Week 21 - May 23

- US market condition as of 10:40 am (EST)

- May 23 Option Trades

- NVDA 10 for 1 stock split.

- Stock split 2020s comeback.

- Housing Bubble? or Lack of Supply will help?

US market condition as of 10:40 am (EST)

Here the current condition:

Nasdaq is up due to Nvidia's strong earnings. Dow is down right now.

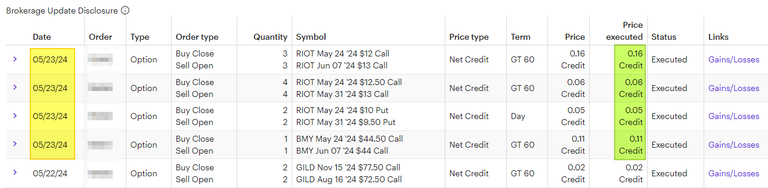

May 23 Option Trades

Here are today's options trades:

Summary:

- Rolled RIOT covered call two weeks out and up $1 for $16 each.

- Rolled RIOT covered call one week out and up $0.50 for $6 each.

- Rolled RIOT PUT one week and down $0.50 for $5 each.

- Rolled BMY covered call two weeks out and down for $11.

NVDA 10 for 1 stock split.

Why do a stock split? In theory, all else is the same. You get more slices of the pizza, but the size of the pie is the same. If a pie was cut from 8 slices into 16 slices, your part doubled in slices, but the total piece of the pie is the same.

https://www.cnbc.com/2024/05/22/nvidia-announces-10-for-1-stock-split.html

One big reason is increasing liquidity and making easier for small investors to trade your stock.

For example, as an option trader, I need to own 100 shares of a stock to write a covered call. With Nvidia trading near $950 each, that is $95,000 in stock to sell one covered call. If your company has an ESPP plan, having a lower cost makes it easier to acquire one share.

One advantage of a stock split is for the dividend collectors. Most companies don't like to pay in a fraction of a penny to shareholders. The lowest common payout is often the standard .01 (one penny) per quarter. This is exactly what is happening with Nvidia. They currently pay out $0.04 per quarter per share. After the split, that would work out to $0.004 per quarter.

This is why they are moving from:

- $0.04 Before May 22 (or $0.004 per quarter after the 10-for-1 split)

- $0.10 After May 22 (or $0.01 per quarter after the 10-for-1 split)

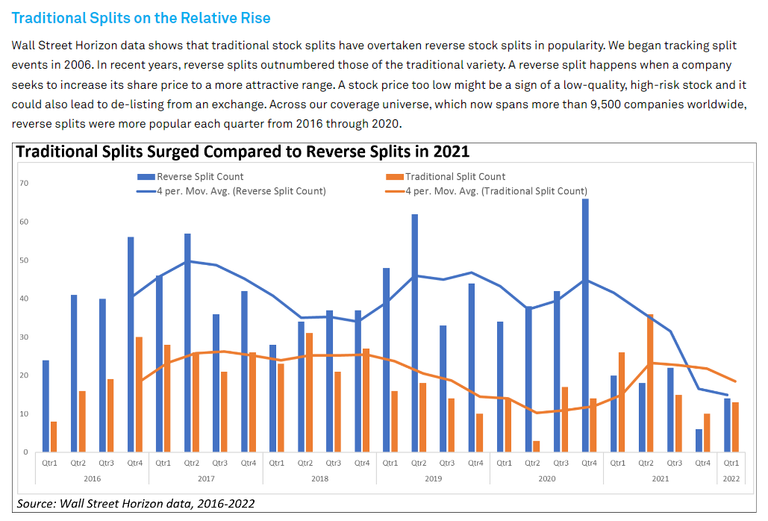

Stock split 2020s comeback.

Any investor knows that stock splits were popular during the 1990s bull run. After that, we enter a long period (or a long BEAR super cycle). Is this the next bull cycle where splits are making a comeback?

Reverse split was popular in the decade of 2010 coming out of the bear market. Not we are starting to see the bull cycle where traditional stock splits are happening again.

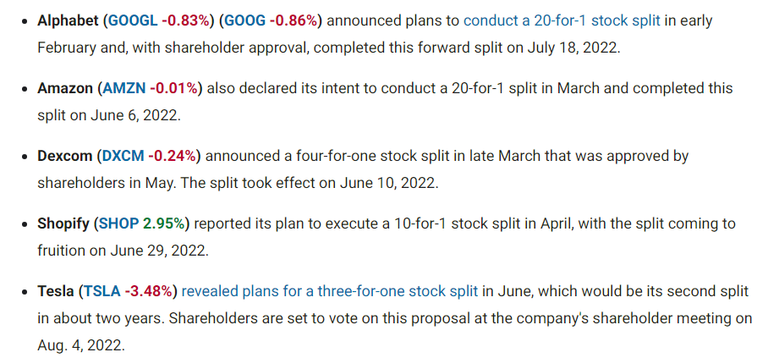

In 2022, some of the big ones were:

I would like to see more top 200 stocks trading over $150 do a 2-for-1 stock split. Those that are over $250 can do a 3-for-1 or a 4-for-1 split. Many of these companies are in the S&P500 Index.

Housing Bubble? or Lack of Supply will help?

Many experts are still on the opposite end of this debate. Apartment rents are special now where you don't pay for a certain period. Rent generally doesn't drop because it impacts people's views on the properties, but you can get one or two months "free" on a new lease agreement. Will RENT decline in 2025 or 2026 because it is out of alignment with the current market conditions?

Unemployment is rising. Income is "flat" or not rising as fast as employees need. Mortgage rates are still expensive. Property Taxes and Homeowner insurance are much higher now than 2 years ago. All this is causing some issues with the housing market.

Hello there,

Do you do modelling of stock returns?

Could I send you a direct message so we could talk more on this?