Week 14 - Apr 4 Investment Moves

- April 4 Options Trades

- Lotto / Powerball "1+ Billion" dollars

- Bitcoin / Ether Investments

- Web3 (Big Time) investment.

- Risk/Reward

April 4 Options Trades

Here are today's option trades:

What moves did I make?

- SQ covered call - rolling up (SP) and out (in time) for $163(x2).

- RIOT CashSecuredPut - rolling down (SP) and out for $10.

- RIOT covered call - rolling up and out for $7 (x2).

- F covered call - rolling up and out for $9 (x6).

- F covered call - rolling up and out for $31 (x3).

- F covered call - rolling up and out for $13 (x2).

I would like to see the markets stay FLAT for a while (or go back down). As a dividend investor, my DCA (Dollar Cost Averaging) works better when markets are heading downward.

As an option investor, I prefer flat markets so I can make money using covered calls, CSP, and Iron Condors with ease. Things are harder when markets move more than the "expected move" in either direction.

Lotto / Powerball "1+ Billion" dollars

When Mega-millions and Powerball's jackpot goes above $500M (USD), the news loves to talk about it.

Everyone who doesn't play might drop $10 a week until someone wins, creating this FOMO that drives the jackpot even higher. Lotto has done a job in marketing the concept of "You can't win it if you are NOT IN IT".

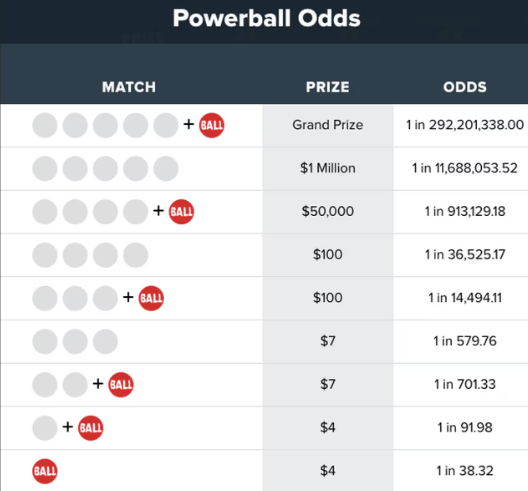

The problem is the MATH does not add up. I'm not just talking about the "Odds" right now, but lets take a look at the odds:

As an investor, I have to look at what type of system this is.

Pooling money together and then picking a winner via a lottery is not a WEALTH creation system, but rather it's a "wealth redistribution" system. 10% of fees go to the vendor (the person/business) in most states that sell the ticket. About 50%* is used to fund the prizes. The rest is used for admin costs and the rest goes to the STATE. What this means is the money you get comes from other players. The rest "disappears" in FEES, ADMIN Cost, and funding state's budgets. For example, in Florida, lotto money is used to fund college scholarships (aka Bright Futures).

Bitcoin / Ether Investments

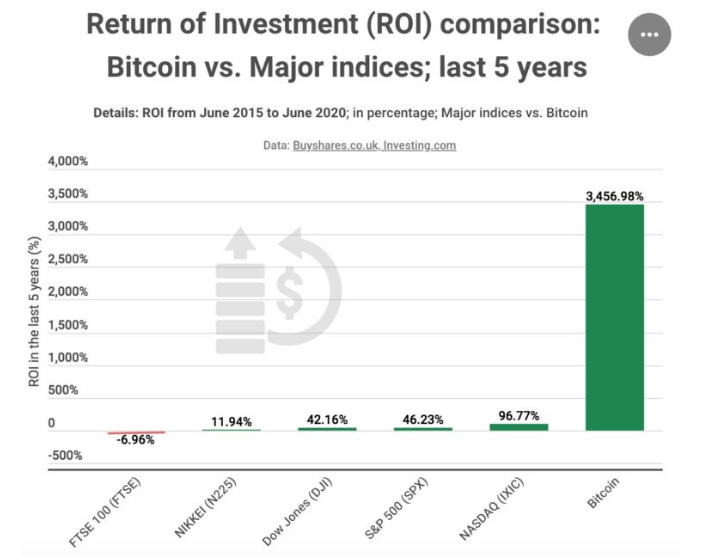

Now compare that to Bitcoin or Ether as an investment.

If you are willing to spend $10 a week on LOTTO and get ZERO back, why would you not want to piss away $10 into Bitcoin? This is where most people's LOGIC doesn't make sense. "Bitcoin is a scam", yet the same people are more likely to spend $10 on beer or a lotto ticket.

To understand this, you need to compare it to normal investment choices like this:

Using data from June 2020, we know Bitcoin outperformed any investment. If you used 2024 data, it would be a similar chart since Bitcoin moved to over $60K recently (and trading higher than any point before 2020).

Web3 (Big Time) investment.

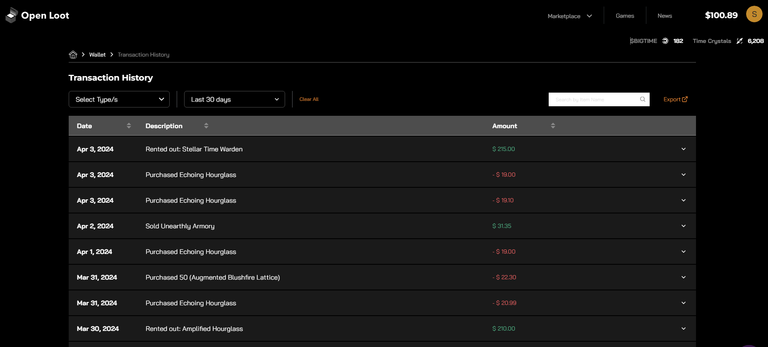

Just a quick update on my NFT web3 gaming assets. I love playing video games and I like it even more when the games I play let me control the ASSETS (NFT). Let me share a screen capture from #BigTime:

When you have CONTROL of the ASSETS, you can BUY, RENT, or SELL the in-game items for whatever price you set. Let the market decide if there is a "DEMAND" for that item, which will tell you what price you can get for that ITEM. You don't need to go to college to understand supply/demand, but playing a video game can teach you that much faster.

If you can spot a profitable "trade", why not repeat it until it is no longer profitable? If you do this right, you should be able to make moves that create value while playing a video game.

Risk/Reward

Don't forget that all investment has risk.

Don't believe what a random stranger is saying on the internet.

Do your research and learn about what risks/rewards you are willing to take. If you like the lotto, that's fine. If you like real estate, that's also fine. If you hate Bitcoin, that's good too. The key is to understand the risk involved and make the best decision for you.

Have a profitable day,

Solving Chaos