PREAMBLE

This is not intended to be a definitive guide to trading. This is only a manual or guide created only with the knowledge and experiences that I have acquired during more than 7 years in this game.

It works for me, but that does not mean that it works for everyone since it depends a lot on the psychology and risk aversion of each individual.

In any case, I can tell you that I am not going to invent the wheel on many things either, but surely what I explain here will clarify many things for those who want to start in this world or even for those who are looking for a path that will guide them to become a better trader.

Having said this, please note that everything I am sharing here is not intended to be financial or investment advice.

First of all, let me tell you that I know that beginnings as a trader are hard. Everyone wants to earn as soon as they start in this world, which inevitably leads them to be a sort of "cannon fodder" when they submit to the market or, as others call them, easily become "MARKET LIQUIDITY" that continually feeds those who are more experienced in this job.

In a Technical Analysis approach (we won't touch on fundamentals here), the market moves mainly following liquidity.

Taking it to the absurd, and remembering a statement that I read some time ago on social networks, "If you cannot find the liquidity, then, most likely, YOU are the liquidity", the novice trader's money usually becomes the target of all market sharks.

My goal with this series of posts that I start today is to try to transmit my knowledge and methodology in the fight for survival as a trader first, and success and sustainability afterward.

All the strategies, theories and pseudo-laws seek to deal with this liquidity offered by the market. Being a "wannabe trader" means starting with learning and training first, understanding charts, understanding patterns, resistance, and support, understanding indicators, and knowing how to use them. Read a lot, learn from the "proven winners" and not from those who want to sell you infallible methods.

It goes without saying that this learning will accompany you, and it has to do so, throughout your life as a trader since the markets are changing continually and what works today may not work in the near or distant future, it is a only matter of time.

The question here is how many of these "wannabe traders" will overcome and assume the learning phase as a mandatory duty?

I already tell you, that very few do it, or they do it very discontinuously and promoted by FOMO/FUD feelings.

Being a trader means always being that, a TRADER, in moments of great euphoria and in moments of fear, bullish or bearish sentiment. You must be able to adapt and read the market at all times, leaving your feelings aside as much as possible.

So yes, this is a MIND GAME, since depending on your psychology and skills, your attitude and aptitudes as a trader may vary and, very often, will lead you to failure, frustration, and, ultimately, abandonment of the activity.

What it is about here is to minimize irrational or emotional decisions to the maximum possible depending on the nature of each person and, then, have a competitive advantage in decision-making that will help in the search for personal success.

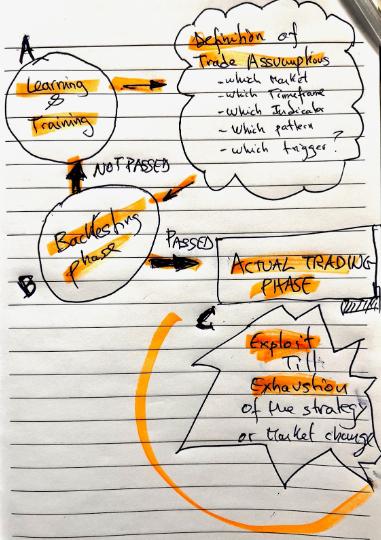

During your work as a trader, there are three key phases that repeat themselves over time in an infinite lifecycle:

- The Learning Phase

- The Backtesting Phase

- The Actual Trading Phase

During the Backtesting Phase, as output it will quantify and qualify the feasibility of a specific strategy. Then, It will be our responsibility to assess whether or not it is worth taking the backtested strategy to true operation in the Actual Trading Phase.

The Actual Trading Phase will be exploited until the exhaustion of the same strategy or its invalidity as a profitable strategy due to changes in the nature of the markets.

By this I mean that it is possible that the strategy you are using ceases to make sense simply because many others have also found it with what has been totally canceled over time, ceasing to be a competitive advantage over the rest.

Remember, for you to win someone else has to lose, it is sad but this is THE ONLY LAW OF TRADING that actually works, all the rest are valid THEORIES until a certain moment in history in which another more developed theory occupies the place of its predecessor.

LEARNING PHASE

As I said, everything starts from learning. However, this guide that I start today is not intended to give magical lessons on which indicators or strategies to use, Internet is already full of free content, all you have to do is filter out the noise of what really matters and try to learn from the best. If you have a mentor then you have a great advantage, if on the contrary, you don't, I'm afraid you're going to have to work harder (LoL), sorry for this but I had to say it…

I won't recommend one trading style or another either, the reality is that your trading style should be adjusted to your psychology and your available time.

In my case, I find that day trading or even scalping are more suited to my mentality and availability, I also have to tell you that for a trading strategy to demonstrate its robustness, many, many trades are necessary... and scalping provides a very high number of opportunities, something that other systems, such as swing trading, do not.

Within the learning phase, once you have gained some knowledge, enough or not, it is possible that you have already recognized "possible advantages" in the chart that has the potential to be exploited.

It is time to evaluate its potential. So, we enter the process of "Defining trade assumptions".

Something like...

"if these conditions/requirements occur then the trade is possible and is likely advantageous".

These conditions and requirements should define all aspects of the trade and respond to questions as the following ones:

- In which market? (pair/asset/...)

- In what time frame?

- What pattern/indicator signal/trading pseudo-law or a combination of the previous ones (aka "Confluence") should occur on the chart during the selected time frame?

- What should be the trade trigger (which often coincides in definition with the entry point)?

- And finally, and more important, what would be the condition to consider that the trade has failed? In other words, what would be my STOP-LOSS point?

Yes, I work ALWAYS with STOP-LOSS and I recommend its use as well, for obvious reasons that I will explain in another post...

BACKTESTING PHASE

We then enter the backtesting phase. It is in this phase in which you "simulate" the potential of the strategy.

Tradingview and other charting websites like Coinglass offer enough historical data, sometimes for free, to see what a pair/asset has done in the past. This can be done manually or automated (Tradingview Strategy Simulation), although the latter requires some basic programming knowledge.

I believe that in this phase, I must evaluate mainly how many times the trade conditions are repeated and how many times its development after the trade trigger is satisfactory versus the times it has failed.

I do not evaluate or consider amounts won or lost in a first instance, in fact, at first I only look at the WIN RATE, that is,

(Winning Trades / Total Trades) x 100

During the backtesting, it is necessary to get a sample with as many trades as possible and ideally should be simulated in different states of the market, with representation from various market conditions such as Bullish, Bearish, or Range. The sample should be as comprehensive as possible.

As a general rule, I do not accept a sample of less than 100 trades, but a higher number is recommended.

Once QUANTIFIED and seen that the win rate is greater than 60% at least, it is necessary to evaluate if the strategy has the capacity to produce profit in theory, or QUALIFICATION of the strategy.

Personally, in order to qualify the strategy I use the following approach:

On the same sample, we quantify the number of winning trades that have a profit ratio 1.5 times higher than the risk, that is, if every time the trade fails we lose $1, the trades considered winners must earn at least $1.5 or more, but we will always consider 1.5 as the theoretical earned value.

In the same way, we also quantify the “minor” winning trades and give them a weight of 0.5

Briefly:

- Winning trades have a weight of 1.5

- Losing Trades have a weight of 1

- Minor winning trades have a weight of 0.5

The sum of all the “weighted” winning trades divided by the “weighted” losing trades will give you a factor that should be greater than 1.2 at least.

In the example below, this ratio is 1.5, so it has a pretty good winning potential (great in my opinion):

Another example that complements the explanation, in the image below, 7 operations have been identified fulfilling the conditions to open 7 SHORTS.

- Out of the 7 operations, 5 are winners and 2 are loser, WIN RATE =(5/7)x100 = 71%

- Out of the 5 winning trades, 4 reached a Reward to Risk ratio of 1.5,

- the other winning trade did not develop as expected but could have made a profit, we counted it as 0.5.

Overall 1.5+0.5+1.5+1.5+1.5-1-1 = +4.5

W/L Ratio = 6.5/2 = 3.25

Do you get the idea?

We are in backtesting, everything is theoretical and based on past data, nothing guarantees future data or errors in the execution of the trade and, above all, it is possible that when most trade occasions happen, we are not there to take them all.

Remember, it is very important that the strategy works in the timeframe and period of time in which you are going to operate.

As a summary, according to my experience, a strategy whose backtesting gives me at least a 60% WIN RATE and a theoretical W/L RATIO greater than 1.2 is a candidate to be SQUEEZED or used in our operations to see how it behaves in real-time.

From now on you have two options, start trading yourself with, highly recommended, little budget and so, very contained risk, or use a platform/exchange/broker where you can trade in real-time in DEMO mode with fictitious money for your real evaluation (BINGX is an exchange where you can do it, but there are many others).

ACTUAL TRADING PHASE

Using simulated money to execute your strategy in real time has its advantages, obviously, YOU ARE NOT RISKING YOUR MONEY... but... IT IS NOT THE SAME.

In fact, let's say that when you use simulated money what happens is what also happens with BACKTESTING on past data, which is that the PSYCHOLOGICAL variable does not act in the same way as when you use real money in real time.

When you trade with “play money”, emotions are not 100% part of the equation of the real trading process and so what happens is that you are really lying to yourself since you do not experience the PAIN or FEAR that you get when you lose or when you do not take advantage of all the development of an operation.

In addition, what usually happens in reality is that depending on your psychological state, especially after having experienced a few losing trades, your emotions can lead the management of the trade making you try to win the trade as soon as it is done, without even waiting for it to arrive halfway through your TAKE PROFIT target.

Do you understand what I mean?

Trading with “Play Money” leads often to get very optimistic results, far from what you get using true-money from your own pocket.

So, because the psychology cannot be accounted on the simulation (neither during backtesting nor while using “Play-money”), I am not convinced by any strategy whose results after at least 100 backtested trades do not give me a minimum WIN RATE of 60% and a W/L Ratio higher than 1.2 (Remember that this ratio is based on "weights" for every win and lose elected by myself in a very subjective but realistic way, you could also define yours if you prefer).

During ACTUAL TRADING PHASE, we get to work with real money, it is now where we are going to demonstrate that our backtested strategy is really profitable and we are going to exploit it as much as possible with the time available and our own psychology, fears and uncertainties.

This post is being too long and I wouldn't want to bore you from the beginning of the "saga".

I think that for today is enough and up to here everything I wanted to say in general about the TRADING LIFECYCLE.

In successive posts I will focus on the ACTUAL TRADING PHASE, breaking down the processes that must take place in this phase chronologically, giving information and tools so that anyone can understand:

- Strategy and Risk

- Identification of the SETUP

- Definition of Trade Objectives (Take profit and Stop Loss)

- Definition of the total amount to invest in a trade, Position Size

- Entering the trade

- Trade Management

- Consistency and Trust

- The compounding Effect

- Create a Trading Journal

- Automation

I hope you have enjoyed this first post of "My Trading Guide". This post will be updated every time I publish a new one explaining the processes listed above.

Let me know in the comments if you have any questions about what I have exposed or if you need me to develop something in more depth.

Enjoy!

Posted Using LeoFinance Alpha

Epic info here, well done on your trading and TA knowledge and also thank you for compiling these notes for us to learn from. Trading is a vast subject that appeals to a certain mindset, like LEO tribe of course. Progress and success comes from practice and experience.

I tried to be synthetic but it’s difficult 😂

🤓

Absolutely, I completely agree! It's a continuous work in progress for the majority of traders - "leaving your feelings aside as much as possible."

Appreciate that you're sharing your trading knowledge.

Great post, keep them coming.

Like that quote about Liquidity and agree that playing with demo accounts is no substitute for using real money (emotions are hard to control!).

So are you a full time trader Eddie?

😂, no, I trade only when I can

Aha, you sound like a professional!

almost

Good introduction for newbies !!

i'm really interesting in the next posts ! you got me!

I didn't really do a lot of backtesting but it can be a good tool but I also don't daytrade. Trading is tough and people should only take the best trades (such as a strategy you believe in).

How do you know which is best trade?

When multiple indicators match up. For example, long term charts, indexes lineup, resistance and support lines hold up.

This is a good one friend, it feels so great to do this and learn.

#hive #posh

Great job and information!

Thanks