Oct 24 Investment moves -

- Options Trades for Oct 24

- Some #Option Explanation of Trades

- #AMD Put credit spread

- Selling off #dividends and buying what

Options Trades for Oct 24

Here are my confirmed trades as of 11:28 am (EST).

Some Option Explanation of Trades

#MARA and #RIOT have been moving up. Therefore, I'm adding risk into the PUT (moving the strike price up) and reducing risk by rolling up the Covered Call Up (in Strike Price) and Out (adding more time).

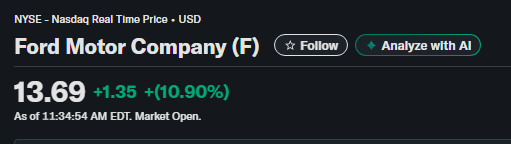

Today, #Ford is trading 10% up on GM earnings and its own Q3 earnings. So I did the same thing that I did for MARA/RIOT on the Ford options that I have open. I mostly own FORD for the dividend, which I use to buy higher-risk investments.

The adjustment trade on #JEPI was to widen the gap between the put credit spread ($57) and the covered call ($58) strike price of only $1. After the trade for April 2026, the endpoints are now $56 (CS) and $59 (CC). If I don't make any money on the April Option, I should make money as long as JEPI stays in between the two Strike prices of the CS/CC.

AMD Put credit spread

#AMD --> can be a complex trade because I have a put credit spread, covered calls, and Iron Condors open at the same time.

Let's focus on the "put" credit spread.

You can see if you added all the totals (all of them are credits/profit), it's $1.64 (reduced fee already). In the last 6 weeks, I made about $160 just using a put credit spread of $1k of buying power. That comes to a 16% ROI (160/1000) in the 6 weeks.

We also know that AMD has moved from like $150 to over $250 a share. So I was showing the value of "time decay" on the PUT credit spread side. Remember that I also own AMD shares, with a #coveredcall on them.

Now here is the important part. Yes, I'm happy that the shares are moving up, but with a covered call that is ITM (In the Money), that limits your upside. For me to capture that "LOST upside", I needed to alter my Strike Price on the COVERED call. On Oct 6, I did that with a total of $1500 of value coming back to me. In a previous post, I showed that the cost was less than $265 in cash.

Selling off dividends and buying what

Here is a list of things I sold:

Everything was from a dividend stock, mostly from the reinvested shares I got/ or will receive. Generally, I wait until the ex-date or around the time the dividend comes into my account. SKX was the only exception since it is going PRIVATE at $62.50 buyout price.

You can see I sold off companies that were mostly up lately (except for Visa/BMY).

Here is what I ended up buying with the cash:

The themes are one of the following:

- Add more Bitcoin/Ether proxy positions

- Looking for the next retail food to 5x-10x with (#CAVA/#WING)

- Adding more Growth Index ETFS with #QQQM/#TMFC

- GameStop (#GME) was a play on Pokémon/Magic The Gathering hype.

- Can #BYRN be the next #AXON in 5 years? We start a position now.

The goal is to use STABLE #dividend companies to provide income so I can invest in future growth companies/opportunities. This means it does not require a job/401K plan to grow my net worth since 2025 has only $5K of new capital into my 401K so far this year.

Let's see what happens next!

Solving Chaos