN 123456789123 AAAPA1234P

PAN Service Centre

Visit designated service center of PAN service providers like NSDL/ UTIITSL.

Note: Linking of Aadhaar with PAN is not applicable if you don’t have Aadhaar number or enrolment ID and if:

- You are residing in the States of Assam, Jammu and Kashmir and Meghalaya

- You are a Non-resident as per the Income-tax Act, 1961

- You are older than 80 years of age

- You are not a citizen of India.

So apparently the government is focusing on unifying all your details to know every source of your income. And of course, its more relevant for those who have everything in white and do transactions online or through a mode, which has proof. But can all these measures, prevent corruption or flow of black money ? They are all dealt in cash, isn't it ?

Are we really honored for being honest ?

Thanks for the reminder dear.. I also got the message from ICICI bank on the same. I had done the linking in Jan 2021 and to your question on are we really honored for being honest? Absolutely NoT.. & it's very sad.. Take care.

Posted Using LeoFinance Beta

I feel sometimes like we are under communism in the name of democracy 😀 - such pathetic governance.

Oh wow my friend, some of the things seem quite restrictive in regards to finance. Thank you for sharing this with us as it provides me with a view of other countries and how they operate.

Posted Using LeoFinance Beta

I think today they have extended the end date till June. My parents haven't linked it yet and I was wondering about the consequences. But good that it is extended now and we have some more time to do this.

Yesterday my friend tried to link it through the website and she mentioned that she had some issues with the site. So that is also there.

Yes, yesterday, the site was not able to deal with the load seems.