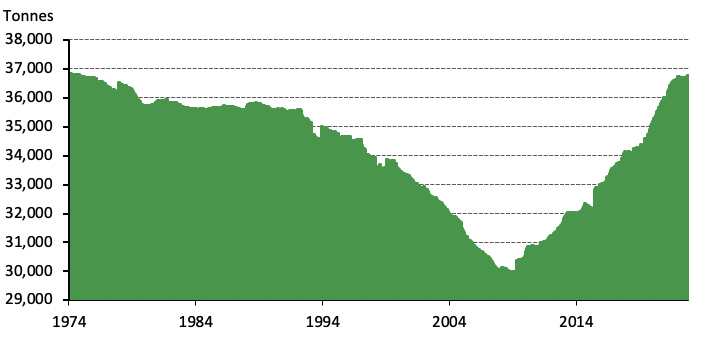

Recent reports by the World Gold Council (WGC) disclose the fact that worldwide gold demand and OTC markets have increased by 28% higher in 2022 than the year of 2021. In the meantime, the surging demand superseded the last year's record in the third quarter and as a result, central banks' gold buying is at its peak in an all-time quarterly record in Q3 2022. These central banks are buying more gold in 2022’s fourth quarter which indicates that the gold held by these central banks is at the highest level since 1974 when the USD was pegged with the price of GOLD but that is now past. Recently published data shows the suspected gold buyer as China which is accumulating too much gold and they have the highest reserve of USD also! In October, central banks worldwide obtained 31 tons of gold but the rate of buying GOLD has increased more in Q4 which is quite mysterious!

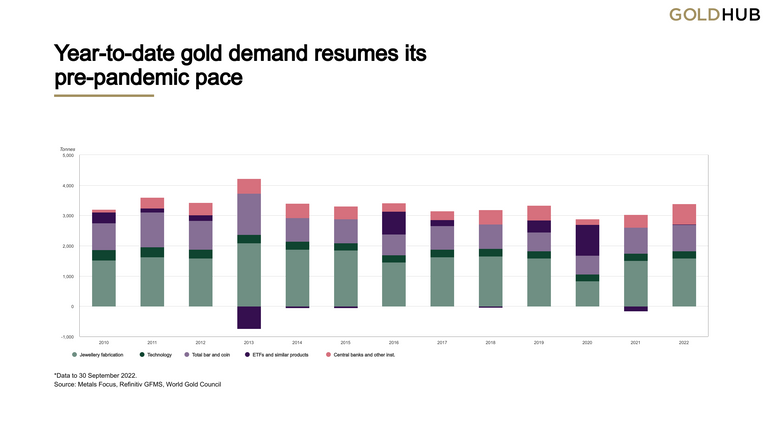

Among the top buyers officially published data shows that the Central Bank of the UAE is the highest gold buyer in October by adding 9 tons to its gold reserves and a yearly increment of 18 tons. Turkey has also bought roughly 9 tons and the Central Bank of Türkiye has been the biggest purchaser of gold in 2022 by adding 103 tons to its reserves so far. But the more interesting fact can be observed from the following graph which shows that jewelry fabrication is the largest portion of consumers of gold. It is indicating the following concerns my opinion,

- People are losing belief in traditional money due to the ongoing printing and skyrocketing inflation.

- Personal freedom in the economy is still bound to the precious metal and GOLD as the top priority.

- The national banks worldwide are trying to bring a change or preparing for a revolutionary change!

Sources: Metals Focus, Refinitiv GFMS, World Gold Council; Disclaimer

Also, the ratio of the total bars and the Central bank's buying discloses another information about the aggressiveness of the central banks to buy gold! The central banks are also selling gold from their reserve in some countries like Bangladesh for tackling the financial crisis also! But the overall demand is increasing rapidly which is not ignorable. The global recession is fueling up to move toward gold or any alternative to the existing inflammatory system. The best thing is that people are now realizing the true essence of inflation and they are trying to overcome it from their own perspective.

For an example I can say about Bangladeshi people who are withdrawing their money from the banks especially the Islami Bank which is suffering a lot due to mismanagement which I have discussed in my previous post. Also many banks are suffering from liquidity and lending from the Central bank. And banks are failing to convince the general people to keep their money in banks- Bangladesh Bank brushes off liquidity crisis 'rumour,' says people's money safe in banks. Even our Prime Minister is telling people to keep money in banks but people are withdrawing money and buying some assets and property to save their money from the aggressive inflation all over the world. The Prime minister of Bangladesh stated in a people's gathering- ‘If you withdraw money from banks and keep it at home, thieves will be encouraged’, isn't it funny?

Though the leading central banks traditionally buy gold from large commercial banks or directly from the companies that own gold mines. but in the retail market, Gold has been doing very well during the last two months and currently trading for $1,793 per unit. Since Nov. 3, 2022, gold has increased 10.07% against the U.S. dollar, from $1,629 per ounce to the current $1,793 per ounce value on Wednesday, Dec. 9, 2022. And if the demand exists at the current level the price is expected to surge as there is no proper alternative to GOLD.

Though cryptocurrencies were supposed to get a portion of the GOLD but the COLLAPSE of LUNA, MASSACUR of FTX has destroyed this opportunity in the current situation. But still many people like me are hoping for a better scenario as the existing FIAT currencies are not doing good at all to tackle the problems that people are facing as the central BANKS are printing how much money they need! So, people will definitely go for any alternating option and cryptocurrencies will grow sooner or later.

Besides Gold, property investment could be another great option but due to the COVID-19 pandemic the property business has been affected badly and the bleeding sector is still trying to survive as people are trying o cut every possible expenditure in this bad time on the verge of Global recession.

Though the underlying reason for accumulating gold is not clear the current situation and the suffering with the bank notes are the driving force for the central banks to prepare for the bad times and they are accumulating GOLD. And also the global leadership has done many occurrences like Ukraine War has made Russia a lot of sufferings with the dollar-based business which is a headache for many countries. But Gold is universal, there are no obstacles with the GOLD in such a situation Gold contains an intrinsic value in itself!

What is your thought about this, let me know in the comments. Thank you very much for the time to read my post. I will catch you at the next. Have a nice day!

Accumulating Gold too?

Posted Using LeoFinance Beta

Yeah, they are!

That and also Russia and China

Indeed for being the rival!

Do you think banks accumulating gold will do good for the price value of gold in the market

If the demand increases, the price will go up until they dumped the market by selling them abruptly. That's the economic cycle I think. Thanks for stopping by.

Dear @tanzil2024!

The action of central banks around the world buying and collecting gold means that the value of fiat currencies will eventually fall!

Currently, the world has plunged into inflation as international oil and natural gas prices skyrocketed.

So, it is very difficult for ordinary people like me to get through the winter.

I don't have the financial ability to buy and collect gold, so it's harder to live.

Eventually, This winter will be even more brutal for the poor!

That is a shitty game, prints money, and makes the poor people more difficult!

No wonder if fiat currencies collapse in the future and it will happen one day as these papers have no intrinsic values!

I agree with you!

So, Are you going to invest in cryptocurrency?

I have no plan for investing in Crypto!