If you start looking into Defi (decentralized finance) projects like WHive, there is a risk involved you may not be aware of called impermanent loss.

What is Impermanent loss?

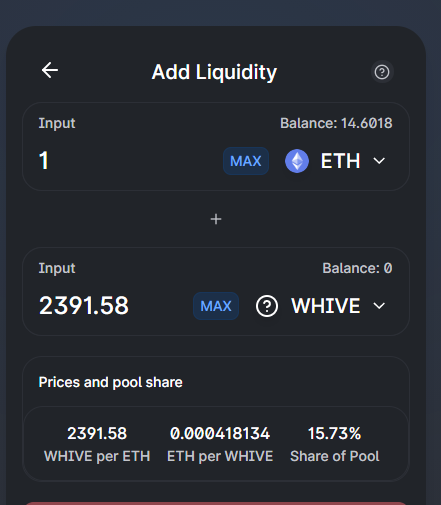

When you provide liquidity to a swap you usually need to provide an equal valued token for each side of the swap. In the case of WHive - ETH or the upcoming WLeo - ETH, let's say you want to provide 1 ETH worth of liquidity. In the case of WHive pool, you would need to provide 2391.58 WHive to provide 1 ETH worth of liquidity.

If you would be allowed to only provide one side of the swap, the pool would quickly be unable to provide swaps as one token becomes more popular than the other.

Let's say we provide this 1 ETH worth of liquidity to the WHive-ETH pool, shortly later WHive goes up in price. At some point this price difference becomes an attractive opportunity to traders to take advantage of the arbitrage opportunity. Traders will then purchase WHive from the swap until the price is similar to exchanges.

At this point, people providing liquidity for this pool will be left with a combined value of assets that are worth less than if they just held those assets in their wallet.

For example, in our situation with WHive, we have the following tokens:

- 1 ETH

- 2391.58 WHive

WHive goes up 10%, and is now worth 1.1 ETH. Traders will buy WHive until the price on UniSwap reflects that ratio. In theory, if both assets were valued the same (like when you deposit into a liquidity pool), the final result would look something like 1.1 ETH & 2152.422 WHive. UniSwap has no way of knowing what the external price is of these assets and depends on traders to keep them in line. This does not happen immediately and is the result of profitable trades that cut into your profits as a liquidity provider.

If one asset in a swap varies dramatically, you can lose money providing liquidity. This is why stable coins are popular pairs on Uniswap as the risk of losing money due to pricing is minimized.

This is called impermanent loss as it is only a loss if you pull your tokens out of the liquidity pool. If the price comes back in line, the loss is mitigated. If you do pull your tokens out of the liquidity pool, the loss will become real. This loss is not always a loss to your investment, only compared to if you just held on to the coins in a private wallet rather than providing liquidity.

The more volatile the assets being swapped, the at risk you are for impermanent loss.

Posted Using LeoFinance

Known as a "paper loss" for as long as there have been markets.

The use of euphemesims in DeFi is second to none in covering up and hiding what it's really all about!

Do they have one for caveat emptor? 😂

Are you providing liquidity to any of whive pools?

If yes, please do drop a line. I'm trying to maintain/create an incentive to provide liquidity for wHive pools

https://leofinance.io/hive-167922/@jocieprosza/do-you-know-anyone-providing-liquidity-to-whive-pools

Excellent explanation for a concept not well understood for many, thanks for this.

No risk no Reward

HIVE Witnesses and HIVE dApp founders needs to take high risk

Definitely no finance risk if you didn’t buy $HIVE with your own money.

Time and energy people who put into build our ecosystem is kind of risk many of us are taking

Exactly

No pain, no gain. Right?

Posted Using LeoFinance

I have heard it said.

Great explanation, the risk is also there if the coin goes down in value as well. If your paired coin goes down, traders will sell the coin, and you will loose ETH too as the pool is shifting towards the loosing coin.

Great explanation.

I shared this post on Twitter to try and get your work in front of more people.

You can find me and follow me on Twitter if you like? https://twitter.com/dick_turpin I've also upvoted you and shared your content on Hive. Hope That Helps.

Don't forget, you can upvote peoples comments too!

Really need to learn how this defi works. Any idea what a noob like me can do to have a hand-on experience without putting my funds?

I don't know a way to get hands on without spending money as I don't know of any simulators out there, but you can check out some YouTube videos like this:

Thanks. I will check this out

well written i liked it

DISCLAIMER :

This content is for informational, educational and research purposes only.

Please get the advice of a competent financial advisor before investing your money in any financial instrument.

It is strongly recommended that you consult with a licensed financial professional before using any information provided here . Any market data or news commentary used here is for illustrative and informational purposes only.

Trading involves a high level of risk. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future performance. Consult an investment professional before investing.

All ideas , trade signals , opinions and/or forecasts are for informational, educational and research purposes only and should not be construed as a recommendation to invest, trade, and/or speculate . Any investments made in light of these ideas, trade signals, opinions and/or forecasts, expressed or implied herein, are committed at your own risk. I am not an investment advisor, information shared here is for informational, educational and research purposes only and not a recommendation to buy or sell anything .

@themarkymark

Good explantation on impermanent loss, many are not aware. In terms of this, one thing i'm not certain is this just specific to ETH LP's or do other LP's in other "non-eth" atomic swaps such as BNB OR JUST also suffer the same fate?

If there was a way to create a chain that did not suffer this fate it would be high on my list.

Impermanent loss sucks :)

Posted Using LeoFinance

So why make wHIVE and not wHBD - which is basically a stable coin attempting to be pegged at 1 USD?

Not sure why Hive was chosen, I can only assume as it is the primary focus. If there was a mining reward token like UNI or DAI, then wHBD would make sense, but since it is only really a swap, it's more about getting Hive out there. (In my opinion).

I call this "paper-loss" though. Most times, whenever I want to buy a DeFi coin, I just suggest that it be listed on ChangeNOW and I buy as soon as they list it. But for joining liquidity pools, I use Uniswap

It seems that this defi thing support ethereuim more than hive. I'm afraid people will have to buy ethereum to buy whive and what's the benifit of hive in this case ?

My post was just about Defi in general not specifically wHive. I just used that as an example.

That being said, wHive is a gateway to allow Ethereum users to get Hive although it isn’t being a used a lot for that purpose.

With all this defi craze I've been trying to get caught up on it and this is great information thanks for sharing it Marky.

Every day I am using these two superbly useful Impermanent Loss calculators.

See example: https://bit.ly/3xRmBme

See example: https://bit.ly/3AKTrXX

Very detailed analysis but easy to understand. Most comprehensive Impermanent Loss calculators I have found so far.

Posted Using LeoFinance Beta

Now checking it against my database of known compromised or unsafe domains.. you'll see another reply if it's in there. If not, it's likely safe to open.

For more information about risks involved in shortened URLs, read this article by Forbes.

{average of post/comments with Shortened links I found per hour: 106.3}

Where's the video you talking about salt boy?

exactly, learn to read.