Week 17 - Apr 27 Investments Summary

- Week 17 - Good week due to earnings from Tech Company

- April 26 Option trades

- What is JEPI?

- Testing JEPI in my portfolio

- Rule of Thumb - 4% withdrawal.

- Caution - limited data.

- Designing a better retirement

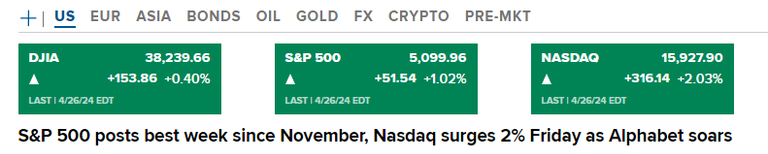

Week 17 - Good week due to earnings from Tech Companies

This week Google announced their first dividend ever. The market had one of the best weeks in several months. You can read that here if you like.

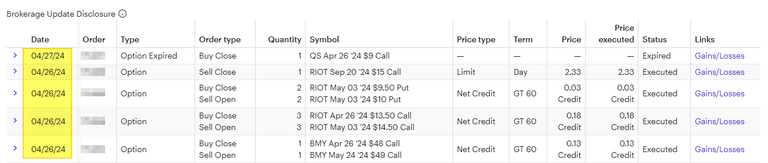

April 26 Option trades

Since I did not post my trades on Friday, April 26, I show you what I did yesterday.

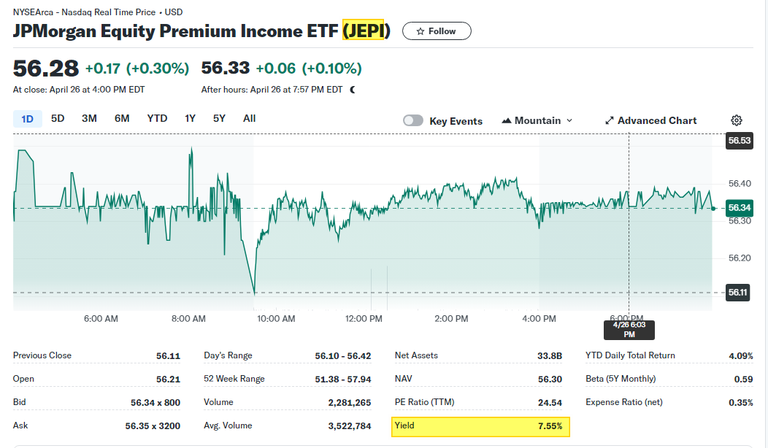

JEPI - Retirement Option?

For those that follow my trades, know that I have been looking at different holdings that can be used to build wealth and can be used in retirement. JEPI was one of the holdings since it was yielding over 10% back in 2022. Today the yield has dropped to around 7.55% per Yahoo Finance website.

Q: What is JEPI?

A: JEPI stands for the JPMorgan Equity Premium Income ETF. It’s an exchange-traded fund that aims to deliver monthly income and equity market exposure with less volatility.

JEPI seeks to achieve its objective by:

- Creating an actively managed portfolio of equity securities, primarily from the Standard & Poor’s 500 Total Return Index (S&P 500 Index).

- Selling call options with exposure to the S&P 500 Index through equity-linked notes (ELNs).

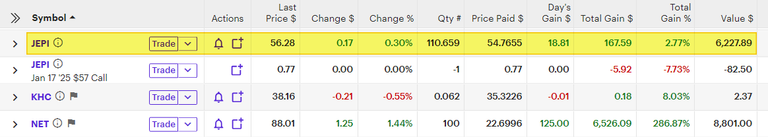

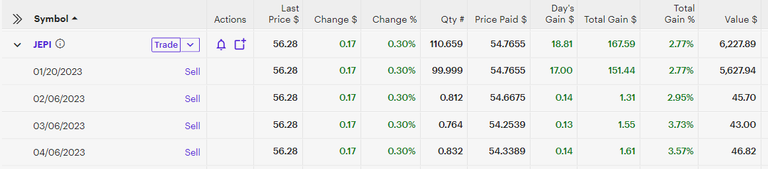

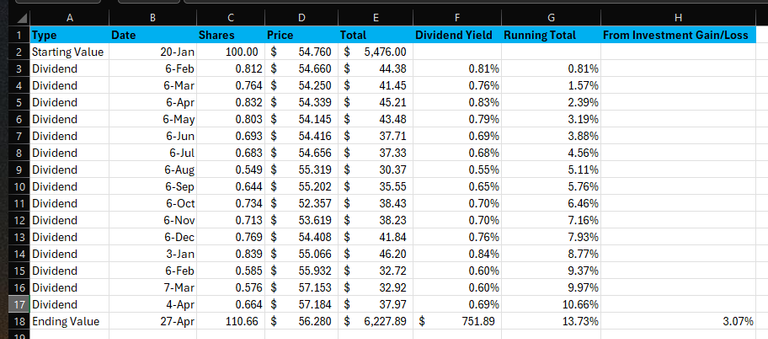

Testing JEPI in my portfolio

I purchased JEPI back on Jan 20, 2023 and I held on to this holding for about 16 months. I had reinvested all the dividends back into more shares and today I have 10 more shares of JEPI than what I started with.

In the first year, it returned about 7.83% using 11 months of dividend. I did not get a JAN-2023 dividend since I purchased the position after the dividend was paid out. If you included Jan 2024, you will see that would bring up my yearly dividend to 8.77%

As of today, the running total of dividends is about 10.66% with the underlying holding gaining about 3%.

Rule of Thumb - 4% withdrawal.

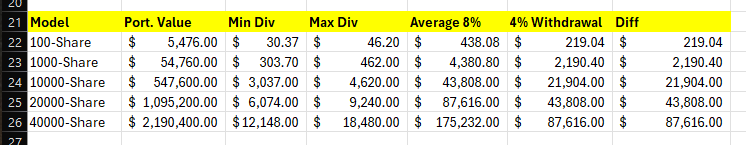

The traditional retirement portfolio model uses this concept of a 4% withdrawal from your portfolio. The original study uses a 60%/40% stock/bond mix and concluded that it has a good chance of lasting 30+ years.

Since 4% withdrawal has been one of the "rule of thumb" being used to set the standard, it often means you need $1 million for $40K of income per year.

My test was using 100 shares of JEPI. But if I had purchased 20,000 shares of JEPI, I would have collected around $85K. My monthly dividend low would have been 6K a month with a high of $9,200 a month. This cleared would have still beaten the $43K using a 4% from the 1.1M portfolio.

Caution - limited data.

Before you run off and do this, let's review some of the challenges:

- Limited Dataset: Only 1.5 years of data. Need 3 year, 5 year, 10 year.

- Limited Market Cycle: Tested when markets were uptrending.

- Reinvested Dividend: In retirement, you will not be re-invested dividends. No compounding growth there, whereas my data will compound since I will continue to reinvest the dividend for the next 10 years of my testing.

- This is not designed to overcome small portfolio value. You need to save, invest, and plan for retirement using conservative estimates.

- Not financial advice! Seek professional help.

Designing a Better Retirement

The purpose was to design a portfolio with less risk but better returns using the concept of living off dividends and never touching the principal. Using a mix of ETFs, this can be achieved with an average yield of around 5%. If you can hit your FIRE numbers (25x expenses), then this concept will give you either an early retirement and/or a larger monthly spending amount.

Let see what happens next year with JEPI.