Week 17 - Apr 24 Investment Moves

- Apr 24 Options Trades

- Visa June 21 Trade

- Bitcoin Halving and Mining.

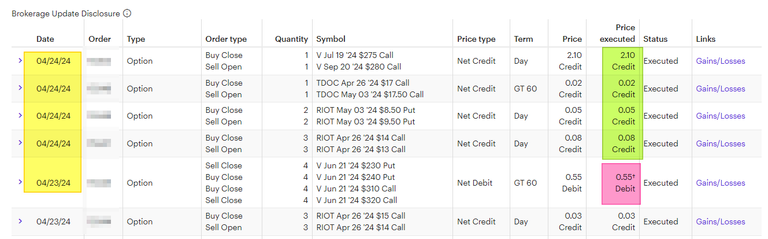

Apr 24 Options Trades

Here are today trades:

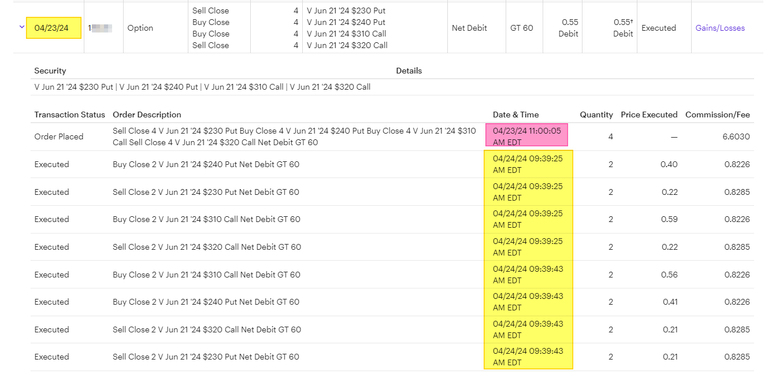

The Visa Iron Condor is displayed wrong on the screen. The time the trade was entered into the system and the TIME when it was EXECUTED are two different things. The details of the trade confirmation shows this was completed at 9 minutes after opening because VISA beat earnings and the stock opened up. As Visa begin to correct with the general market direction, the trade was CLOSED.

Visa June 21 Trade

How did I make money on this trade? Let's review the trade history to understand it:

- April 9 - Opened Iron Condor for $0.74 (each). Premium

- April 19 - Roll the Call side of Iron Condor for $0.08 (each). Premium

- April 24 - Closed Iron Condor For $0.55 (each). Debit.

I collected $82 and closed for $55. The difference is the profit minus the OPTION TRADING FEE. This is not bad for a two (2) week trade (position).

Let's assume the profit is $24 per contract ($80 - $56 = 24). We had 4 contracts so that would be $24 x 4 = $96 in two weeks. In terms of the trade, I used $4K in capital and made $96 in profit in two weeks. That works out to 2.4% ROI on the capital used. If you can annualize this and do this type of trade all year, it would be about a 60% return.

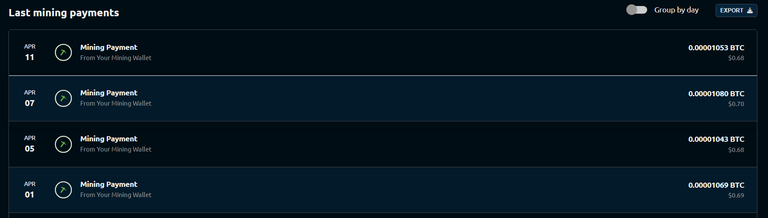

Bitcoin Halving and Mining.

The Bitcoin halving on April 20 had no impact on me. The reason is I only earn a few pennies with my OLD gaming PC. It is not worth much to me so I don't mine for BTC every day. If BTC were to drop from $60K to about $20K, maybe I will mine when the price drops (meaning I get more SAT for the energy used if others are not mining).

The issue is Bitcoin only represents 1% of the average person's portfolio. Most people are not heavily invested and I don't know anyone that got in early. So from my point of view, Bitcoin is often just $100 or $500 of risk. This is not going to make anyone a millionaire. While this is true, it still makes sense to have at least 1% or 2% of your asset in this new asset class.

What investment moves are you making?