Week 18 - April 29 investment moves

- April 29 Option Trades as of 10:05 AM (EST)

- History of NET Covered call

- This week (18) dividend

- 10 ten minutes of the trading day.

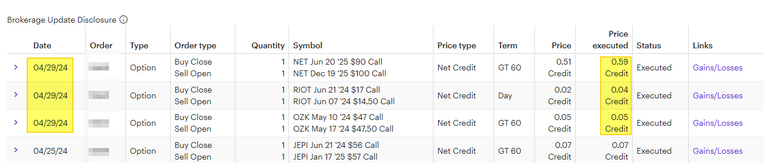

April 29 Option Trades as of 10:05 AM (EST)

Here are my options trades so far today:

Quick Summary:

- Rolling of NET covered call (up and out) for $59 premium.

- Rolling of RIOT covered call (down and in) for $4 premium.

- Rolling of OZK covered call (up and out) from $5 premium.

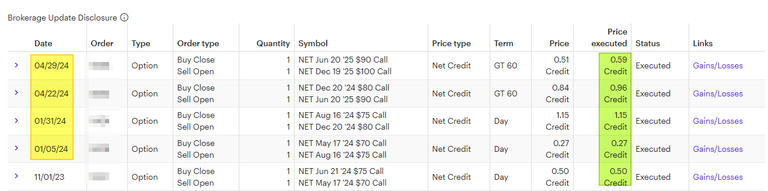

History of NET Covered call

Here is a quick historical view of my "NET" covered call trades:

As you can see, I collected a premium each time (nearly $300 in the last 6 month)! I adjusted my covered call strike price from $70 (May 17, 2024) to $100 (using the Dec 2025). While it seems strange, that will add $3K to my portfolio value if NET trades above $100.

Today trade potential adds $1K of value while I collected the $59 in premium. The trick with covered call is to be happy the small premium while increasing the strike price of the call. If the stock moves close to the strike price, you are glad you did.

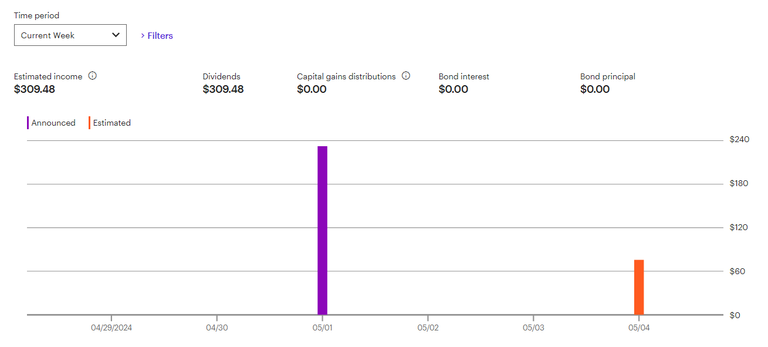

This week's (18) dividend

This week's passive dividend:

Why do dividends matter?

I view dividends as a small component of my portfolio. In terms of dollars, it generates about $1K per month, not enough to retire on.

Dividend "acts" like new capital being added to your portfolio. Because I reinvest all my dividends for the last 20 years, that like me working, saving and investing $1,000 of new capital each month!

20 years ago, it was more like $.50 or $1.00 of dividends. When you first start, dividend payments are so small they mean nothing to most people. Even after 5 or 10 years of compounding, dividends might not reach a point where you can "see" or "feel" the impact.

Today, I save about $500 a month of new capital., When the DIVIDENDS exceeded my monthly contribution a few years ago, this means I was effective saving $1K a month ($500 from my paycheck and $500 from my dividends). Today it is more like $1500 a month ($500 from my paycheck and $1K from my dividend).

Dividends act as a hedge because they use dollar cost averaging. Dividend work even if I don't work (when I'm unemployed). Dividends can grow as the company grows and return value to shareholders. Dividends can be taxed at a lower rate than ordinary income. There are plenty of reason to like dividends.

10 ten minutes of the trading day.

Here is an article about the last 10 minutes of the trading day accounts for the bulk of the trading volume. How does this impact me? It does not.

https://finance.yahoo.com/news/stocks-trade-390-minutes-day-114558081.html

I often buy and hold stock for years or decades. I don't worry about the price at the time of the purchase because it should be higher in the next 20 or 30 years.

When it comes to options, it is a similar thing. I'm not trading in and out of options based on a "penny" swing. So for me, I like to do my trades within the first HOUR of trading so I can post my trades on social media for my readers.