Bitcoin opened up a completely new world of finance for one simple reason. Instantly, the role of creating currency was opened up to anyone. Whereas it was almost exclusively in the hands of governments through central banks, with the introduction of Bitcoin, people realized others were able to the same thing.

Today, we see more than 6,000 tokens listed on data aggregation sites and the number is growing.

While decentralized, non-government controlled currencies are making new, this does not mean that governments are not going to get into the game. Obviously, we see a lot of discussion about CBDCs, which to many, is just another form of economic abyss.

However, if we drill down a bit further, we see how the creation of one's own currency can really enhance a local population. By moving further away from the centralized system, we can see added benefits.

The challenge with present stimulus is very little of it ends up in the hands of everyday people. Instead, the central banking system uses the commercial banks to distribute new money. This ends up enriching those very close to the central bank while the rest end up falling further behind.

Source

Direct stimulus has a much different impact. One Spanish community realized that and is taking measures. With economic calamity due to the COVID-19 lockdowns, this town is seeking to help jumpstart its economy.

The city council of Lebrija has created a virtual currency, elio, that can only be used for payments made to small and medium-sized businesses, according to a report by Diario de Sevilla.

Here we see the creation done at a level much further away from the central bank, in this case the ECB. It is not even the Spanish government doing it. Instead, we see a local city council adopting a virtual currency in an effort to stimulate things locally.

In the age of globalization, this is a radical shift in thinking.

One Elio is equivalent to one euro and almost 600 families will receive between €20 (US$24.50) and €200 ($244.96), which can only be spent in local businesses using an app.

Certainly, nobody is getting rich off these numbers. However, it could be enough to stimulate things locally while shifting enough demand to local businesses. In times like these, for many people, even a few thousand EUROS can make a difference.

It is vital to understand one of the basics of money: it is a tool for collaboration. The more money that is circulating, the more collaborating, i.e. economic activity, potentially takes place.

The problem is when money is distributed via debt and most of it does not get circulating in the economy. Then you get the reverse situation where less collaboration takes place.

In short, the economy gets squeezed as debt servicing takes on a much larger role. Also, we end up with a large portion of economic activity that is done by rent seekers, who extract from the overall pie.

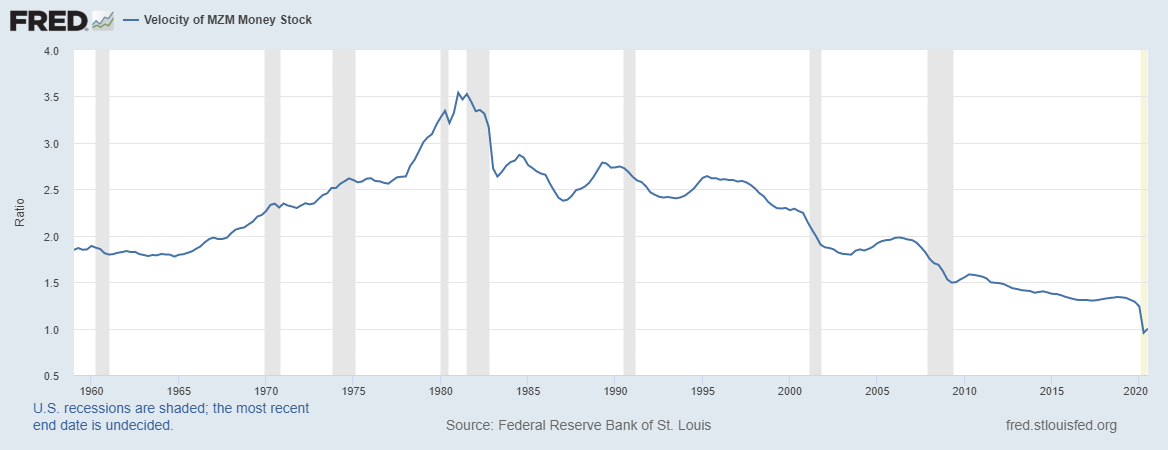

The last 40 years in the United States shows exactly how this played out. In the USD, the velocity of money has slowed to almost a dead stop. It is barely hanging above 1. The other major currencies are actually all reading below 1 on this scale.

This ultimately puts the long-term growth trend below the historical norm. It is another reason why we saw the global economy slowed even before COVID-19. Each passing decade leads to slowing economic activity as debt rises.

Once again, we see cryptocurrency as a way out of this. Have you ever noticed that when people talk about the insane values of Bitcoin, they never mention how it will lead to greater inflation? After all, if BTC hits a $10 trillion market cap, up from the present $500 billion, that is a lot of extra money floating around in the system.

How come the inflation hawks do not believe the same about Bitcoin? Of course, we would them likely see Ethereum worth a couple trillion. In fact, if we add in all the cryptocurrencies, we could see tens of trillions in money circulating.

The reason this is the case is two-fold. To start, money is distributed, for the most part, to individuals, not banks. Thus, all new money is a grassroots stimulus.

At the same time, cryptocurrency is issued without rent extractors tied to it. Since it is not debt when formed, there is no interest to pay back. This will allow an economy to flourish in spite of the increase that is on the market.

As a tool for collaboration, people can be incentivized to do many things. At present, it is mostly done in accordance to governance protocols or providing incentive to do an activity such as walked.

Nevertheless, we are going to see a time when tokens are used to incentivize the design of rockets or doing cancer research. We will see solar, wind, or geothermal systems established using cryptocurrency. Whatever is lacking, crypto will be the tool that can provide for it.

In the United States, it takes an act of Congress (literally) to get direct stimulus in people's hands. With a blockchain such as HIVE, just wait a few seconds and more is issued into the wallets of people. The same is true for many blockchains.

With the economic situation looking bleak for many, cryptocurrency is the shining knight that can save the day. The central bankers and politicians repeatedly proved how inept they are at providing solutions. In fact, a strong case could be made that they cause more damage then they solve.

With all the attention given to Bitcoin over the price run, it is actually the utility of cryptocurrency that is going to provide the foundation for the new financial system.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Thanks for going on the problem, the velocity of money. The slower the money, the bigger the economic issues. Now with the crisis, we see that the stimulus is not accelerating the economic speed. Here you pointed it very well, it does not increase the speed as it is distributed in the wrong places.

I like the idea of stimulus for local to local, as it helps directly. Of course, not all business can be saved as there is no panacea available. Here there might be a shift in business mentality in the months to come and how we want to see them. There is obvious that the local coffee shop can't make it without help. But when we help them, shall we help the big chains also or shall we require bigger businesses to build bigger safety nets? Tricky thing.

Cryptocurrency as local tender can help here, even if it is distributed to bigger chains, they can't spend it anywhere else and the money stays in the local economy. Interesting things to come.

Posted Using LeoFinance Beta

The "virtual" regional money from that Spanish Community you described stem originally from the theory of free money ("Freigeld") from Silvio Gesell. I think first time is was successfully implemented in 1932/33 by Michael Unterguggenberger, mayor of the small Austrian town of Wörgl during the severe economic depression back then. Notes were given out for free (acceptable like cash but in the region only) which would loose value over time, so a quick turnover is incentivized. This principle is called demurrage and is actually quite clever! But after 13 months already, the Austrian central bank stopped the experiment. It was too successful and endangered the classical fiat system. There were other examples too (even today there are some like "Regiogeld" (regional money)) and I think we can still learn a lot from these. It could actually be one way out of the hopeless current money system.

Printing more money without producing more only devalues the currency. Which means more debt without improving the situation of the people (like when they pump the stock market) doesn't actually help the country. For example, if everyone wants milk and the supply chain for milk can't keep up with the new supply then the price of milk will rise (more demand than supply). I do believe that the devaluing of currency will help the price of crypto, but I still think that the ones that can prove themselves will be the biggest winners.

Not if the economy is collapsing and the capital formation is being eradicated at a much quicker rate.

Posted Using LeoFinance Beta

Simply put bitcoin has shown that individuals can personally create value and tokenise their business, as this sole purpose would no longer be monopolised by government and commercial banks at large. Value is subjective and Crypto has made us realise that it isn't just government backed currencies that should carry value.

Posted Using LeoFinance Beta

Value is subjective.

And that is what makes it tough to assess things. Ultimately it is what two people agree upon. Without that, there is no value there.

Posted Using LeoFinance Beta

Couldn't have said it any better, cheers!

Posted Using LeoFinance Beta

btc has shown the way! Many of these 6k cryptos are scams but some are the real deal and can help both us and the whole blockchain ecosystem!

Posted Using LeoFinance Beta

That is pretty awesome. I hadn't heard that about Spain. 6000 Tokens seems nuts to me. Especially when you consider that probably 80% of them will never amount to anything or even produce a product. I am not necessarily against a large variety of tokens, but I think the ones that are out there need to be built onto something. They need to have a function and an actual working system.

Posted Using LeoFinance Beta

Well 20% of the S&P 500 is considered a zombie company because their earnings do not cover the debt servicing costs.

But you are right, most will never amount to anything and will end up as just projects that disappeared without a second thought.

Posted Using LeoFinance Beta

I think this is a good point to make. Tokens and coins are like stocks. In the long run there will be many more. But I think that the ones that will be listed on various (hopefully high level) exchanges will be the ones that have some utility.

BTC is clearly a great store of value. It will continue to be so. Ether is great at smart contracts. As I have been reading recently TRON is secretly becoming the basis of contracts too. STEEM has been (?) the basis of social networking. If course this is just the beginning there is more to come. We see XRP looking like it's in it's last throes. I guess this proves that the ecosystem is active.

We will see what unfolds over the next year. What is hot today might not be so much in a year.

Posted Using LeoFinance Beta

It is great to see how tokenization is moving from virtual spaces into the real world and entire communities and cities benefit out of it. And with that you can encourage the local businesses to grow which is the way a certain space flourishes rather than money to fly in other places. That's one way to solve a problem.

Posted Using LeoFinance Beta

good about tokenizing the local economies, let's hope what existed here does not happen to us that the gentlemen acceded had some sheet metal tokens that they only used and were valid in their coffee farm, then people received their payment for the work in those tokens and then only I could spend them in the farm's cupboard so the emission is considered centralized, but I think this case of lebrija is better since there is a whole free market economy and the state or the municipality only provides the infrastructure and there are many economic interveners, of Either way this is revolutionizing the entire world system that if they are not updated, some could stay with the saga.

Posted Using LeoFinance Beta

I have an optimistic virtual currency will be acceptable and usable for common transaction in real life especially cryptocurrency will became common payment and acceptable in futute ASAP

For an example in Indonesia there are many application that accept bitcoin & other cryptocurrency as payment for buying mobile credit and gold

Posted Using LeoFinance Beta

Russia has had a similar program, some virtual currency has been distributed to certain category of people to spend it only on clothes. This has been done by the government with the purpose of stopping people from spending it on something else.

The Spanish initiative is a good one. Stimulating local economies is vital these days. Buying km 0 products can help a lot.

Yeah and with crypto, it can be programmed to stop people from spending it on things that is isnt designed for.

For example, food tokens have to be spent on that, not cigs or booze. That could be programmed right into the money.

Posted Using LeoFinance Beta

We have something similar in Romania, it's called food tickets, printed on paper that should serve for buying food. But in reality you can buy cleaning products and other stuff as well. At the beginning you could buy alcohol and cigarettes as well, till they introduced some restrictions.

Posted Using LeoFinance Beta

In my country we can flip thousands to hundreds... I am amazed though to see how people are still accepting this pandemic and not showing any attitude at all. Never have I imagined to live such times. If it wasn't for crypto, and thankfully blogging, my finances would have been way worse. I have no clue how exactly crypto will disrupt these corrupt governments and fatty bankers that eat up all the wealth in the world enslaving the population more and more with every decade, but I do hope for a disruption. Most of the people don't even realize how tight the chain has become...

Posted Using LeoFinance Beta

That is true. They completely asleep. Here in the US, it is about to get much tighter for people and they dont realize they are signing up for it.

Truly amazing what is taking place.

Posted Using LeoFinance Beta

the power of blockchai and cryptocurrencies is truly enormous and is slowly spreading among the world population.

There will be a time when we are fully aware of its potential and finally things will change for the better

Posted Using LeoFinance Beta

This is an interesting read. I only became interested in how money is created and utilized a few years ago. Even after studying some of this stuff in school it's taken time for me to gain interest. And I wish that more people would get from under the thinking of deficits and debt and more in line with the possibility and creativity of currency. But I do understand that the missing element of centralized control is scary for political leadership and uncertain to most people.

Your piece here helps to challenge and dispel some myths about money.

I am especially intrigued with your comment:

A lot of this is going on now where artificially induced property values are used to back high levels of debt in the economy. I am not sure that we end anytime soon. Because a part of what rents do is shroud the fact that the economy is owned by those who can trade and hold property.

Oh, my... This is literally insane!

Posted Using LeoFinance Beta