Grayscale is the large Bitcoin fund right now. The trust has more Bitcoin due to the fact that it has been buying up the bulk of what is mined each week.

This took place over the last few months. One of the reasons is that United States investors can get exposure to Bitcoin through retirement accounts. Also, certain type of funds are prohibited from buying Bitcoin directly so GBTC has served to fill that void.

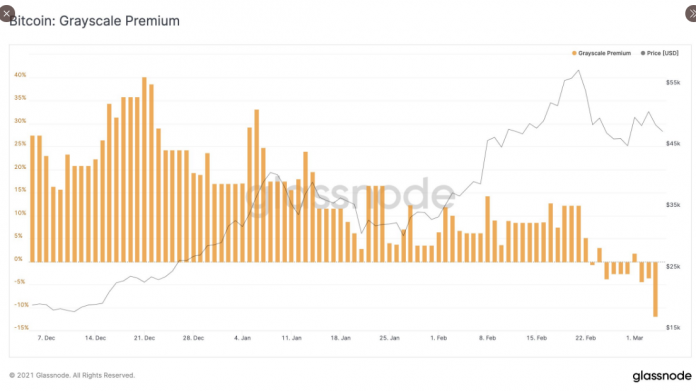

The interest from these two areas sent the premium as high as 40%. This means the shares were trading above the value of the Bitcoin token.

Over the last few weeks, this reversed course and now the GBTC premium is trading below the value of Bitcoin.

Source

Grayscale is a trust, not an ETF, so the correlation between the token price and what the shares sell for will diverge. We saw this on the upside and now it is on the downside.

The question is should investors be concerned?

We see many who are on both sides of this discussion.

Those who feel it is a problem believe that it is due to the threat of competition. While the SEC is still dragging its feet approving an ETF, others have emerged. Since Americans are barred from indulging in the ones that were approved, one is in Canada, it is not likely having much impact at this point.

However, often the threat is enough to kill an asset and most agree that it is only a matter of time before the SEC approves a Bitcoin ETF.

Others feel that Grayscale is going to have to alter its model. Presently, investors cannot exchange the shares for the token. This might have to be offered. Also, there is a 2% management fee charged, which might need to be dropped or eliminated.

Grayscale might be harming its own product. With the introduction of other funds that focus upon alt-coins, we could see money moving in that direction. Litecoin and Ethereum are two tokens that Grayscale purchased a lot of.

As reported by news.Bitcoin.com, Grayscale added 174,000 litecoins or almost 80% of the newly minted LTC in February of 2021. Similarly, the investment company also added 243,000 ETH to its ethereum holdings during the same period.

The reality is that the premium will always existed and simply provide arbitrage opportunities. This is what is leading some to speculate that GBTC will not be affected by the premium turning negative. After all, GBTC is now selling at a discount compared to the token. This means that investors can take advantage of that situation and, presumably, earn an extra 10% when the correction occurs, regardless of what happens to the price of Bitcoin.

Source

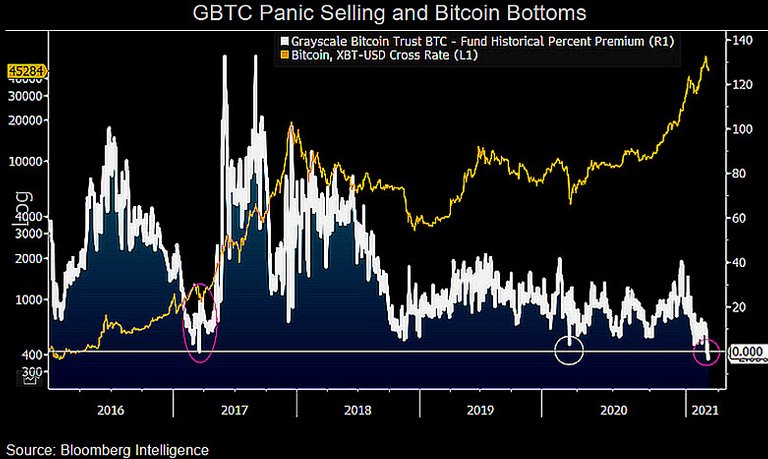

We see still another camp that believes the negative premium on GBTC is a sign that the currency will make it march to $100,000.

The reason is because institutional investors are able to buy below net asset value (NAV), an event that is rare.

We saw this most recently happen in March 2020, when Bitcoin moved from $3,000 to $58K.

In a tweet on March 4, Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said that those seeking clues about what lies next for Bitcoin should look at the Grayscale Bitcoin Trust (GBTC).

Negative premium "could signal march to $100,000"

If this holds true, we could see massive upside for Bitcoin. The premium will even out most likely as more people take advantage of the discount. We are also seeing a lot more institutional interest in cryptocurrency in general, with a large portion of that in Bitcoin.

Premium is not something that retail investors usually pay attention to. It is most common for those who trade options, a factor to consider when deciding to get in. With GBTC, the premium is another factor to consider since the price of the asset could move in way that is not reflected in Bitcoin.

Nevertheless, for those who are on the right side of the trade, it can be a money-making opportunity. This is something that institutions will definitely pick up on. If they are bullish on the price of Bitcoin, you can bet the way they will play it, at least in part, is to get some GBTC. This will allow them to profit as the negative premium moves closer to zero.

The history of GNTC is that it moves in greater proportion than Bitcoin, on both the up and downside. Thus, with the recent pullback in Bitcoin, it is not totally surprising to see the premium turn negative.

My guess is that if Bitcoin bull emerges, GBTC's premium will recover nicely.

Those looking for the $100K price level could be excited by this news.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Btc pump is inevitable. Expecting 100K btc soon.

Nice time to take advantage of the discount indeed!

Posted Using LeoFinance Beta

Yet another example that buying 'Bitcoin' from custodians isn't actually Bitcoin.

The only way to truly participate is to own the keys directly.

Only a matter of time before another huge player gets hacked or otherwise crumbles.

Posted Using LeoFinance Beta

Could an event like that trigger the collapse of the mega bubble in the last quarter of this year?

Posted Using LeoFinance Beta

Once a Mega-Bubble gets thin enough anything can pop it.

A thin bubble will burst due to sheer profit taking, for sure. But the bursting is usually associated with a narrative, at least after the fact.

I think the most likely such narrative is a statement made by someone in the government that makes investors nervous and sucks the air out of any hope left that the price could still go up or something like that.

Posted Using LeoFinance Beta

Yea the negative premium is really appealing to crypto investors. It means you are likely to get more BTC for investing in GBTC. However it comes with a risk because your are not the holding the BTC. It is in the hands of Grayscale.

It was the reason why I didn't go for grayscale but RIOT because it produces BTC. I don't exactly like paying for extra management fees.

Posted Using LeoFinance Beta

That's what I read recently as well. Some people are basically saying that when the GBTC premium collapses it often times precedes an uptrend in BTC's price.

Posted Using LeoFinance Beta

I will not mind 100K. My tiny bag of 0.1 BTC could worth more :P

Posted Using LeoFinance Beta

A fantastic buying opportunity for those who believe in the goals and value of bitcoin!

Posted Using LeoFinance Beta

We might have a nice rally on BTC this year, that is for sure. Barry Silbert will most probably continue buying BTC as he does it on a constant base from 2013, so I think the funds are safe.

Posted Using LeoFinance Beta

I haven't payed attention to GBTC premium before. That may be a valid indicator, but it's too far out of my area of interest to watch it.

I like very much the bitcoin dominance indicator. It was quite accurate so far pinpointing the near end of the bear market.

Posted Using LeoFinance Beta

Very interesting. I guess I can see the arguments on both sides. My thought would be probably most people who are investing in BTC already know how volatile it can be. I am guessing while the Grayscale thing was a little more stable, they are probably willing to accept a little bit of risk with the prices converging and diverging. This is likely going to have little negative impact on the price. That is my expert opinion anyway! :)

Posted Using LeoFinance Beta