Week 16 - Apr 18 Investment Moves

- Markets as of 3:42 pm (EST)

- Option Moves on April 18

- Portfolio movement based on 3:50 pm (EST)

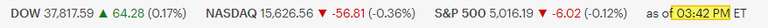

Markets as of 3:42 pm

Here is the market as of 3:42 pm (EST) on April 18, 2024.

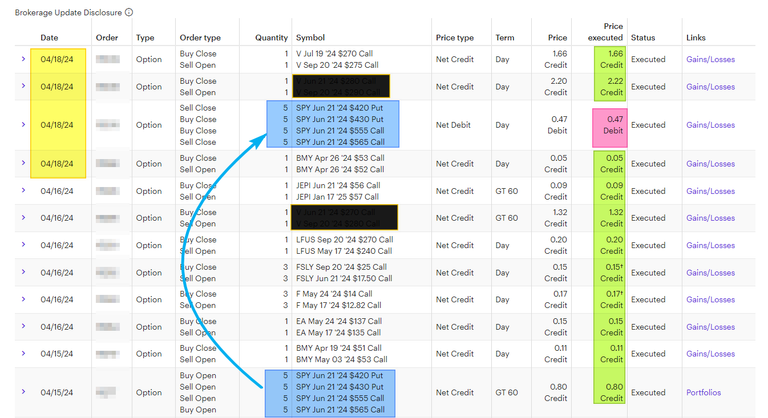

Option Moves on April 18

Here is what I did with option trading:

- Rolled a Visa Covered Call for $166 and up in strike price ($5).

- One "hidden" trade that I don't want to disclose in public. Made $222 on this move on April 18.

- Closed Iron Condor on 5 SPY June 21, 2024 for $47 each.

- This position was open on April 15, 2024 for $80 each. 3 days into the trade and I took the profit by closing my position. I will wait 1 or 2 day before opening next SPY trade. Let the market move in whatever direction it needs before I re-enter this TRADE.

- Rolled a BMY Covered call for $5 in premium by lowering the SP (Strike Price) by $1 dollar. The goal is to roll this if BMY moves toward $52 before April 26.

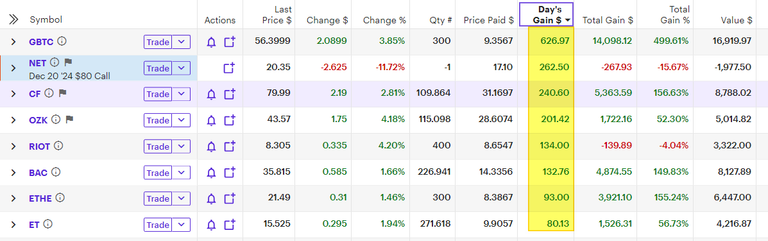

Portfolio movement based on 3:50 pm

At 3:50 pm (EST) this is what the portfolio moves are:

You can see Bitcoin moves impacted GBTC (3.85%), RIOT (4.20%), and ETHE (1.46%). Now we know ETHE moves with ETHER prices and not Bitcoin prices. But this is a view of what position has the greatest impact today. I don't worry about the daily movement, but the monthly and YEARLY moves are what I look at.

Is your asset going?

Is the dividends growing?

Congratulations @solving-chaos! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 250 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: