We are being bombarded with articles regarding the Hive Backed Dollar (HBD). This is something that is getting a lot of attention on Hive. Certainly, this can be viewed as a microcosm of where the entire industry stands at the moment. Algorithmic driven stablecoins seems to be the "in" thing right now. For this reason, the focus seems to be heating up.

Even the Ambassador decided to get into the game by announcing his own stablecoin on Tron. Perhaps someone should have notified him that he already had one with SBD. Either way, he claims to be paying 30%.

Of course, developing a properly functioning stablecoin required more than just tossing it out there and claiming it is pegged. It even goes much further than simply backing it with a basket of other coins. Instead, there is the development of the coin and the direction it is taking. In an upcoming article we will detail the different areas that are vital.

For now, we are going to take a look at some of the basics as it applied to the Hive Backed Dollar.

HBD Stabilizer

This could be the point in time where we see the shift regarding the Hive Backed Dollar. Before the introduction of the HBD Stabilizer, HBD was completely overlooked. This application started the journey of more eyes turning towards it by approaching the biggest problem: the inability to hold the peg.

Since its introduction, the range of movement on HBD has stabilized. Volatility is the enemy here. For a stablecoin to fill its potential, a very tight trading range needs to be achieved.

As the name denotes, that is the goal of the HBD Stabilizer.

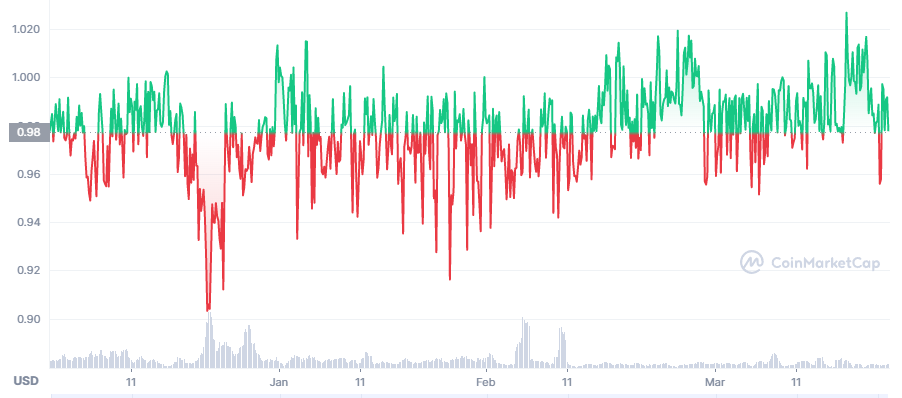

So how did it do? Pulling up a chart, we see the range over the past few months.

This is a fairly tight range. While it is not ideal, it is getting better. As we can see, the downside moves are declining both in terms of magnitude of the drop along with the frequency. Over the past month, things were much tighter than before.

We now see about 5% to the downside and 2% to the upside. This compared to 7% drops in February.

The one year chart shows a marked improvement.

Obviously, the first thing that jumps out about this is the major run ups last year. However, if we look passed that, at the consistent red over the last 8 months, we see it slightly upward tilting. This means the lows are being pulled up, similar to what we see on the YTD chart.

Hence, we can conclude the range of trading on the price of HBD is tightening. That is a positive move. In fact, if HBD is going to be legitimate, this is exactly what needs to happen.

Polycub Liquidity Pool

A lot was made of the pHBD-USDC liquidity pool that went live last week. This was brought out with high aspirations. The goal is to get $5 million of liquidity in the pool.

How is that progressing? So far, after a week, we see the total crossing $300K.

This is obviously well short of $5 million but we have to be fair here; it is only a week. So far, the amount in the pool rose steadily. What this tells us is that it is only a matter of time. In other words, this pool will be viable by the end of the year.

pHBD is obviously a wrapped version of HBD. This resides on the Polygon chain. Each pHBD that is produced is backed by one HBD. The HBD resides in the @p-hbd account on Hive.

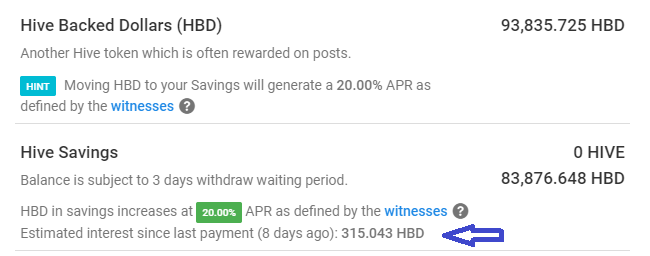

With the HBD that is submitted to be in the liquidity pool, 50% is being placed in Hive Savings. This is earning 20% APR, generating more HBD.

Here is what the account looks like:

Source

As highlight, we can see that by depositing the HBD into the savings, there was 315 HBD generated in a little over a week. This is a number that will obviously keep growing.

The key point with a liquidity pool is to provide people with access to the token This is the equivalent to an exchange in the decentralized world. Here is where people can go to swap USDC (or any Polygon based token) for pHBD. Then, if the person want to get on chain (Hive), the bridge can be used to convert the pHBD-to-HBD.

There is another benefit to this and it ties back to the HBD Stabilizer. Suddenly, when the LP is deep enough the Stabilizer has help. One of the keys for anything to hold a peg is arbitrage. Therefore, having liquidity so traders can easy enter and exit trades when there are market distortions is crucial. Traders who arbitrage are looking for the gaps, in pricing, in different areas. Hence, if the LP gets way out of line to the downside, as an example, one could buy pHBD and sell HBD. A percent or two can make a huge different when playing with enough money.

Here is where we see two things that are crucial. The first is obviously to have enough liquidity so major players can enter the market. Second, we want to have as many different pools as we can so there are more arbitrage opportunities. This is what entices traders.

Fortunately, the Polycub pool is going to be replicated on a number of blockchains as that ecosystem expands. It is likely that we see a liquidity pool of bHBD-BUSD appearing on BSC in the near future. This will provide another entry point for people seeking to get involved with HBD.

Total HBD

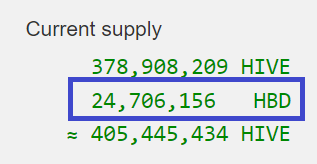

The important thing is to keep watching the total HBD that is available. This can be found at Hiveblocks.

One important note is that roughly 14 million of that total is housed in the Decentralized Hive Fund. This portion of the float is effectively off the market since it cannot be released in large quantities. Thus we can conclude the total amount of HBD available is around 10 million.

That is where things stand at the moment. While many are looking at explosions in the stablecoin market, it is important to get a solid foundation in place. Here is where projects can blow themselves up. Inevitably, many will find themselves on unsure footing if they get popular.

Here we covered some of the basics. As mentioned, an upcoming article will detail some of the other areas of development that are crucial for stablecoin success. Here is where HBD has a solid opportunity because many of those are already starting to be worked upon.

Hopefully this helps to clarify some of the questions regarding HBD and how it is doing.

What are your thoughts? Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Good post @taskmaster4450le. One question though, is if PHBD is based on HBD, why bother with PHBD and not just put HBD into savings? What am I missing here?

Posted Using LeoFinance Beta

A few reasons:

Posted Using LeoFinance Beta

Okay, thanks. That makes sense.

.

Yes the APR goes down as the amount in that increases. At least all things being equal. Of course, APR is the result of a variety of things, one of them being transaction fees. So the more liquidity, the expected increase in activity. If there is enough volume, there can be 10% or 20% of a pool in APR just in fees if the total liquidity is being rolled enough times.

At the same time, there is also the governance on Polycub now. The overall APR on the platform is going to be directed by the community. So people can vote to increase the share that goes to that LP.

Posted Using LeoFinance Beta

This made things lot clearer and easier to understand.

Thanks, have some !PIZZA

!gif pizza

Via Tenor

I am glad it did. Keep paying attention to HBD.

Posted Using LeoFinance Beta

Wrong comment.

Posted Using LeoFinance Beta

HBD it's not that stable for a stable coin, when the market drops a lot it tends to follow. It needs a tighter grouping around $1 to be taken seriously by the people outside the ecosystem

Well as shown, it is getting tighter as compared to where it was. We also just added a lp a week ago that can offer, in the near (medium) future, arbitrage opportunities.

Posted Using LeoFinance Beta

Justin Sun and Tron don't have a track record that would make me invest there, not even for 30%.

Posted Using LeoFinance Beta

He has a track record, just not a very good one in my opinion.

Nevertheless, he will make a lot of money. Will likely gift himself 40% of the tokens created.

Posted Using LeoFinance Beta

haha most likely!

I hope that this is like a beachgoer who, on the first day of visiting the beach, burned out, then he spent a couple of days at home, smearing himself with a fat cream and, after a while, he can again go to the beach and sunbathe until a bronze tan).

Posted Using LeoFinance Beta

I prefer it to be the type who goes to the beach for an hour, gets a base layer, and then keeps increasing it.

We dont want to burn anything with this.

Posted Using LeoFinance Beta

This is ideally, but, practice shows that the influx of vacationers, or new bloggers, creates the prerequisites for beach euphoria, as a result of which, cream sellers will always remain with revenue, and there will be jumps and falls in the market).

Well spotted as the Ambassador does have his own stable coin and just shows what he knows or how much he cares. Terrible character trait when you just want to be in the spot light for self gain.

Posted Using LeoFinance Beta

He stands out like a sore thumb doesnt he?

Posted Using LeoFinance Beta

We just need to keep moving this thing in the right direction. A thousand here, a few thousand there, and the number will continue to grow allowing the liquidity to deepen.

It's just like the wealthy like to say: the first $1M is the hardest. After that, getting from $1M to $2M and from $2M to $4M becomes a much easier proposition. It takes money to make money and HBD is no different. It takes liquidity to keep deepening liquidity. The deeper it gets, the faster it will climb.

Hopefully we can all continue to do our part to keep that number growing. At some point all of the little numbers will add up to a number big enough that a whale can justify stepping in and jumping the number. Once that starts, it could climb very quickly.

As you say, hopefully by years' end we will be talking about multiple LPs having multiple millions of dollars in liquidity.

Posted Using LeoFinance Beta

One key point is the more in the liquidity pool, the more HBD in savings for the @p-hbd account. It is now over 100K. That means it is generated 20K per year, or 1,666 per month.

Get that to a million, and it will be creating 16,666 per month.

So it keeps reinforcing itself.

Posted Using LeoFinance Beta

I'm pretty happy earning 20% ... I'm going to put 100% of my Hive into HBD. And retire.

Keep in mind that HIVE does offer other advantage that HBD does not.

For one there is governance. We also have the price appreciation potential.

But either way, one can do very well.

Posted Using LeoFinance Beta

With nearly 25 million HBD, I say that HBD is doing good. Hopefully there will be more in the future, as everyone'a savings balances are constantly growing by the monthly interest.

Still good. Probably this amount will also be bigger in the future.

It is safe to say that, with the renewed emphasis, there will be more produced. The numbers, I think, will keep rising. As more is put into savings, the amount generated will keep growing.

There are other ways of course, I wonder how many are taking payouts 50/50 now.

Posted Using LeoFinance Beta

Can't we already do something similar on tribaldex? I don't think the liquidity is very large though.

Posted Using LeoFinance Beta

Tribaldex is on Hive Engine, not on BSC.

So a bPHD will create another pool. The key is to keep them rolling them out.

Posted Using LeoFinance Beta

Every HBD I get from now on is going into liquidity pools, With the idea being if HBD does well Hive will follow.

There are a lot of options arising. So it is vital to keep HBD flowing. Where people choose to put it is debatable.

So keep pumping into what you feel best.

Posted Using LeoFinance Beta

I'm pretty happy earning 20% ... I'm going to put 100% of my Hive into HBD. And then retire.

That could be a strong plan.

Posted Using LeoFinance Beta

I should have done that when hive was at $3 though … oh well…

It will get there again I have a feeling.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

PIZZA Holders sent $PIZZA tips in this post's comments:

@pixresteemer(5/5) tipped @taskmaster4450 (x1)

deadleaf tipped taskmaster4450 (x1)

Please vote for pizza.witness!

I'm pretty happy earning 20% ... I'm going to put 100% of my Hive into HBD. And then retire.

Now we really need to think about more use cases for HBD. As you said in one of your comments and als in a previous post. I hope more and more projects will start implementing HBD in their plans. Ragnarok could be one of these. Splinterlands already allows you to buy credits with HBD but most of the times the exchange rate is rather not so nice. Would be great to see the stability of the coin there as well.

And again it was LISTNERDS bringing me to your post, such a great tool.

Posted Using LeoFinance Beta

Yes I read about one that is going to come out in 6-9 months. I have no idea what it is about other than it will be built around HBD and provide plenty of use case.

Posted Using LeoFinance Beta

HBD is doing great and I expect that this will get more attention by the investors but is not it good if it gets listed in exchanges for more reach. How do you see this?

Posted Using LeoFinance Beta

Exchange listing always help. Although that said, we are truly entering the realm of DeFi so if we set up enough liquidity pools, that might be sufficient.

But certainly we need to make accessibility easier.

Posted Using LeoFinance Beta

!CTP

Posted Using LeoFinance Beta

What does it mean when a token is wrapped?

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for providing this valuable information. It is posts like yours that keep me up-to-date.

Posted Using LeoFinance Beta