Hi folks,

this is my first post out of the Leofinance frontend (btw the new startpage is very well done!). Just wanted to give you a quick update of my activities with LEO.

I couldn´t ignore what was going on here any longer, first of all a huge congratulations to the makers of LEO and this community. It is really amazing what you have done!

Staking LEO

The big reveal: Well, so far I didn´t stake LEO at all, probably the only one here in this community (I hope nobody is downvoting me because of it😊). But in light of all the recent developments I definitely should. I just was too busy powering up Hive as much as possible. To add an excuse, at least indirectly I staked some, as I hold >300 SPI tokens, and @spinvest did a terrific job in leveraging LEO to boost its earnings, as evident from their recent earnings and holdings report.

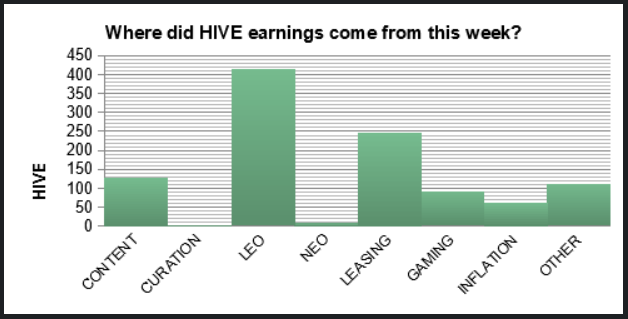

Just one graph out of this post:

LEO contributed by far the most to the recent pleasant price development of the SPI token.

Just in case you didn´t stumble over the SPI project yet, it is definitely worth checking out! Most importantly, they had put >24K LEO in the LP pool! More about it here.

LEOM

From my Dswap gains (read about it here) I was fortunate enough to grab 50 LEOM when they were for sale at 2 Hive each. Now - less than 10 days later! - they are trading at over 4!

Since it was not at all clear to me what ROI is feasible when staking LEOM (there are different statements out there) I had to try it out for myself!

On the 19th Sep I staked the 50 LEOM and as of today I freshly mined 5,045 LEO. This is remarkable - a roughly 5% yield in 10 days (based on the 100 Hive I had spent and on the current price of Hive). I can´t imagine that it will continue like this, but at least so far it is very promising! Does this reflect your experiences too or was I just lucky? I heard there is a probabilistic element in the distribution of the mined LEOs, but not sure if I got this right.

Anyway, I am thinking about to add more. Can´t imagine they can go any lower than now.

LP at Uniswap

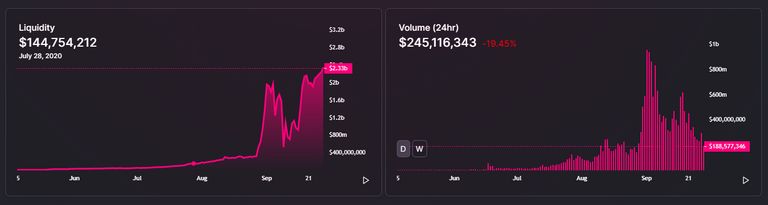

I had some previous experience with liquidity at Uniswap providing on the ETH-WBTC pair, which was not so great at all, and the ETH-UNI pair where I got out some nice fee earnings (calculated 70% APR, but in the last days the volume (and the fees) were sharply declining). Not sure what happened, there was no panic on the market in the last days, was there? However the overall trading volume on Uniswap declined significantly. At the same time the volume of liquidity provided overall is quite healthy, even on an all time high:

Well, high liquidity volume and low trading volume leads to lower fee earnings, because the few fees are distributed among more liquidity providers, right? On the other hand I am pretty convinced that LEO has even a brighter future than its current price suggests. And there is still the 300K LEO bounty!

So I took some ETH which were anyway idling and swapped them to WLEO. For 3.5 ETH I got 7,530.865 WLEO (the gas fee was 6.35$ which seems acceptable (nowadays)), so on average 1 WLEO costed 0,000467 ETH or 17c. On Hive-Engine I would need to pay currently 1.0489 Hive which makes app. 16,9c. Seems that it was more or less OK - but of course that can change daily. If Hive had not recovered a bit recently, it would have looked quite different. So I added it to the few test-LEOs I had there since last week and was nicely surprised that overall I hold now app. 1% of the liquidity pool.

That makes calculating the bounty somewhat easier 😁 (if it stays like this).

Now I am just in the waiting mode and won´t touch those for a few months. I hope the fee earnings together with the bounty bring a profit that is worth it. One shouldn´t forget the opportunity costs. The same money in staked Hive brings 3,3% inflation plus 10+% curation rewards. So at the end of the day it is also a bet which Token, Hive or LEO, will have the better development. Anyway exciting times...

Posted Using LeoFinance Beta

Hab Mal ne Frage zu dswap. Ich hab 200 BEE gestaked und 100 für den Basic Plan gezahlt, wo ich dann eine Config für einen Markt erstellt habe. Er führt bei mir aber keine Trades aus, muss man noch irgendwas anderes machen? Ich hab HIVE in meiner HE Wallet, aber den anderen Token nicht, muss man beides haben?

Nein, es reicht, wenn man Swap-Hive hat. Den ersten Trade sollte er dann automatisch ausführen. Ist der Dswap auf "aktiv"?

Ja ist er. Ich schau mir das nachher Mal nochmal an und frag Mal im discord wenn's trotzdem nicht geht.