Good day Hiveians!

Join me in analyzing the crypto markets!

Hive has an internal market where you can buy or sell Hive and HBD

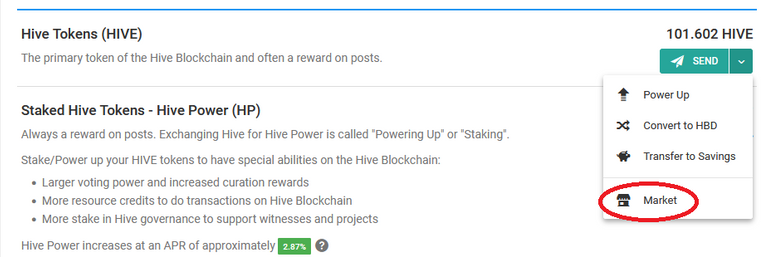

In this post I want to cover how to use the market as well as to cover some of its limitations. If you have never used the market it might be worth checking it out. You can get there (with peakd.com) by clicking either on your Hive or HBD and select market on the drop down list.

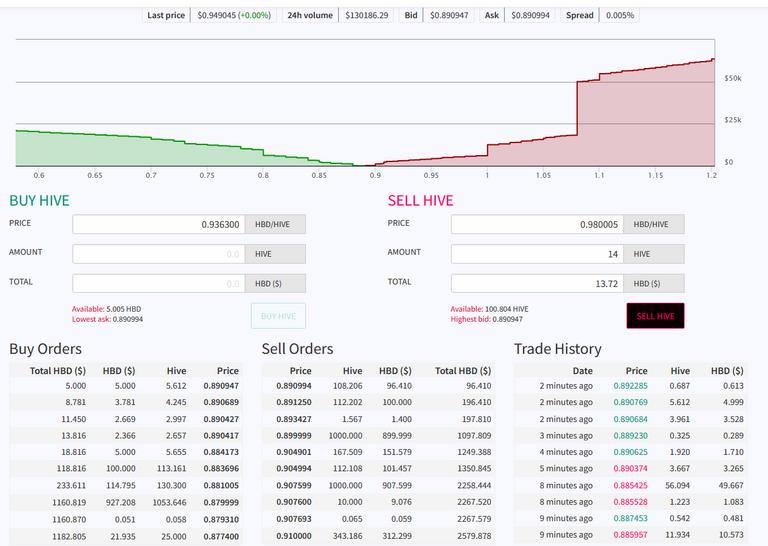

The next page might first be confusing if you haven't see an order book. Essentially you see buy and sell orders that people have placed. It is made visible by the "depth chart" that you see as the green and red blocks in the top of the screen. The market will always give you the best buy or selling orders which are placed at the top of the order book, i.e., on the first position of the table. So if you wanted to buy Hive, the best buy order would be at 0.890947 and if you wanted to sell, the best selling order is at 0.890994. The space between the highest buy order and the lowest sell order is called the "spread". For this time the spread is fairly low at around 0.005% (seen at the top of the screen); sometimes it can be much higher. A lower spread is always better for the market in general and normally coincides with a higher volume.

The volume can be seen at the top of the chart. It is at $130186 which means that this is the amount that was sold or bought on the market in the past 24 hours. The higher the volume, the more liquidity which in turn means it is easier to make bigger trades on the market. Volume should therefore always be rather high. As this is an internal market and has not too many users the volume is always fairly low. I have rarely seen it above $500k.

Some problems with the internal exchange

There are some caveats when using the market. First, as just mentioned, low volume means that it will be hard to place larger orders. You can see this in the screen above: On the left/right side of the columns of the buy and sell orders is the total HBD. If you wanted to exchange $1000 on the market it means that the first buy order would only give you 5 HBD and the first sell order 96.41 HBD. This is of course much lower than the $1000 you have. So you are essentially left with a large amount of your order that cannot be filled. In that case you could wait for people to buy/sell your large order, but due to low volume it would probably just sit there for quite some time. The problem therefore is that you cannot do large trades quickly. The first big buy order of 927 HBD is at a price of 0.8799 which is a much worse ratio that you should be getting. And the largest sell order is at 0.899 which is also not optimal.

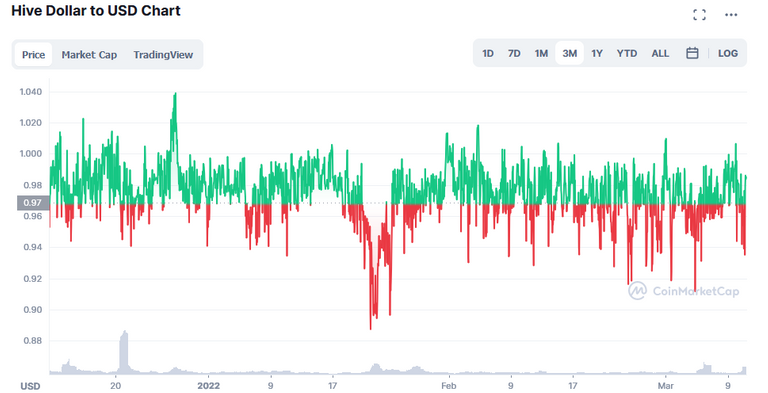

Second, the price of HBD varies and is rarely pegged at exactly $1. This can be actually good if you want to sell Hive as you will get more HBD. But it is bad if you want to buy Hive as the value of HBD is below $1, i.e., you get less Hive as the HBD you own is below its pegged value of $1. You can see the price history of HBD here:

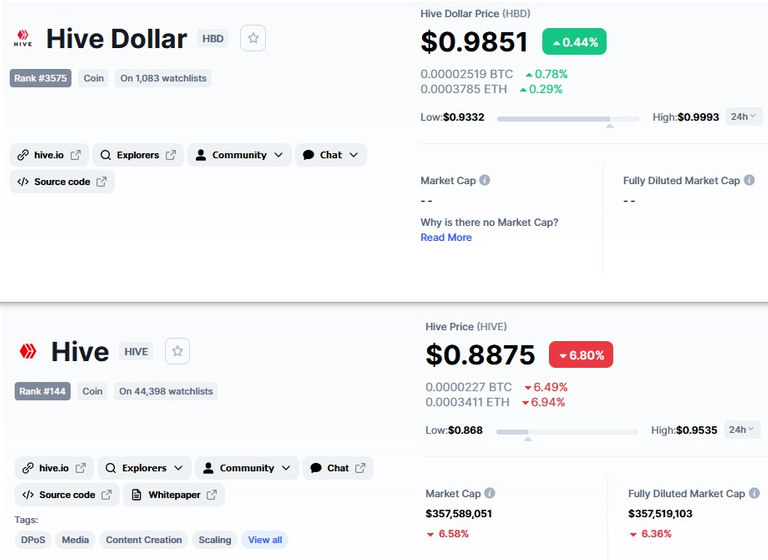

On average it trades about 2-3% lower than $1. This under performance will likely continue for the foreseeable future as HBD has a low distribution. The next hard fork will address this by raiding the haircut to 30% (read more about this in @taskmaster4450 or @blocktrades posts). But then again, it might actually be "good" if you want to sell Hive. You can see this by looking at the order book again. The highest buy order was 0.890947 (however with only 5 HBD), but the external markets (on other CEXs) are currently saying that Hive is worth $0.8875. This is because they have other trading pairs (mainly USDT which is much better pegged to $1). You could therefore sell Hive for 0.890947 as opposed to 0.8875. The obvious problem is that there is almost no volume to make larger trades and also it is hard to send the HBD to other exchanges to sell it for a profit in time. In fact at HBD sitting at 0.9851 one would expect to sell Hive for about 0.899 on the internal market as Hive should be selling for 1.5% higher (i.e., 0.8875 + 1.5% = 0.899). Sometimes when HBD falls even lower, e.g., to about 0.95 the difference becomes more evident in the internal market. Because of this gap and the profit margin attached to it, HBD, however, always recovers!

Hope this is helpful! :)

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!

Thank you @tobetada that is handy to know.

I use to use the internal market alot and it is always good to use but sometimes frustrating due to shortge amount of hive.

Posted Using LeoFinance Beta

yep.. low volume

I use internal market every time, everything you wrote is correct. Large orders take time, even small ones sometimes. The good thing is just that it is faster than the 3 days conversion on peakd.

Thanks for sharing this, it is an helpful piece!

This is amazing. All this analysis is quite complex. I bought hbd on the he just by market order. Sometimes I check the buy and sell, I put in a limit just before the sell and it works. Example; sell is $1.05 and buy is $0.99, then I do a limit order for $1.02 to buy. Usually that might take some time, as long as you are not in a hurry !

Thanks for analysing. I do use the internal market anytime I want to trade and it's been good for real.

I also hod on to what you said at the last part, never spend what you can't afford to loose

Posted Using LeoFinance Beta

I use the internal market it's pretty awesome and nice to use

Internal market is better unless you want to pay some fees using blocktrade.

Wow. This is good to know. Thank you.