Week 19 - May 7 Investment Moves

- Today Markets

- May 7 Options Trades

- Week 19 Passive Dividend

- DGI and DRIP

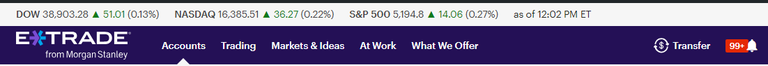

Today Markets

Here is the current market price:

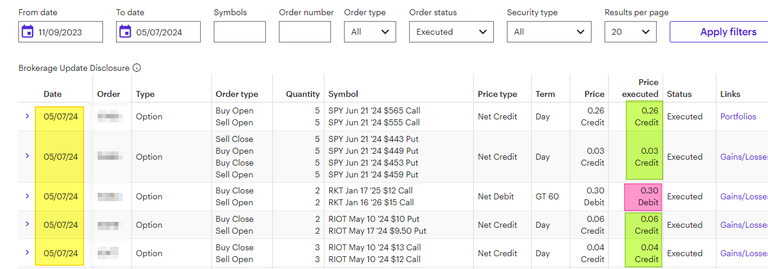

May 7 Options Trades

Here are today's options trades as of noon (EST):

Summary:

- Added Call Credit Spread (to make Iron Condor).

- Adjusted risk on PUT side for more premium.

- Rolled up and out Rocket Mortgage from $12 --> $15. This was already ITM, so adding one more year and paying $30 each could result in my capturing the upside if Rocket can stay around $13-$15 in the future.

- Rolled CSP (cash secured put) down and out.

- Rolled Covered call down for more risk and premium.

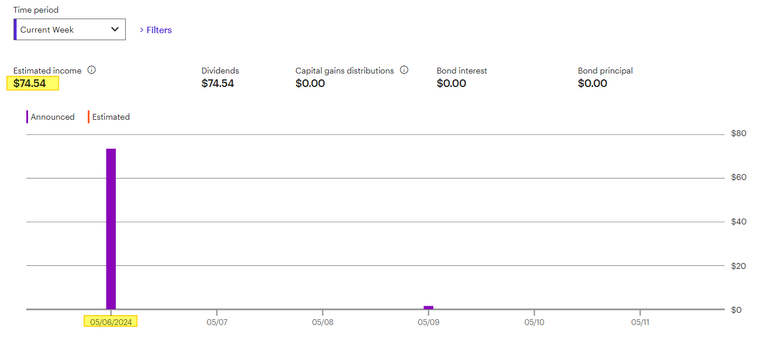

Week 19 Passive Dividend

This week's dividend is only $74. Most of it was paid out last night. As always, I'm reinvesting the dividend back to repurchase more of the underlying security that paid the dividend. Before 2019, buying STOCKS often had a fee of $7 per trade. So reinvesting dividends was often a way to add more shares via your brokerage account without incurring any fees.

DGI and DRIP

Before the discount brokerages account and Low-Cost Index ETF, Dividends Reinvestment Plans (DRiP) and Dividend Growth Investing (DGI) were more common.

The last 25 years have changed to favor retail investors and today it's possible to invest without paying much in terms of FEES. Therefore I have moved away from DRIP and even DGI. What I learned was dividends in my portfolio can be used in a way to hedge or reduce risk. However, I no longer suggest using only a DIVIDEND approach to investing as a way to "build wealth". My view is very different from what this article from Keith S of the Motley Fool thinks.

However, those in the FIRE community or retirement age should consider looking into using a high dividend approach to reduce some of the risk of spending all your principal too early in your retirement phase.