Summary of my "adventures" as a daytrader and Scalper in Crypto (Futures mainly) and Stocks, Forex and Commodities.

I use two different trading platforms, for crypto I use BINGX (No KYC required), very low commissions and good service.

For Stocks, Forex and Commodities I use DARWINEX, a fully regulated broker and METATRADER 5 platform.

This last week we have transitioned from one month to another, so I am going to present the results as if they were two different weeks, the first corresponding to the last 3 days of January and the second corresponding to the days corresponding to February.

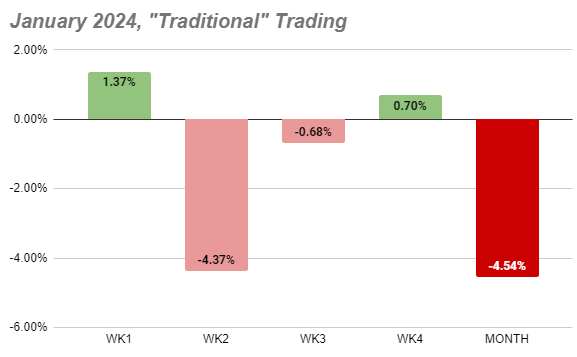

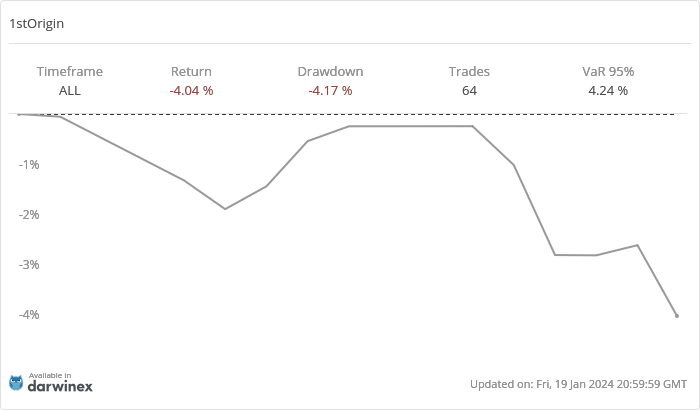

In summary, I have had very good results in "traditional" Trading, especially in FOREX and with a specific pair, the AUDNZD, and also trading Natural Gas (XNGUSD) which is making me recover a little from the DRAWDOWN that I have been accumulating since the beginning of the year. The month of January, however, has remained at an official loss of -4.54%.

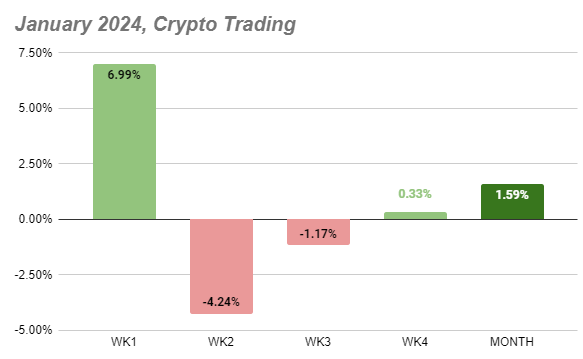

In crypto, on the other hand, the week has not been so good, I have failed many trades but, even so, I have ended the month of January 1.59% up.

#29, 30 and 31 of January and closure of January Results

Some data from my operations during January:

Crypto Trading:

Total No. Trades: 82

Win Rate: 53.66 %

Profit Factor: 0.9708

Trading Stocks, FOREX, Commodities:

Total No. Trades: 101

Win Rate: 50.5%

Profit Factor: 0.583

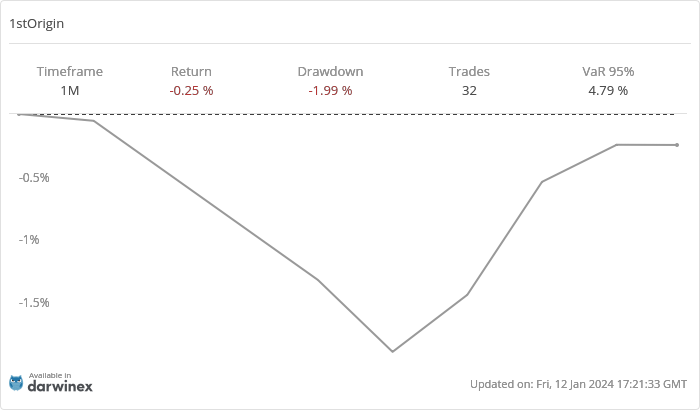

#1, 2 start of February Results

Some data from my operations during February:

Crypto Trading:

Total No. Trades: 3

Win Rate: 33.3 %

Profit Factor: 0.1823

Trading Stocks, FOREX, Commodities:

Total No. Trades: 4

Win Rate: 50%

Profit Factor: 1.011

I risk 0.5% of my account per trade with a maximum daily risk of 3%.

Conclusions and Objectives for next week:

Paradoxically, what had been going badly for me before (traditional Assets) now seems to be going well for me (crossing my fingers here), on the other hand, crypto is giving me some problems lately.

However, this week's sample is too small to know if the improvements proposed last week are having a positive effect or not, so I cannot draw conclusions about the trades made during these days.

I continue, however, applying the "rules" of the previous weeks:

- Remove SL if the trade is opened overnight or beyond the daily closure of the market

- If the trade is good, do not move the SL unless there is a support beyond the 0.5R

That's all Folks!

Posted Using InLeo Alpha

Posted Using InLeo Alpha

Good luck. I think the traditional market can be hard to get a handle on. Maybe follow the trend on the major indexes there because it tends to be correct. I would consider the major indexes then the sector ETF to see how well that stock can do.

Your win rate is quite impressive and I believe in coming weeks, it will definitely improve because you will definitely learn from your mistake

May you get your goal. Good luck

One thing we should keep in mind is that whenever the market gets stuck like this, it is bound to go down

You are actually doing well in profit and I believe it can improve