Ethereum, launched in 2015 by Vitalik Buterin and his team, is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Unlike Bitcoin, which is build primarily as a digital currency, Ethereum's blockchain is designed to be a global, decentralized computer. Its native cryptocurrency, Ether (ETH), powers these applications and is used to pay transaction fees and computational services on the network.

Over the years, Ethereum has undergone significant upgrades to improve its scalability, security, and functionality. The most notable of these is the transition from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0, also known as the Beacon Chain, which aims to address the high energy consumption and scalability issues of the original Ethereum network. As of 2024, Ethereum continues to be the leading smart contract platform, with a vast ecosystem of dApps, decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs).

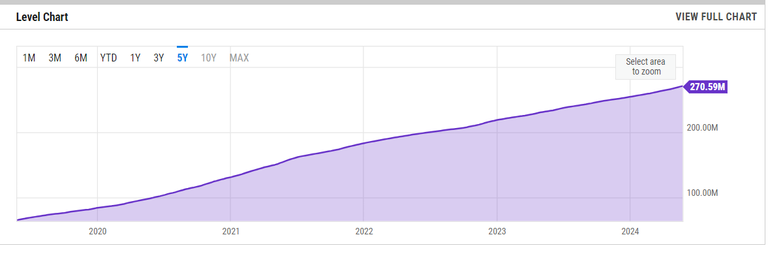

Number of Wallets

As of 2024, Ethereum boasts over 250 million unique wallets. This impressive growth highlights the widespread adoption and use of the Ethereum network.

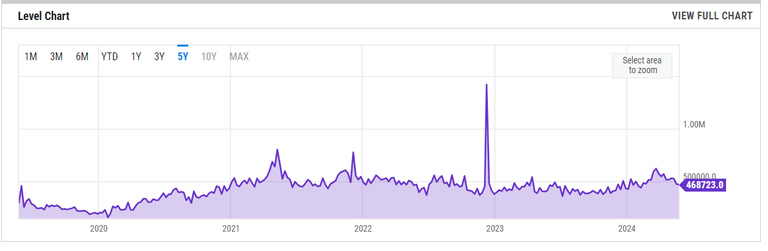

Active Addresses

Active addresses are a crucial indicator of network activity and user engagement. Ethereum consistently maintains a high number of daily active addresses, averaging around 500,000 in 2024. This figure, although slightly lower than previous peaks, reflects a strong and sustained user base actively interacting with the network.

Daily Transactions and Volume

Ethereum processes approximately 1.2 million transactions per day. These transactions encompass a variety of activities, including transferring Ether, interacting with smart contracts, and trading on decentralized exchanges (DEXs). The daily transaction volume on Ethereum often exceeds $20 billion, showcasing its role as a critical infrastructure for the DeFi ecosystem.

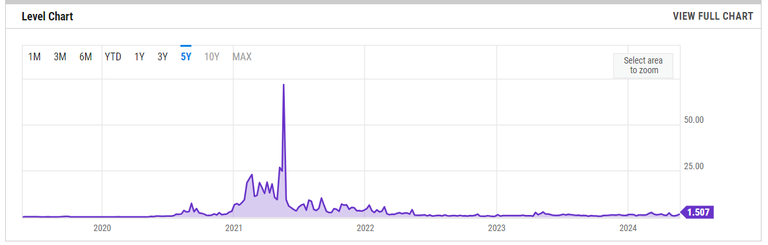

Fees

Transaction fees on Ethereum have been a contentious issue, particularly during periods of high network congestion. In 2024, the average transaction fee fluctuates between $10 to $30, depending on network activity. While Ethereum's transition to PoS and Layer 2 solutions like rollups aim to alleviate high fees, they remain a significant consideration for users and developers.

Staking Rewards

With Ethereum's transition to PoS, staking has become an essential aspect of the network's security and governance. As of 2024, over 20 million ETH are staked, representing approximately 17% of the total supply. Stakers earn rewards for validating transactions and maintaining network security. The annual yield for staking Ethereum ranges from 4% to 7%, depending on the total amount staked and network conditions.

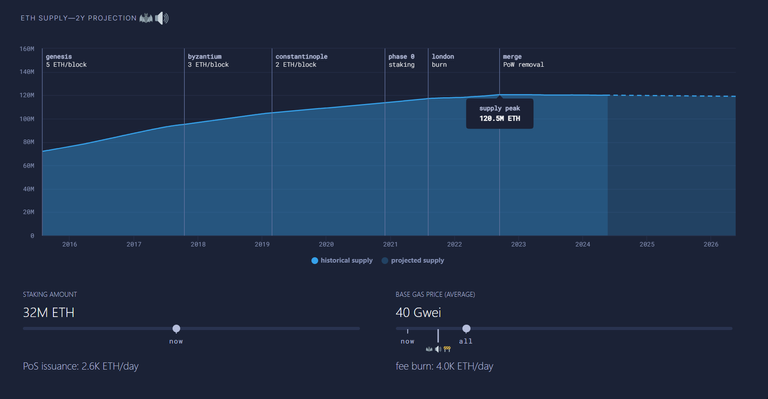

Inflation or Deflation

Ethereum's monetary policy underwent a significant shift with the implementation of EIP-1559 in August 2021. This upgrade introduced a base fee mechanism that burns a portion of transaction fees, reducing the overall supply of Ether. As a result, Ethereum has become deflationary at times, with the rate of ETH burned surpassing the issuance of new ETH. In 2024, Ethereum's annual inflation rate is effectively close to zero or slightly negative, contributing to the scarcity and value appreciation of Ether.

Total Value Locked (TVL)

Total Value Locked (TVL) is a critical metric for assessing the health and growth of the DeFi ecosystem on Ethereum. As of 2024, the TVL in Ethereum-based DeFi protocols is around $150 billion. This capital is distributed across various DeFi sectors, including lending, borrowing, trading, and yield farming.

Distribution of TVL

Lending and Borrowing: Protocols like Aave, Compound, and MakerDAO dominate this sector, with a combined TVL of around $60 billion.

Decentralized Exchanges (DEXs): Uniswap, SushiSwap, and Curve Finance are major players, collectively holding over $40 billion in TVL.

Yield Farming and Staking: Platforms such as Yearn Finance and Lido facilitate yield optimization and staking services, with a total TVL of about $30 billion.

Stablecoins and Asset Management: Protocols like Tether (USDT), USD Coin (USDC), and DAI contribute significantly, with a combined TVL of $20 billion.

Liquid Staking Protocols and EigenLayer

As of May 2024, approximately 18 million ETH are locked in liquid staking protocols, equivalent to about $67 billion. Major players in this space include Lido, Rocket Pool, and Ankr, which provide liquidity to stakers through tokenized representations of staked ETH.

EigenLayer, a liquid restaking protocol, has emerged as a significant player in the Ethereum ecosystem. It allows stakers to re-stake their staked ETH (sfrxETH, mETH, ETHx, etc.) to earn additional rewards by securing various services and applications. Currently, around 5 million ETH, valued at approximately $18 billion, are restaked on EigenLayer.

Ethereum remains the cornerstone of the blockchain and cryptocurrency ecosystem, continually evolving to meet the demands of a growing user base and technological advancements.

Number of Wallets: Ethereum Unique Addresses Chart

Active Addresses: Daily Active Addresses Chart

Fees: Average Gas Price Chart

Inflation or Deflation: Ethereum Burn Chart

Market Cap:Ethereum Market Cap

Total Value Locked (TVL): Ethereum TVL

P.S The numbers speak for themselves.

Posted Using InLeo Alpha

Ethereum tokenomics are strong and with the approved ETFs we will see fresh money pouring in this great ecosystem. I believe that it is doomed for greatness and it will be a gold gem in the peak of the bull run.

Yes at this point is extremely big and the ETF will help a better adoption and exposure to more capital. This cycle is the one that crypto are finally become legit asset in the eyes of the financial system.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.