Week 20 - May 15 Investment moves

- Today's Market Condition

- April CPI - 3.4%

- May 15 Options trades as of 10:30 am (EST)

- RIOT option position explained

- Ally Bank - Pro Position

- Ally Bank - Con Position

Today's Market Condition

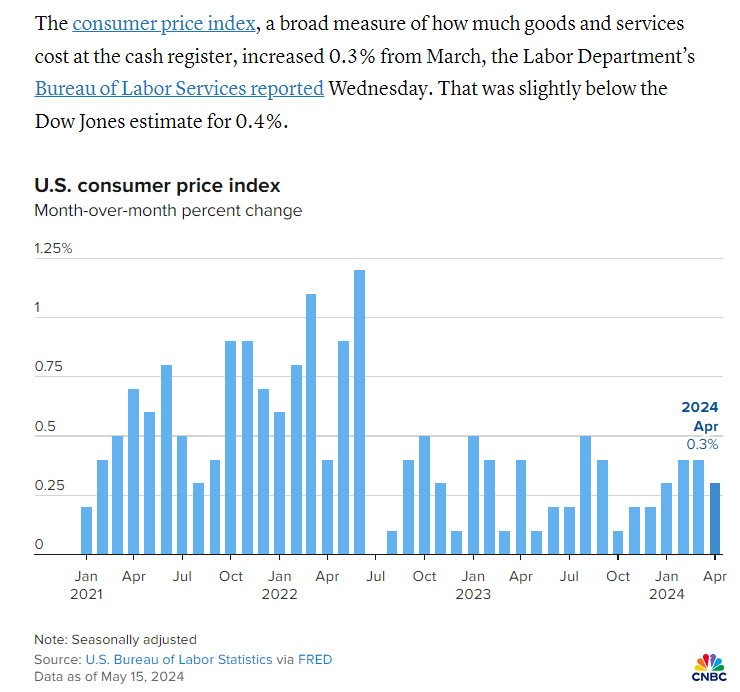

April CPI - 3.4%

The CPI — the Federal Reserve’s preferred inflation gauge — rose 0.3% for the month of April, lower than estimates for a 0.4% monthly increase, according to economists polled by Dow Jones. The measure rose 3.4% year-over-year, coming in line with expectations. Monthly and yearly numbers for core CPI, which excludes volatile food and energy prices, were both in line as well.

CNBC explains it here

If you are looking at the chart of the CPI you can see that 2021 and 2022 were high-inflation months. We are still "increasing" at a slower rate at this point. The problem is any increase just makes things more expensive, which is what squeezes the US consumer to have less and less cash each month.

May 15 Options trades as of 10:30 am (EST)

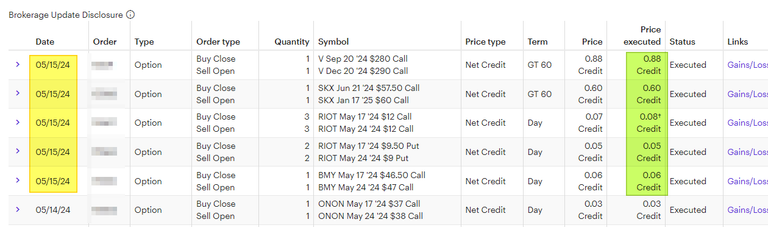

Here are today's option trades:

I like to post my trades at the time I do it, not just at the "closing of the position". Many folks do that to pick and choose their winners to share on social media. If you post the trades at the opening, then you can tell if they are using selective winners only. Since I'm rolling many of my positions, I'm closing and opening a new position in the same trade.

Summary:

- Rolled Visa Covered call (OTM) for $89 premium today and increased the strike price to 290 (or $1K extra upside potential).

- Rolled SKX Covered call (ITM) for $60 premium today to increase the strike price by $2.50 (or $250) of profits. I had to add 6 months of time to the option to get a credit today while moving the covered call in my favor.

- Rolled RIOT covered call out one week for $8 premium each.

- Rolled RIOT CSP down and out one week for $5 premium each.

- Rolled BMY covered call up and out to next week for $6 premium.

RIOT option position explained

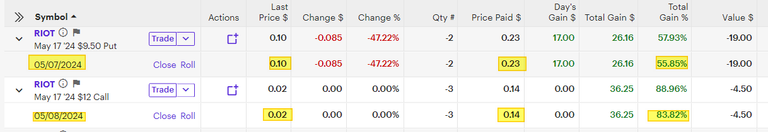

To understand the RIOT trade today (MAY 15), you need to see the before and the after of the holding in my portfolio.

This is what the current position looks like on both sides. Both are moving in my favor (I made a profit) and the CALL has little value left. When that happens, it is best to close the position and move on.

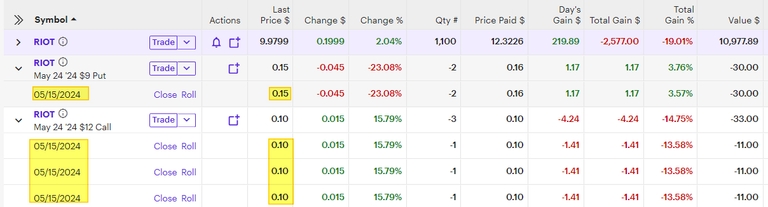

What I ended up with is:

- 3 x $8 = $24 on the covered call side.

- 2 x $5 = $10 on the PUT side.

- Lower the PUT to $9 (from $9.50), lowering the risk.

The covered call is still at $12 with RIOT trading under $10. - By increasing the range between the PUT/CALL, I'm reduced my risk.

Ally Bank - Pro Position

According to Matt Frankel of the Motley Fool, he believes Ally is doing well. See this video for further understanding of his views:

Ally Bank - Con Position

Ally is a bank and banks do well during the expansion of our economy. We are either at the end of the growth and would guess we passed the "peak" and now we are growing at a slower rate than in the past.

NII - Net Interest Income is often used for bank stock. When we are at a rising interest rate, the NII grows. When we are cutting interest rates, the NII will shrink. Interest rates are in a "holding" pattern right now. However, since stocks are FORWARD looking we need to ask if interest rates are going UP or DOWN in the future. All data suggested we are going down. However, in 2024, we might only get 1 or 2 rate cuts instead of the 4-6 that experts were suggesting a few months ago. That means the economy is stronger and we don't need the cuts right now.

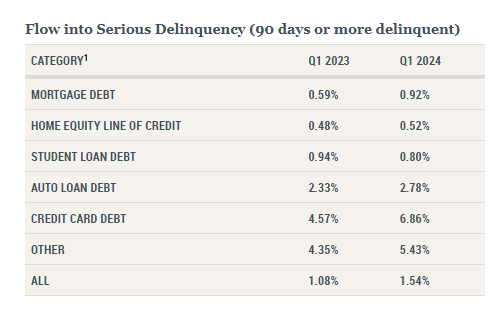

According to the NY Fed, debt is increasing and delinquency is showing a troubling trend.

They provided a chart to show the late payment/serious delinquency by different categories. Auto loans are having more people NOT paying their car payments, which Ally has a large portfolio of. In the other areas, ALLY has risks as more consumers are not able to affordable their payments.

Which side are you on? Do you think the economy is strong, or are we near a bubble and things are getting worst?