Summary of my "adventures" as a daytrader and Scalper in Crypto (Futures mainly) and Stocks, Forex and Commodities.

I use two different trading platforms, for crypto I use BINGX (No KYC required), very low commissions and good service.

For Stocks, Forex and Commodities I use DARWINEX, a fully regulated broker and METATRADER 5 platform.

Summary of the Week:

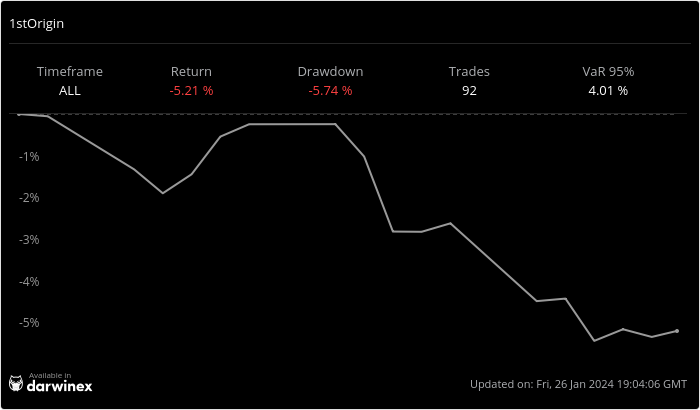

Another bad week of trading results, since I changed Broker at the beginning of the month I have suffered a series of problems which I am still in the process of resolving.

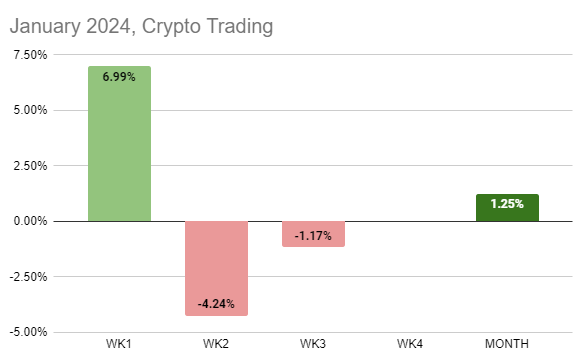

In Crypto the week has not been so bad, although I have been losing for a few days even more than I had gained the rest of the month, I have managed to end up positive in total, with a gain so far this month of 1.25%. However, I have lost -1.17% compared to last week.

As I said, I am still adapting to the new broker and also to their trading platform, MT5. This is causing me some problems with the STOP LOSS, especially in operations that I leave "open Overnight" with the Stop Loss set...

What happens is that, as you know, in the asset markets, Forex and commodities, they have operating hours.

At 23:59 the MT5 server closes the interbank market to apply Swap charges from liquidity providers. At those times there is practically no liquidity in the market so the spread increases, giving rise to differences between the BID and ASK charts, in times of high volatility / low liquidity, the spread range opens, giving rise to differences between both graphics...

In short, when the market opens again, the "instant" liquidity is almost zero and, therefore, the first operations to close are those that have STOP LOSS close to the previous close, so many of these are closed for the liquidity provider's algorithm helplessly.

In FOREX it closes for just a few minutes each day, but this also affects.

I have lost at least 4 trades, which should have been winners, due to this "effect" that I had not experienced before, I am going to have to modify my trading a little to ensure that my Win Rate continues as planned and that my losses They also follow the calculated average...

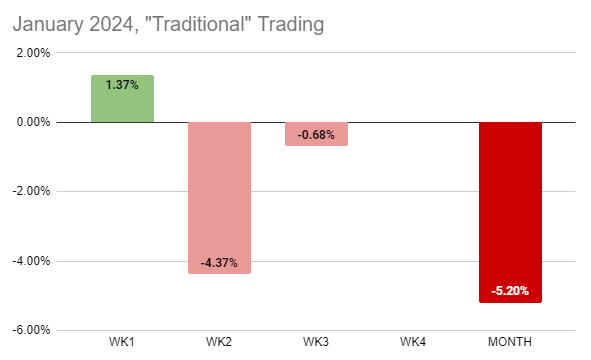

However, I am quite positive here, the week has been bad, I have lost -0.68% compared to the previous week although I want to think that the week would have been a big winner if I had not had those problems that I have mentioned...but hey, better to lose now and learn than not to lose and get screwed in the future.

The month of January is losing -5.20%... let's see if in the remainder of the month, 3 days, I am able to reduce this value to the maximum...

Some data from my operations during this month:

Crypto Trading:

Total No. Trades: 71

Win Rate: 53.52 %

Profit Factor: 1.018

Trading Stocks, FOREX, Commodities:

Total No. Trades: 92

Win Rate: 48.31%

Profit Factor: 0.4962

I risk 0.5% of my account per trade with a maximum daily risk of 3%.

Conclusions and Objectives for next week:

I'm on the "good track" to solve the current DRAWDOWN, although I still have to polish many things.

Some lessons learned that I have to implement are:

- Remove SL if the trade is opened overnight or beyond the daily closure of the market

- If the trade is good, do not move the SL unless there is a support beyond the 0.5R

That's all Folks!

Posted Using InLeo Alpha

This is great to see how your week goes and you have been able to stay fit which is cool to see also actually

Hope so next time you will get higher goals.

Thanks

Congratulations @toofasteddie! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I don't think I have ever heard about overnight trades having issues before. I don't really understand why it wouldn't have liquidity issues. I hope you are able to work around it.

At this time if we talk about the market, at this time we have entered the full cycle, it will definitely come down but after a few days it will go back to the same place as it is now at 43 thousand.