Week 19 - May 10 Investment Moves

- Today's Market Conditions

- May 10 option trades

- Portfolio Rotation (Buy/Sell)

- Low-Cost ETF

Today's Market Conditions

As of 10:30 AM (EST)

May 10 option trades

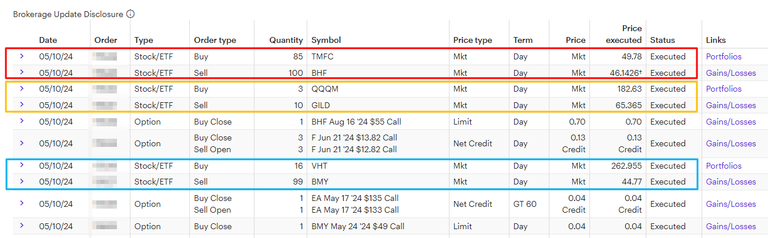

Here are my trades so far on May 10:

Quick Summary:

- Sold BHF. Buy TMFC.

- Sold GILD. Buy QQQM.

- Sold BMY. Buy VHT.

- Closed BHF Covered call (so I can sell my 100 shares of BHF).

- Rolled F Covered call down in strike price for more risk.

- Rolled EA Covered call down in strike price for more risk.

- Closed BMY Covered call (so I can sell my 100 shares of BMY).

Portfolio Rotation (Buy/Sell)

Why did I sell my position? I wanted to review my portfolio and I noticed I had a bunch of individual stock in my portfolio. Some of them were underperforming and others were growing due to my dividend reinvestment. I wanted to "rebalance" the portfolio by selling some positions and adding other holdings.

For example:

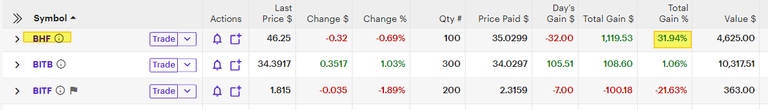

BHF returned 31% or about 1K in profit(See red box).

By selling 100 shares of BHF at $46.14, will net me $4614. I used that money to buy TMFC, which is an ETF that tracks the 100 stocks Motley Fools recommends and has in an ETF. This is a higher-risk type ETF but is still better than owning One stock that might underperform over the next 10 or 20 years.Sold 10 GILD (See yellow box).

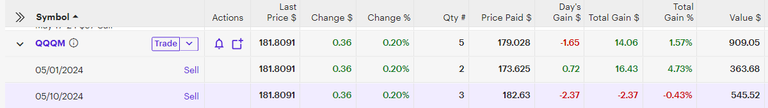

Selling 10 shares of GILD that came from the reinvested dividends over the years. Buy 3 shares of QQQM. I only have 5 total shares and will continue to build this position over the next 5 years.

Sold BMY (See Blue Box).

Selling BMY since BMY has been underperforming. I think a better solution is to get VHT (Health Care ETF). This is to reduce risk by owning a single stock and replacing it with an ETF of the same industry.

Low-Cost ETF

ETF has plenty of advantages over single stock. While there is a fee of using an ETF, most people will do better by owning an ETF over a basket of stocks. Why? Most of us are not going to pick the best stocks to own. It's very easy to pick underperforming stocks in your portfolio. So why take that risk when switching to an ETF is very easy to do.

To show this, we need to look at long-term performance. I would like to look back 3 years or 5 years from now and see if switching to an ETF was the right move for me to do.