Week 3 - Jan 19 Markets Update

- Jan 19 US Stock Market - New highs

- What next in 2024?

- Jan 19 Options Trades

- Bitcoin Trade

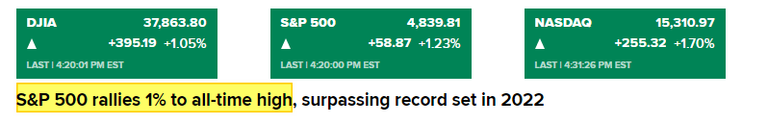

Jan 19 US Stock Market - New highs

The SP500 hits new closing highs today passing the old mark that was under 4800. The old intraday high was at 4818.

Are you one of those who moved your money into cash waiting for the crash since 2019 or 2020? If so, you might have missed your window in March 2020 during the first COVID lockdown in the USA. After the, the markets has been a bit more risky since it been moving up/down more. But in the end, we are now at ALL-TIME HIGHS and we just starting 2024.

What next in 2024?

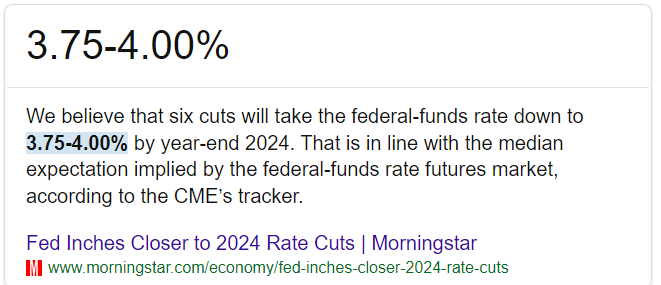

It's an election year in the US and over 60+ other countries. The soft landing might be happening as we speak. The election will cause something that I might not normally have witnessed, that is RATE CUT happening because inflation is under control and not because we need to jump-start the economy. Normally, the FED is too late into the game of rising and lowing rates. But FUNNY things happen during election years!

My 2024 predictions:

- Feds will cut between 0.50%-1.25% in total in 2024.

- Feds will only do between 2-3 Cuts into 2024, which is lower than most experts predict.

- 2025 will continue with several more cuts in FED RATE.

- The stock market will be flat for the year.

- The deep recession we are looking for might not happen. The pain of the recession will impact different people in stages.

2024 will be interesting to watch and witness, which makes it harder to predict what will happen. The soft landing might be currently going on and at the current rate, the FED will need to cut rates to tell the story that PEAK INFLATION is over. However, the pain of this "stealth recession" will continue as different phases will have different impacts on different people.

Phases of this stealth recession:

- Auto industry was already impacted with cars at over MSRP and used cars were very expensive. Auto Loan default from those buying in 2021-2023 will rising. Since used car pricing is dropping, it might make sense to see some people defaulting on their $600-1000 car payments and going back to the $5K-10K used car market.

- Student Loan Payment: due the last few years most loan payments were not required. A few of them (a small percentage) have been forgiven since then by the US Govt. This phase only impacts the segment of the population that got student loans and is now asked to start PAYING those loans back. I believe up to 50% of these borrowers don't have the free cash to do so.

- US housing: is a much more complex issue than ever. In some markets, it is hot (like Florida/Texas). Real Estate has always been a local issue. The migration of the population because of Remote Work, Relocation, or Retirees will continue to impact housing. Some people are moving to lower-cost areas of living. But the big issue is still mortgages with 6%+ interest rates. That will prevent many families from upsizing or moving into a newer home. Refinancing your home or cash out refi might not make any sense now, but it did when you got a new LOAN for 2.5%-4% two years ago.

- Job Markets: the unemployment rate is about 3.7% right now. In a stealth recession that is caused by other factors, you not going to see an unemployment rate of 8% or more. I do think you will see unemployment around the 5% area, but that is due to the "soft landing" that is being engineered. Most people will feel good having a job. Others will continue to jump to another opportunity. For most people, this means consumer spending will be down or flat until the next growth cycle in 2025.

- Travel spending has been up since COVID-19 and that trend will continue. Experiences over things will still be an important part of our culture and help justify spending on vacations, holiday travel, and other experiences.

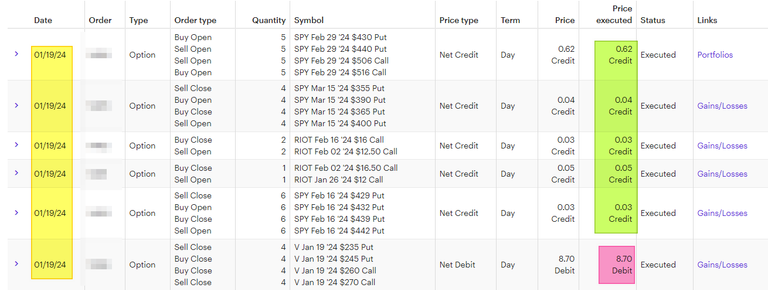

Jan 19 Options Trades

My options trade for today. The bad news is the nearly $4K loss in Visa Iron Condor. Visa went on to close at over $270 per share. When I placed this trade, Visa was under $250 a share.

So the bad news is my options trade went bad, but I'm LONG on Visa stock. My gains in the stock have more than offset the losses I experienced with this VISA Iron Condor for Jan 2024. I will continue to use hedging on Visa in 2024 while trying to reduce risk and make money.

Bitcoin Trade

Bitcoin has been selling off since the SPOT ETF announcement. This has impacted RIOT and MARA shares! Since I have mostly RIOT Covered Calls, I will adjust them for some more premium and see if those things will eventually bounce back up (which is what I'm expecting).

I also used this time to pick up some SOLANA, since I believe SOL might move more than BTC or ETH during the same time frame going forward. This will be a short-term bet that I'm making. I will eventually sell and move the cash into BTC or ETH at a future time.

How did you do on the week #3 of 2024?

What adjustment/trades did you make?

Solving Chaos