Week 51: Dec 21 - Today Markets.

- Week 51: Dec 21 - Today Markets

- FED: Soft landing vs Recession?

- Week 51: Options Trades

- NFT/Bitcoin moves

- Here is a quick summary (unofficial) for 2023:

Week 51: Dec 21 - Today Markets

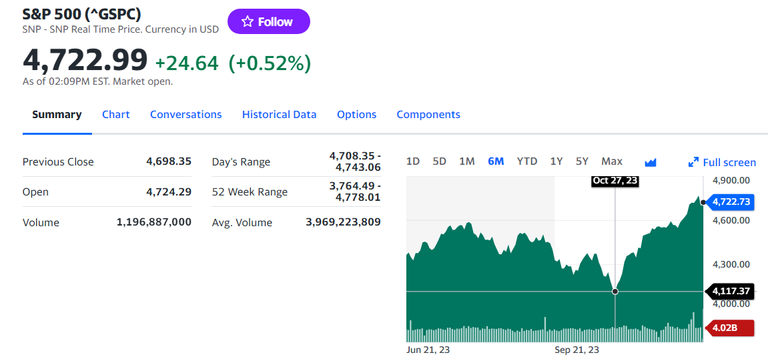

Today the markets are GREEN, following yesterday's "big drop". However, if you zoom out one month, the MARKETS are UP. If you zoom out for two months, the markets are UP.

1

What the market does in one day does not mean it is a trend. The Santa Claus Rally started around Oct 27 (this year) and it generally does not end until the first week of January.

FED: Soft landing vs Recession?

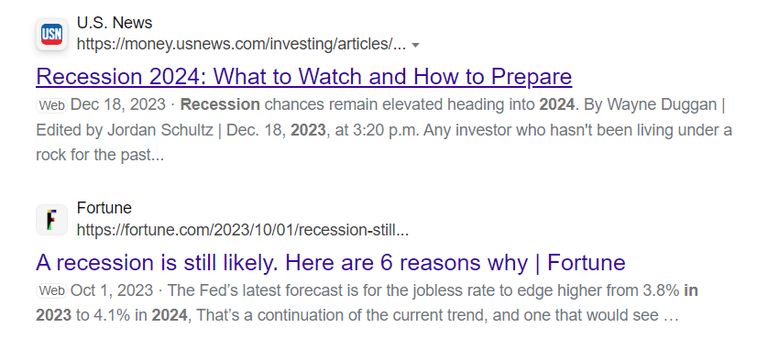

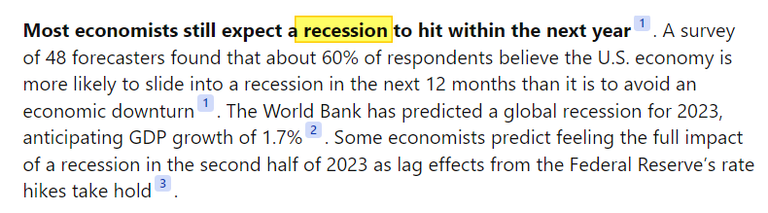

The recession many expected to happen shortly after MARCH 2020 (Covid-19) never did come. They pushed it to 2021, 2022, and then 2023. Many of us are still looking for the big "R" word to come, except we are on the verge of 2024.

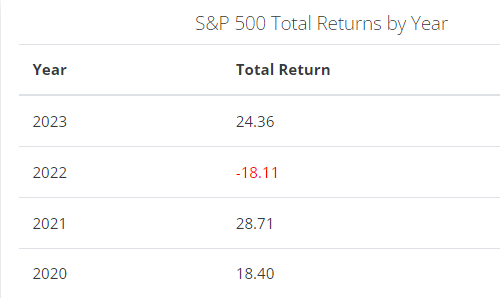

A quick Google search shows some of the popular viewpoints on recession. 2023 was the year that MARKETS entered record HIGHs territory. That is the opposite of what you think when we have HIGH inflation and recession chatter for 3 years!

At this point, it is time to admit most of the experts were wrong in their prediction for 2023. Does this they are more likely going to be right in 2024?

Week 51: Options Trades

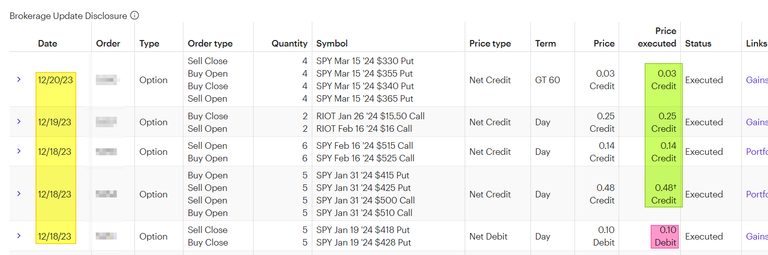

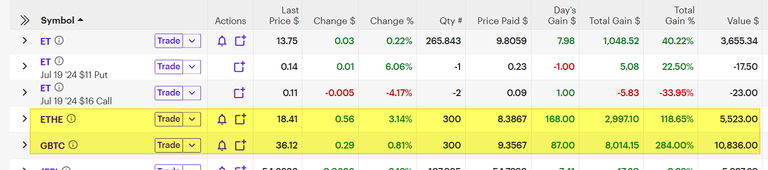

Here are some of my trades for this week, since I don't have any to share for today (Dec 21). I have been spending lots of time adjusting Covered call up and OUT and adjusting Iron Condor (PUT legs) on the untested side. This year has not gone my way. I was doing just fine going into May/June and then this year had two long-term trends (both GREEN) created some problems for my Iron Condors. That will impact my Options trading Profit for 2023.

NFT/Bitcoin moves

Most of us know that the BEAR market was painful. This is more so if you had money in FTX, Celsius, Terra Luna, etc. We all know that the bitcoin cycles are often called the "4-year". If you survived the BEAR market, you might need to hold on during the BULL market. We also know that BEAR markets are good to help the market consolidate and the weaker projects fail. No matter how you look at it, BTC/ETH had a great year in 2023!

If you were buying it when no one else was, then you did well. 100% in a year is incredible. Most are looking for the upward trend to continue. This is the very reason why I purchased LONG CALL options for Jan 2025. I can sell in 2024 if I need to, or continue to ride the move to the moon.

Here is a quick summary (unofficial):

- 2023 401K plan value: up between 20%-25% (depending on the plan).

- 2023 Profitable, but small. It is still possible for me to end the year losing money.

- 2023 Dividend: stable and boring. But it still works in all market conditions.

- 2023 Bitcoin/Ether: is on the move and many think 2024 will continue that trend.

- In the end, the hedge worked and did its thing. I would have made more money if the markets were +/- 15% a year, but this year was

Generally around Dec 30 to Jan 2, I will start to work on my 2023 year-end summary after all the TRADES are in and accounted for.

I like to look at all the data at the end of the year to see what happened and what adjustments I need to make. I think I had a decent year as an investor. You can't complain of 24% returns in the SP500!!

Have a profitable day,

Solving Chaos