Elon Musk made a lot of news with the filing of his purchase of over 9% of Twitter. This caught the attention of the entire social media and financial worlds. Is Elon going to decentralize it or what he is going to do?

This clouded over another important announcement by one of his companies, Tesla. We know Musk makes a lot of headlines in the cryptocurrency world but for some reason this went rather unnoticed. There might be good reason for it since few seemed to pick up on it.

You would think news like this, if true, would spread through the entire crypto community like wildfire. Musk even says the word "cryptocurrency" and there are 5 articles written about it.

Nevertheless, we will delve into it since, even if not the case with Tesla, does show the future of Decentralized Finance (DeFi).

Tesla Financing Real Estate

According to The Defiant, Tesla is using MakerDAO to take out loans for real estate. This is going to be used for their service centers.

6s Capital closed a deal with Tesla for $7.8 million. This is all a bit suspicious since Musk didn't make mention of it. Of course, in his realm, $7.8 million to finance a service center isn't really on his daily radar. Nevertheless, if this were something they did, you would think he would be out pounding his chest.

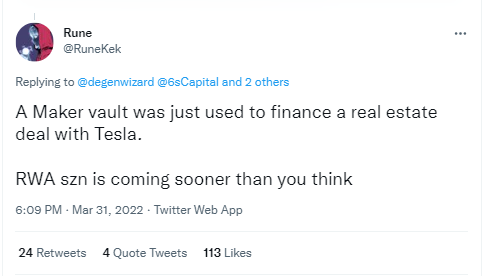

A Tweet did appear from MakerDAO's pseudo-anonymous Co0Founder.

The idea is to use this to build new service centers. Tesla is sitting on close to $2 billion worth of Bitcoin. We could see this as a new way to tap into capital which would allow them to finance expansion.

Of course, if true, this would be enormous. Here we would see another step in the evolution of cryptocurrency as a financial ecosystem. Tapping into the value of existing assets is one of the major promises of cryptocurrency.

One of the main concepts is that banking system is going to be under threat. There is little doubt that digital wallets really are going to hinder deposits at some point in the future. At the same time, DeFi has the potential to radically alter how people access money. This will include institutions including Tesla.

Hence, this type of deal does make sense, even if it is an April Fool's joke or a ploy for attention.

Trillions In Real World Assets

People really do not realize how big a market we are talking about. There are a couple hundred trillion in real world assets out there. Much of this is untapped since it is non-liquid, over regulated, and very difficult to deal with. The digital age makes things much quicker and more efficient.

The challenge for DeFi is the lack of liquidity. This is obvious since it is a rather newer realm. The existing financial system grow over 150 years, with returns only generating more capital. DeFi is basically in its 3rd year.

At this point, something like this could hold appeal for a company such as Tesla since the deal would not show up as debt on its balance sheet. It would effectively go under an operating expense since the deal would be paid akin to rent. This is much different than accessing the traditional capital markets to raise money including going through the banking system.

Here is where we can see the ongoing values of cryptocurrency becoming a vital component to growth. Through collateralized lending, we can see how the financing of real world activities will lead to wealth generation. It is a transformation that the industry really needs to take.

Ultimately, there will likely be a day when some very big players enter this realm. After all, the bankers are not going to sit back and willingly give up their share of the financial market. Of course, they didn't do that with mortgages yet FinTech companies were able to wrestle most of that market share away.

We are at a time of major transformation. Perhaps Musk and Tesla pulled off another step in the massive evolution that is taking place. Or, maybe, this is a total fabrication. Either way, it does provide insight into the future.

Accumulation Of Assets

This is showing the importance of accumulating assets. The industry is still in its early stages and, while it is true we are not talking in billions like Tesla does, we can follow the same concept.

Putting value to work is one way to expand things quickly. It also creates a feedback loop whereby the value of our assets increases as more activity takes place. When those assets are dormant, we can see how it is a lost opportunity. Right now the Bitcoin on Tesla's balance sheet is simply sitting there. Sure, it can go up in value along with the market. However, if they could put it to use while still retaining it, that would provide a much larger financial benefit.

This is the basic idea behind economic expansion. Debt is viewed as a bad thing by most people probably since their use of it is for credit cards and car loans. That is only going to get one further behind. Of course, step back and look at things from the other side. Both of those are extremely profitable for the lenders.

At this point, we are very early in the game. We are going to see a lot of experimentation taking place. The interesting aspect is the ability to "create money". We will see how platforms incorporate this concept into their operations. It really does open the door to a great deal.

In the meantime, just keep filling the bags. Whatever the token, keep an eye on its value. As things are built out, this could end up being included in some lending platforms that help to grow things quickly.

Essentially we are going to have to generate trillions of dollars in liquidity. Some of this can come from money brought into the system. This is how Wall Street thinks. However, the other way is to use our ingenuity by utilizing some of the core concepts of cryptocurrency. The key will be to do this on a small scale, many times over. That is how we grow.

Fly under the radar until we are so large things cannot be stopped.

Most do not need a loan for $7.8 million. However, we can easily see how 1,000 people could use $7,800. This is even better if they are taking it out against their own assets.

We are getting to the point where options that were once only available to the biggest players, i.e. major corporations and Wall Street, is now available to all of us.

Whether Tesla stepped up to help change the game is debatable in this instance. What is not is the fact the game is changing.

And we all have a front row seat.

So what are your thoughts on this? Do you think Tesla actually did this or is this a ruse?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Based on the fact that Musk challenged Putin to a duel and offered Ukraine as a prize as his property, lol, the guy likes to talk about what he can never accomplish, although, the evil dwarf needs to be punched in the face ... most likely he bluffs a little.

Interesting take considering he is leading both the EV and space race.

They said he never would deliver 500K cars in a year. It was also stated that landing a rocket on a barge could not be done.

So be careful with your hatred for the guy. He does have a track record of getting things done.

PayPal

Tesla

Spacex

What does your resume look like?

Posted Using LeoFinance Beta

I think that you are mistaken, regarding what you called hatred, I meant that Putin needs to be punched in the face, and not Elon, but this is not so important. I have more respect for the technical side of Elon, and would look towards the hyperloop if he was on your list.

This technology will be extremely useful for our home planet. I'm not looking towards Mars. As for Tesla, I consider it an overpriced project, which, most likely, will soon become obvious and very affordable. Regarding the payment system, I cannot tell you my opinion, because I did not use it, when this happens, I will share my opinion and study the issue more deeply.

The agenda of main stream media is something we should always question. If true this space is making major moves and the ordinary eye is deprived of but given twitter hype for them not to see what is possible in this space

Well I dont expect the mainstream media to cover this. Actually I have no idea if they did since I pay no attention.

However, this is something you would expect the crypto coverage on. Yet nothing.

Which is why I question how legit it really is.

Posted Using LeoFinance Beta

I wonder if the tesla like companies enter into any blockchain, doesn't that blockchain gets affected with their developers joining the centralized organization? I hope by Elon getting involved into such DAOs they don't lose the freedom and end up being govt pawns. Do you think in long term this would help?

Most blockhcains are centralized already. Look at the foundations, labs and companies behind them. So, if what you propose happened, just changing pool chairs.

In this sense, if this is true, Tesla is just using a service. They arent involved that I can see with Maker.

But then who knows.

Posted Using LeoFinance Beta

Quote from the forum post.

They seem to be working closely with Tesla for some time now. People keep dismissing Maker but they seem to be making some serious progress.

This is big news indeed. Gonna need to follow it more closely from now on.

Posted Using LeoFinance Beta

I would say it is huge news if it is indeed true. A bit perplexed how the mainstream crypto media didnt pick up on it.

This could be a huge breakthrough if it is the case. It will show how important liquidity is going to be.

Posted Using LeoFinance Beta

Very interesting! Uggg tho, why so crypic in their communication!!!?? Lol Only time will tell. Indeed, fill those bags. Many boats to catch. What a realm to have a front seat in. Oh my!!

Posted Using LeoFinance Beta

There are a lot of seats to choose from. Many will end up being very comfy over the long term.

Posted Using LeoFinance Beta

wOa, yes sure why not. 2B of OG BTC are very handy after all. You can run a small city by collecting only the APR on that across different DEFI Networks.

Well not sure that something like Tesla would run around yield farming different DeFis apps.

But you get the point: yield is vital when you have the resources. That is what all of us need to keep drilling into our heads.

Keep filling those bags.

Posted Using LeoFinance Beta

100% true, anything one sells in 2022 will haunt them the next 20 years down the road.

The sheer amount of abundance that crypto is creating seems surreal, but it's the real deal.

I totally agree with you here however I wonder how best Bitcoin can be put to use by a company like Tesla. For security reasons, they wouldn't want to lend it out to exchanges through staking. The nature of Bitcoin doesn't fit in well when it comes to DEFI. The reward from few exchanges that offers earning opportunity with Bitcoin is not encouraging except for the fact that Tesla might have something tangible in the end due to the amount they posseses.

I agree with you, idle assets doesn't promote growth.

They are simply staking it for a loan to open up service centers. At least that is how it appears.

Take a few million of the $2 billion, take out a loan, build a service center, pay off the loan using the proceeds from the operations of said center.

Posted Using LeoFinance Beta

Sometimes I wonder if that is the way going forward to avoid taxes. If you borrow the money, I think you can get away with a lot of things at the end of the year and I hear about the rich doing it all the time.

Posted Using LeoFinance Beta

Corporations operate under different tax rules than individuals.

Here is it a matter of accounting. Their debt ratio doesnt go up through this since I am sure there is no requirement to account for DeFi loans using crypto in the SEC rules (that might come at some point).

Instead, this is operations, which protects their debt ratio.

Posted Using LeoFinance Beta

Good read.

Elon musk investing heavy money in Twitter is bad. It may make investors to pull out from Twitter

Posted Using LeoFinance Beta

He has done unbelievable jobs at Tesla, SpaceX and other stat-ups.

I am a big fan of him, but I don't understand about his intention about going to mars. He should have asked me why I choose to stay on earth. !HaHa.

But in the crypto space, he doesn't seem to be very transparent. He questioned web3 and promoted meme coins.

I felt like he's not using his influential power in a right way or not with the best intention for the crypto industry but for his own good. May be I am wrong.

Interesting!

Posted Using LeoFinance Beta

Glad About this.

The use of defi technology is quite expansive. I don't want to say limitless.

It's great what can be accomplished.

Tesla is absolutely one of the most important companies on our planet, I was a little surprised by the acquisition of shares of elon musk of Twitter as I believe that for the free speach there are decentralized platforms that truly guarantee free thinking but this further move Tesla, told in your article, projects it into a futuristic dimension. Thanks for the constant information service you do.