Week50: Dec 13 - Fed day and the impact on my portfolio.

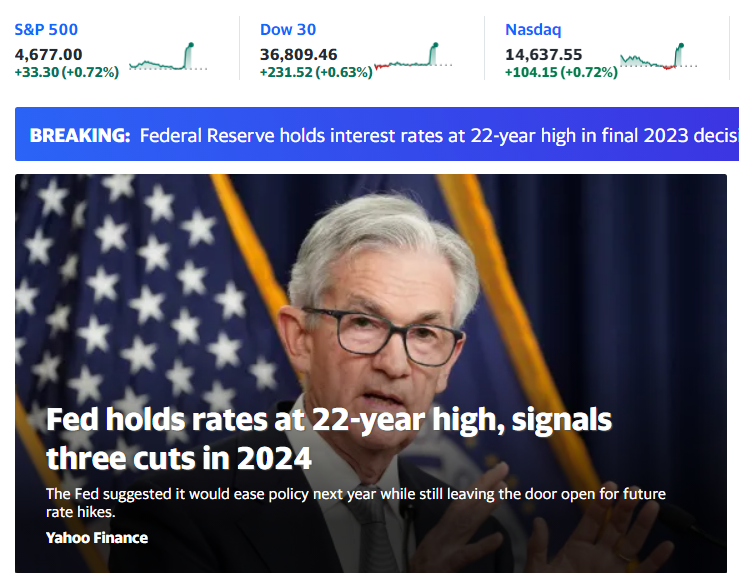

- Dec 13 Markets. Dow - Record Highs

- Fed hold rates.

- BTC/ETH in today's markets

- Dec 12: Adjustment of Covered call/ Cash Secured Put on ET.

Dec 13 Markets. Dow - Record Highs

Markets are up after the FED hold RATE. Is this a good thing or a bad thing?

High rates slow down the economy. Unemployment is still low. This market often complains about high inflation, aka high prices. But the data shows that people are still spending (via credit card data, car sales (both used and new), and home sales (even when mortgages are between 6.5%-8%).

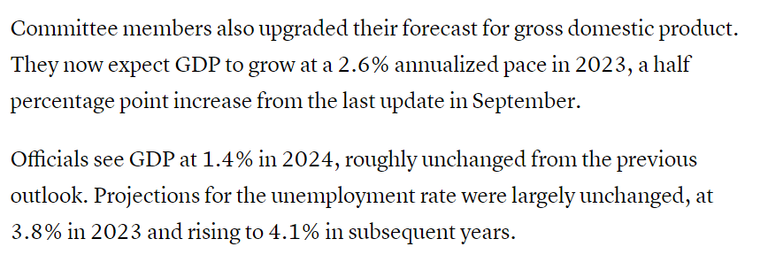

Fed holds rates.

Here is the current data:

- Fed rate in range of 5.25%-5.50%

- Full effects of a higher rate have not been fully felt (lag in data and spending habits).

- Employment rate: 3.7% - 3.8% (historical low) --> which is good.

- At or near PEAK FED rate for this cycle.

- Are cuts coming in 2024?

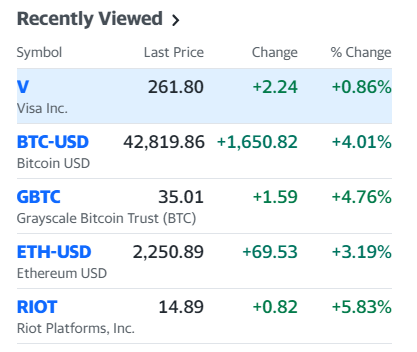

BTC/ETH in today's markets

The markets are GREEN, just like most sectors.

I'm happy when my net portfolio moves in the GREEN rather than the RED direction. I only love RED markets when I want to add more assets to my collection. This is generally when I am under 40 (but it will also happen when I'm in retirement) or when I am looking for an opportunity because I have dry powder (cash waiting to be invested).

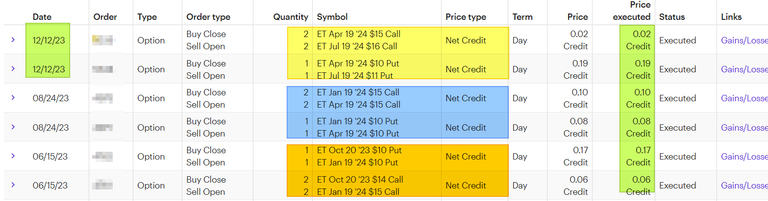

Dec 12: Adjustment of Covered call/ Cash Secured Put on ET.

I own ET in my portfolio, paying a 9% dividend yield.

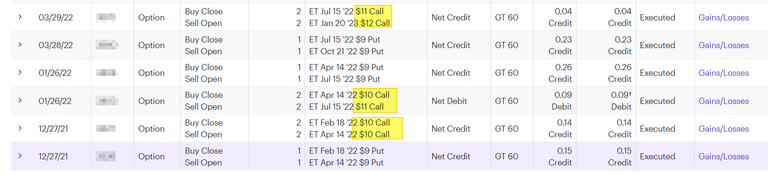

Yesterday, I adjusted my portfolio because the April options had lost more than 50% of their value, and I wanted to change my position. This is one of my boring holdings where collecting the premium is very LOW, but the odds of my options going in the money (ITM) are also LOW. When options go ITM as a seller of options, it's a bad thing. This is how I lose 2K, 3K or 5K in a single OPTION position. Actually, I often lose money way before it goes ITM, because there is lots of TIME available on the options. This is what happens to my Visa, SP500 or RIOT positions.

Over time, as ET shares are moving up, I'm moving my Covered call to 16 dollars from $10 back in Dec 2021.

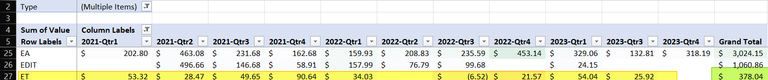

Based on my screen captures, it easy to see that I'm making money using covered calls on ET shares. However, I have 20K rows of options trade historical loaded into Excel and can pivot on the data.

I have made about $370 from Options over the last two years. This position is boring and doesn't get as much attention as my RIOT, EA, Visa, QQQ or SPY trades. But if I was honest, I think these trades are easy to make with no stress, making me money each year without ever going ITM (in the money)!!

Have a profitable day!