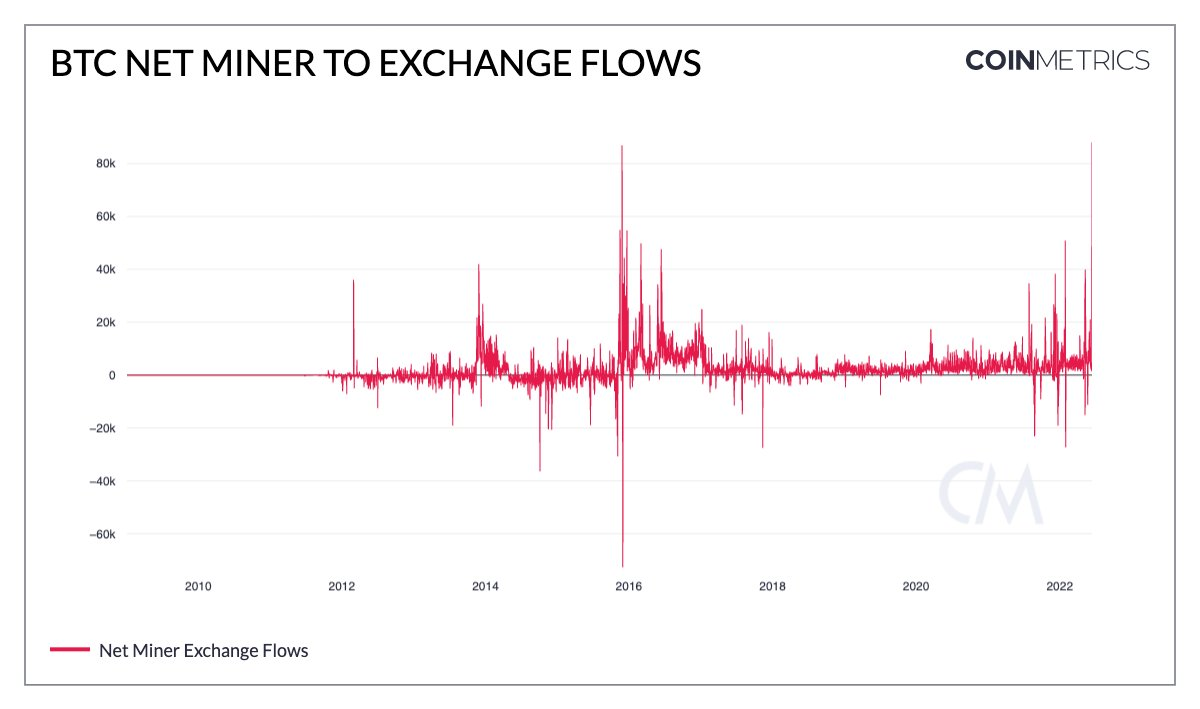

During the past days Tuesday and Wednesday we have seen something unusual in the BITCOIN industry and it is the fact that a new ATH has been reached in the number of BITCOINS that the miners have transferred to the exchanges.

(Source)

Exactly 88,000 BTC have been reached in a single day, a figure only seen previously in 2016 and which, in theory, would indicate a possible capitulation of some of the "weakest" miners in terms of sustaining their infrastructure and for which to mine BITCOIN It would not represent something profitable at the moment.

In fact, many of these miners, who are usually the least efficient, and who have reserved their BTC to sell on the Bull Market are forced off the network as the price drops, and they have to sell these reserve bitcoins, causing the price to drop further.

At the moment we know that the weakest miners are sending large amounts of BTC to the exchanges and the only reason they are doing it can only be to prepare for their liquidation...

On the one hand, the possible capitulation of the miners has only just begun and although there are no precise signs that this has affected the price yet, I fear that it will in the next few days or, if you rush me, a few weeks from now. ..so any "breather" to the upside could mean a good time for these miner-submitted reserves to be sold on centralized exchanges. The consequence will be a new abrupt fall and don't make me say how far it will fall, but I don't see clear support between $20,000 and $13,000, even if this means breaking the historical trend that BTC has never before fallen below the ATH of the previous cycle...

On the other hand, and from a positive point of view, if the miners are already beginning to distribute their reserves, it could mean that the BOTTOM is very close in time.

Patience.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people(@toofasteddie) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

If it reaches 13,000, several investors with loans are going to liquidate them, and we will be in recovery for a longer time, due to the domino effect, which is already in motion, which is not good news

The only good thing that I rescue is that the video cards are going to be given away in a few months.

Good post, you have my vote 100%

I hope that there is no false bottom that will deceive us at the most crucial moment)

Posted Using LeoFinance Beta

I think its all the impact of big whales. They can digest any coin

all the while I'm cheering in the background to go lower so I can buy more : P

Is this a valid trend in the past? I never really tracked things such as this and I agree that the BTC miners are treating this as a business. So they need to sell to pay off their expenses.

Posted Using LeoFinance Beta

Let's see how this unfolds in the coming days.

We need to separate the weak hands and build new diamond hands for the next rally.

Posted using LeoFinance Mobile

agree

If, for example, reserves provided by miners were sold on the central exchanges and this contributed to a significant decline, should we withdraw our remaining coins?

I don't see the connection neither...in any case, better to have your BTC out of the exchanges ALWAYS, unless you want to sell them

It looks like we are not out of the cold yet, I hope there's a positive to this for Bitcoin not to dip further, 13k will be catastrophic id that happens.

Posted Using LeoFinance Beta

Think about opportunity not catastrophe

Sure are some wishing for a dip that low to take advantage.

Posted using LeoFinance Mobile

problems of the small amount of bitcoin remaining in mining with the low price may affect the currency in the future unless there is an exact direction to the bitcoin reserves