Welcome to part 2 of Beating Bitcoin with a Simple Trend Following Strategy and a very merry Christmas to you and yours.

If you missed part 1, it's worth a read before continuing with this post and you can find it here on LeoFinance or here on Hive.

Recap

In part 1 we discussed Bitcoin's lengthy pull back and recovery cycles (drawdown phases) and suggested investors could achieve superior real and risk-adjusted returns vs buy-and-hold by applying a simple trend following strategy.

We then explained the most basic of trend following strategies, the moving average cross, and went on to show a moving average cross strategy outperforming buy-and-hold over a 2 month period.

In part 2 we will look at how the same strategy performs in bull, bear and ranging markets, and then pull all that together to explain the strategy's results over a 2 year period covering all these cycles.

The 2017 Bull Run to 20K

On January 12, 2017 BTCUSD set a low of $735.50 - Bitcoin would never again trade this low, going on to trade as high as 19891 on December 17 - a trough to peak gain exceeding 2500%:

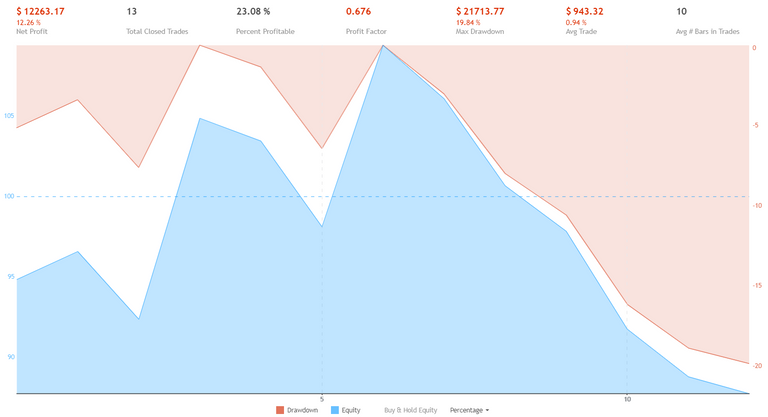

Let's take a look at how our simple trend-following strategy performed over the same* period:

Our strategy takes 9 trades during this period, 55% of those trades are profitable and the strategy's total wins are 17 times larger than it's total losses, for a net return of 1015%. Great results, but we've clearly under performed a perfect buy-and-hold for this period.

Not to worry, remember our goal with this strategy is to out perform Bitcoin over a longer horizon via minimizing the impacts of bear cycles.

*Note: We have let the strategy run for another 6 days to catch the actual exit, avoiding illusion of a perfect close based on the test period.

The bears come home to roost

After the joys of 2017, 2018 provided a rude reality check. Bitcoin gave up the vast majority of gains from the prior year, falling nearly 84% from Dec 2017 to Dec 2018:

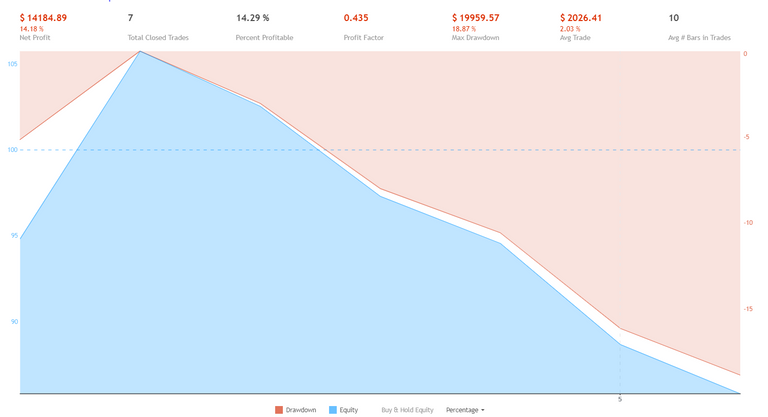

This is where our trend-following strategy should kick in to preserve our gains - as this is a buy-side-only strategy, we will likely still lose money in a down trend, but the strategy will attempt to preserve capital by going into cash when ever the market turns lower:

During the 2018 bear market, our trend following strategy loses only 12% vs the buy-and-hold's 84%.

It's also worth noting that the strategy is actually profitable through some of this period, it appears to start losing near the end when we are ranging between 6 and 8K before the final drop lower towards 3K.

Let's take a closer look at that.

The worst enemy of a trend following strategy

From July to Nov 2018, Bitcoin doesn't actually do much of anything at all, finishing slightly up 0.29%.

There's one decent wave higher and no doubt a ton of short term trading opps, but as far as the long term trend goes, it's sideways:

For a strategy looking to capitalise on long term trends, and especially one using moving averages, this is bad news.

All we will get a is a lot of noise from the MA's crossing endlessly over and under each other with no follow through:

Note that the the real problem here isn't really the range, it's the size of the range and the fact that it's contracting ie we make money on the largest wave, lose a little on the second smaller wave, then get chopped to shit once the range contracts:

As expected, this is where the strategy actually loses money, for a buy-side-only strategy, it actually performed pretty well in the first half of 2018.

Tying it all together

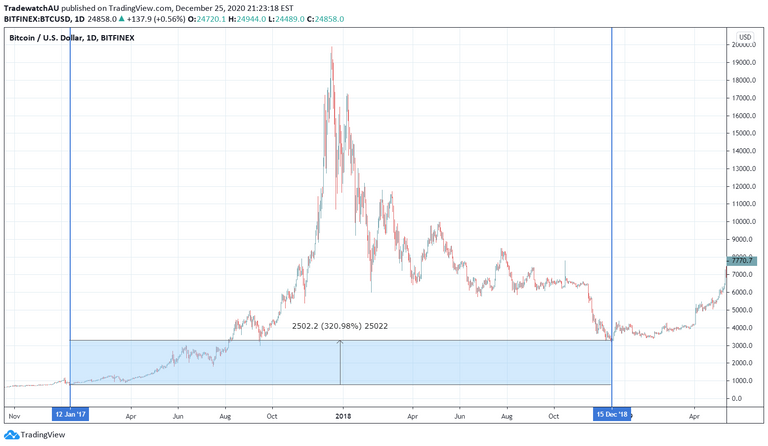

Let's take a look at these market profiles together. From Jan 2017 to Dec 2018, a buy-and-hold strategy saw significant gains of more than 2500%, followed by significant losses of close to 84% and a prolonged period of sideways before a final drop lower, leaving you up 320%.

Hardly a bad return over 2 years, but considering the 2000%+ given back, far from ideal:

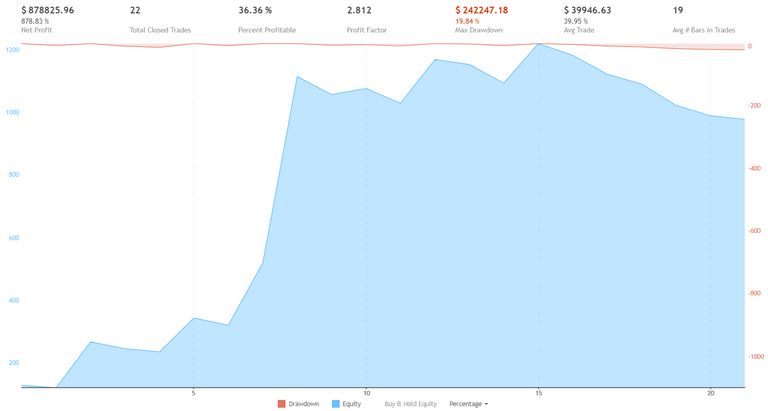

Over the same period, our simple trend following strategy saw smaller gains of around 1000%, but a much smaller loss of roughly 12% when the bears came home to roost, leaving us up more than 870%:

This is a substantial improvement over the buy-and-hold strategy, delivering superior returns in both real and risk-adjusted terms.

It's worth noting that if we had the risk tolerance (and risk capital!) we could have levered our trend following strategy 3-4x whilst still keeping max drawdown below the buy-and-hold's 84%.

A note re: past and simulated performance

Please bear in mind that past performance, and especially simulated and hypothetical performance, does not guarantee a strategy will achieve same or similar results in to the future.

These results over account for commission charges, but they do not account for live environment considerations like slippage and available liquidity.

Though the strategy has indeed performed well in forward testing since it was designed in 2019, as it is a buy-side-only trend following strategy - it does rely on Bitcoin trending up (or at least trading in a substantial range) - if Bitcoin does begin trending down permanently (or trade in a prolonged tight range) this strategy will also lose money, albeit at a slower pace.

It's also worth noting that in the event of further BTC strength in the coming years, it may be harder for Bitcoin to achieve growth multiples than it once was ie growth from $25 to $50 is an easier psychological hurdle than growth from 25K to 50K.

Don't miss part 3

Originally, I'd promised to share 2014 through 2020 performance in this post, but this is already a lot longer than expected so we will save that for next time.

In part 3 I will also reveal the actual strategy behind these results - MA types and speeds - for those of you who can code Pine (anyone!) or anyone who just wants to set up the MA's on your daily chart.

I'll also make the Pine code itself available free via discord DM for a limited time, so be sure to follow me on your favourite Hive frontend so you don't miss out.

Posted Using LeoFinance Beta

Thanks a lot! This is really interesting and valuable!

Posted Using LeoFinance Beta

Most welcome bud, glad you found value in it!

Posted Using LeoFinance Beta

Congratulations @tradewatchblog! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Appealing Nice way to learn and earn at the same time Crypto world is here!!! Daily Manager

Posted Using LeoFinance Beta

Good stuff mate! Look forward to part 3

Posted Using LeoFinance Beta

Cheers bud!

Posted Using LeoFinance Beta

This is unique information I should read 1st part of this article.

:)

Posted Using LeoFinance Beta

Mos def you can't be sleeping on part 1

Posted Using LeoFinance Beta