Week 20 - May 14 Investment Moves

- Today Markets as of 10:15 am EST

- May 14 Options Trades

- ONON Holding explained

- BAC covered call explained

- $1400 CAR Payment

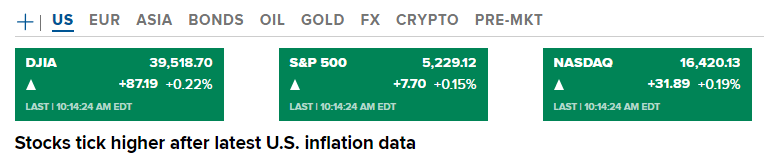

Today Markets as of 10:15 am EST

Here is the US current market condition:

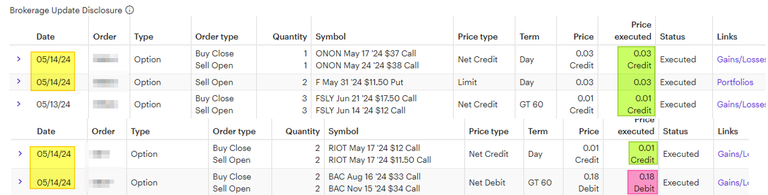

May 14 Options Trades

Here are today's (May 14, 2024) options trades as of 10:30 AM (EST):

Summary:

- Rolled ONON Covered call up and out for $3 premium.

- Open new CSP on F for $3 premium.

- Rolled RIOT covered call down for $1 premium (~17 cent after fees).

- Rolled BAC covered call up and out for $18 Debit.

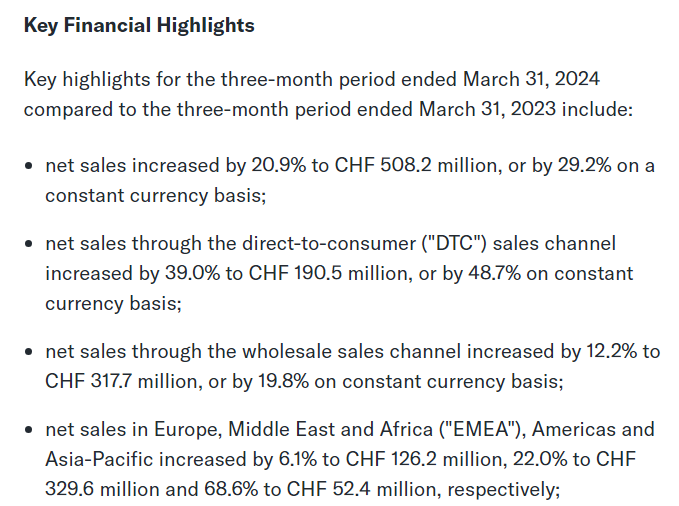

ONON Holding explained

Several weeks ago, I started a new position with "ON Holdings" because I wanted more exposure to the sneaker industry. I already owned SKX (Skechers U.S.A). Today, earning shows that it growing nicely and the stock moved up because of good quarterly results:

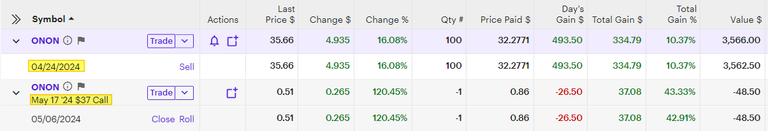

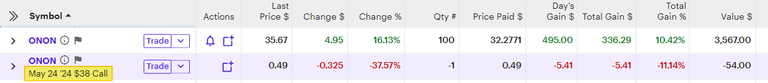

Here is what my holding looked like before my trade:

Here is what my holding looks like now:

I rolled up (by $1 in strike price) and out one week for a $3 premium. The net result is I got $3 today but if ON continues to $38, I increase my potential upside. Now it's possible ON stays between $34-36 over the next few weeks and I got paid the $3 premium today for my bet.

BAC covered call explained

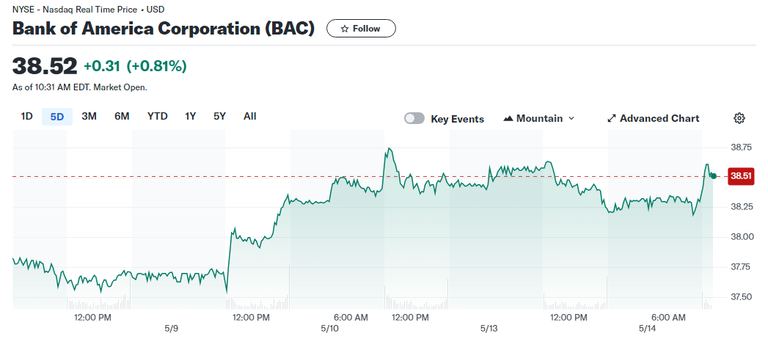

Why did I roll Bank of America covered call?

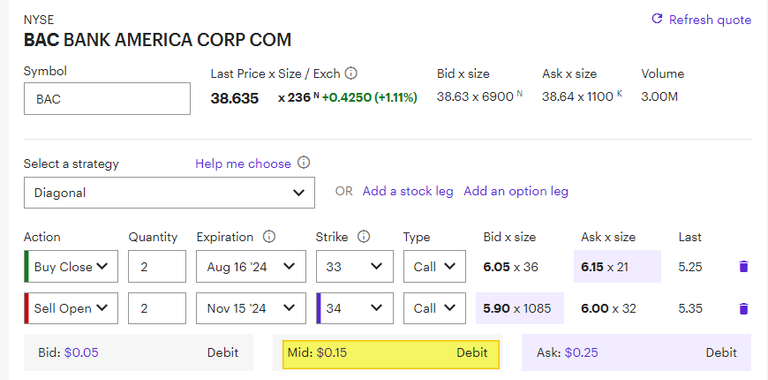

BAC is trading up today and for the last 5 day has been trending upwards. I closed the Aug $33 covered call and opened the Nov $34 covered call. I spent $18 each contract to do this trade. Why did I do it?

From a pure math point of view:

- Minus $18 Today (May 14) for each contract.

- Plus $100 Today for each contract (Strike price $33 --> $34).

- $100 - $18 = $82 net profit today (if and only if BAC stays above $34).

- 2 Total Contracts (2 x $82 = $164 potential profit).

With BAC trading at $38.63 today, this makes sense to increase the "upside cap" of the covered call using $18 to gain $100. The covered call was already ITM (In the money) and working against me at this point. To make sure this makes sense, I need BAC to stay above $34 in the future. If BAC drops to $20, then doing NOTHING was the beat thing. If BAC stay above $34, then this would be the best move.

$1400 CAR Payment

On Tic Tok and other news reporting folks with $1000+ car payments. This is a growing trend and accounts for less than 10% of auto loans.

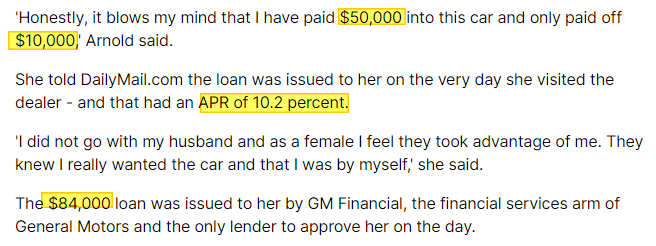

But this story is making the rounds:

3 years into making $1400 car payments, she realized that her $50K has only paid down $10K of the principal. With an interest rate of 10%, this is one reason why. The second reason is the loan was not a 36/48/60 month loan but more likely an 84/96 month loan.

Wait... there is more:

The husband's car payment is worse than her payment! What is going on here? There is good news. She got rid of her car and paid cash for the replacement car (at least that is what I understand).