Week 18 - May 1 Investment Moves

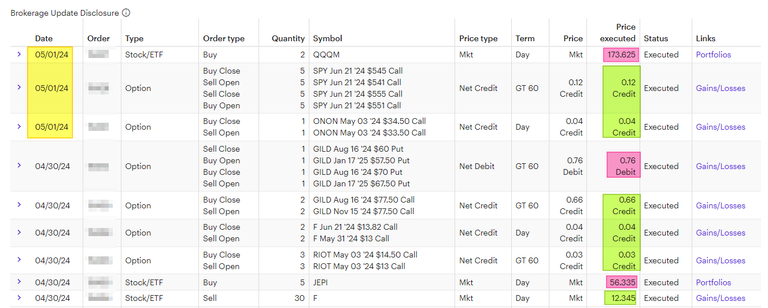

- May 1 investment trades

- Apr 30 investment trades

- Ford vs JEPI (pair trade explained)

- April Monthly Loss

May 1 Option trades

Here are my investment trades for today:

- Purchase 2 shares of QQQM.

- Rolled Call side of Iron Condor (June 21) for more risk.

- Rolled ON covered call for more risk in exchange for $3 of premium.

Apr 30 investment trades

I did not create a social media post for any moves done on April 30. So I will create a summary of what trades I did yesterday.

- Rolled GILD Iron Condor out and down. Costed me $77 dollars.

- Rolled GILD covered call out for $66 (x2) or $131.

- Rolled F covered calls in and down for $4 each.

- Rolled RIOT covered calls dowwn for $3 each.

- Sold 30 F shares for $370 dollars.

- Purchase 5 JEPI shares for $281 dollars.

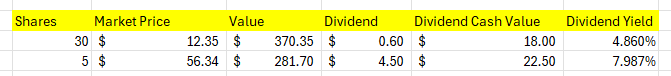

Ford vs JEPI (pair trade explained)

The way I think about it, the F and JEPI are paired together. I took the proceeds from selling 30 shares of Ford and I will replace it with 5 shares of JEPI. Why do this? It's more of fixing the portfolio sizing issues. I have several thousand shares of FORD and each year, I get more from the dividend. This is more true since I held onto FORD for over 7 years now.

I quick look at the charts shows that by swapping out 30 shares of Ford and getting 5 shares of JEPI, I will increase my dividend each year. This will keep my Ford position from growing any further if I continue to sell each quarter and continue to buy JEPI instead. For those that followed my previous post, I only had 100 shares of JEPI when I started in Jan 2023. A year later, I had 110 shares, with 10 shares coming from dividend repurchases.

So JEPI is a small position in my portfolio while Ford is considered too big. I'm reducing some risk by adding more JEPI (which are mostly SP500 Index and covered call options). Reducing the size of a single stock holding position can be a good thing.

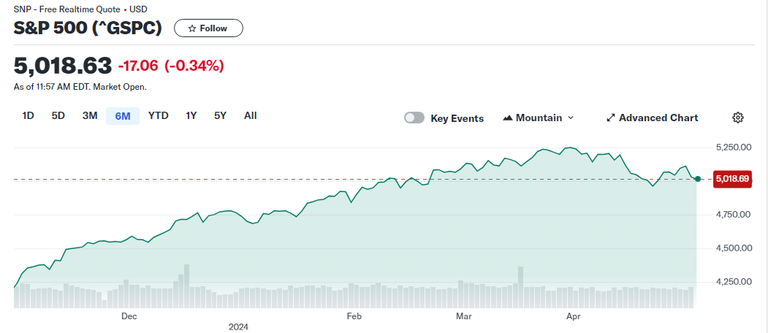

April Monthly Loss

The stock market had a rough 30 days in April. If you zoom out for s3 months or 6 months, you will see the markets are still in the GREEN.

It's never good to have a limited view without understanding the context. It's up on a YTD, 1-year, and 5-year view. If markets stay above 3000 (it is at 5018 now), then markets have been good for you. As a long-term investor, I prefer the markets to go down NOW. It is better to be down when you are in the accumulation phase.

The markets are whispering that we might only see ONE or TWO Fed Rate Cuts in 2024 and that some of those will be PUSHED into 2025. I never believe in the 5 or 6 rates in 2024, but I did not predict how fast the FED has pivoted and changed it messaging.